With inflation at a 40-year high and interest rate hikes beginning to be implemented, more and more overleveraged companies with sinking FRISK® scores are in greater danger of bankruptcy in 2022.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

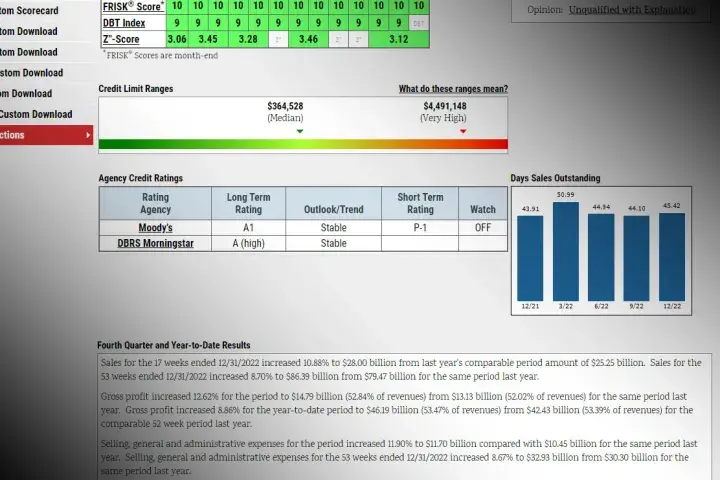

The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. Here’s how financial ratios play a role.

Avoid the crash: not having a daily risk download like what we provide subscribers with our proprietary FRISK® score, when world events like armed conflict are changing industry every day, is like flying a plane without instruments through a hurricane.

While risk analysis professionals may be tempted to use the statistical FRISK® score as a component within a different model, such as one that is rules-based, doing so may generate suboptimal results.

Keep your brains about you: if it looks like a zombie, acts like a zombie, and reports like a zombie, it is probably a zombie.

Knowledge of how and when to react to a business defaulting is essential; cutting ties with a customer or supplier too soon could lead to a missed sales opportunity, while being too late can result in financial loss.

The media and financial institutions, including the Federal Reserve, underreport the proliferation of zombie firms, a frightening reality you must not ignore. Learn how you can use the FRISK® score and other CreditRiskMonitor report features to protect your company from bankruptcy-prone zombies.

Public and private companies need to be proactively evaluated in distinct, different ways by risk management professionals - fortunately, with the FRISK® score and PAYCE® score, CreditRiskMonitor has world-class solutions for both subportfolios.

In preparation of future bankruptcies, credit professionals are using CreditRiskMonitor’s Credit Limit Ranges solution for automated monitoring on the size of credit lines.