The number of businesses that credit managers, procurement teams and corporate treasurers interact with can range from a handful to hundreds depending on the size of the company they work for. Companies should not have unwanted exposure; the financial health of its counterparties should always be monitored and, to that point, financial risk needs to be monitored differently for public and private companies. CreditRiskMonitor's proprietary FRISK® and PAYCE® scores have you covered.

The FRISK® score is 96% accurate in assessing public company financial stress and bankruptcy risk within a 12-month period, and our coverage today spans more than all public companies worldwide. CreditRiskMonitor’s PAYCE® score, meanwhile, is 80+% accurate in predicting financial stress at more than 330,000+ private companies within our existing database.

Use the FRISK® score for Public Companies

Public companies tend to be larger than private companies, but that doesn’t necessarily mean they are less risky. According to our research, public companies tend to pay their bills on time right up until they file for bankruptcy. This behavior occurs since public companies often have access to capital markets. While access to markets might be an advantage, distressed public companies may obtain high-interest credit facilities, balloon term loans, or issue dilutive equity/hybrid securities just to satisfy funding in the short-term.

And while all U.S. public companies must report their financial statements according to GAAP, management teams are allowed to apply accounting methods that differ from industry competitors. For instance, management might use aggressive revenue recognition or cost capitalization, among other things, that can help to mask financial difficulty. Further complicating the matter, nearly every public company creates their own adjusted non-GAAP metrics within their financial reporting. This reporting will typical yield more favorable results. All of these practices are perfectly legal, but they increase the challenges that risk professionals face as they look to assess counterparty risk.

This important knowledge point is but one of the multitude of reasons why the FRISK® score is such a vital tool in assessing public company financial risk: the score is updated on a daily basis, unlike most financial models that change on a quarterly basis (such as the Altman Z”-Score). The key data components for the FRISK® score include variables such as stock market sentiment, ratings from leading credit agencies, unique financial ratios, as well as our proprietary subscriber crowdsourcing. Each of these high-quality variables are counterbalancing weights to one another, ensuring that the score provides a consistent and accurate result.

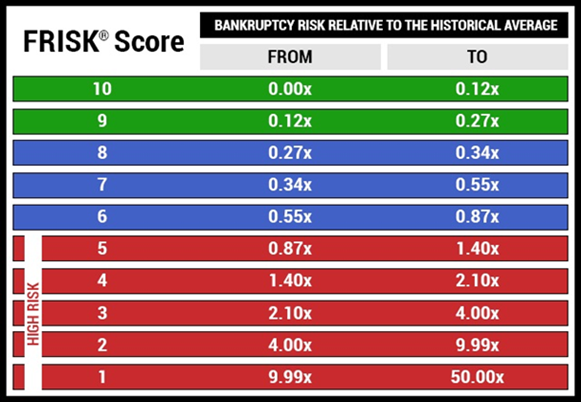

Below is the FRISK® score chart:

Based on the chart above, FRISK® scores between “6” and “10” are generally stable or healthy businesses, whereas scores between “1” and “5” (also known as the “red zone”) require careful monitoring by subscribers. Using this tool allows you to focus your time on the public companies that pose the most risk so you don't waste effort doing deep dives on companies that are healthy.

Crowdsourcing is a unique contributor to the FRISK® score given that it considers the aggregate click data of our subscribers, including risk professionals from nearly 40% of the Fortune 1000. These are subscribers who are just like you, hard-working professionals trying to figure out where the greatest risks are in their portfolios. Therefore, it shouldn't be surprising to find out that the addition of the crowdsourcing data into the FRISK® model helps detect risky companies with more precision and better timing.

If a crowd of risk professionals are worried about a particular business, it’s probably worth looking into. CreditRiskMonitor's crowdsourcing data not only recognizes when this is happening, but it incorporates it into the FRISK® score so you are apprised of any changes on a daily basis.

The implications of subscriber crowdsourcing are material. For example, if several trade creditors think a business might fail within the next 12 months, they could adjust selling terms that would adversely impact the company’s working capital position. Last year, we observed such a worst-case scenario unfold when Toys “R” Us actually filed for bankruptcy because of constraints placed on it by its supplier base. Prior to their downward spiral, subscriber crowdsourcing picked up on the increased risk.

The PAYCE® Score on Private Companies

Credit risk management for private companies is difficult. Private companies are not required to disclose their financials and don’t always care to share them. Therefore, professionals will usually end up relying on payment behavior to assess risk. Clearly, if a private company is delinquent on paying its suppliers, particularly on a dollar weighted basis, it is bad news. However, CreditRiskMonitor’s PAYCE® score has enhanced this approach for risk analysis through the use of artificial intelligence.

The PAYCE® score utilizes artificial intelligence and machine learning to produce a powerful score. The model looks forward one year in advance to identify financial stress and bankruptcy risk. The two key inputs of the model are trade payment data and public filings, such as federal tax liens.

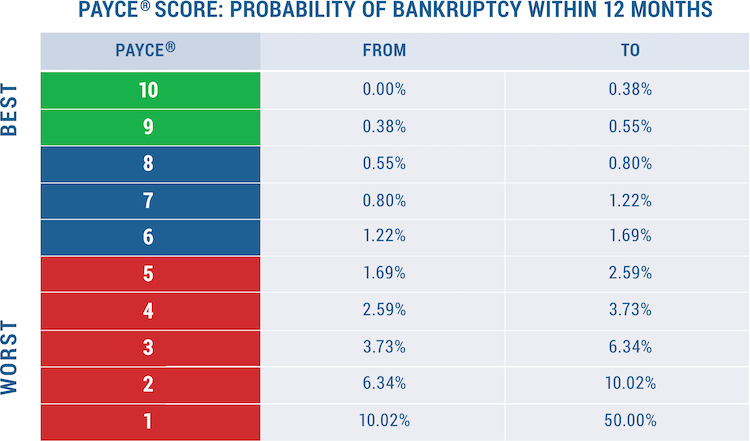

Below is the PAYCE® score chart:

Similar to the FRISK® score, the PAYCE® score shows when a company is financially healthy or in distress. So if your counterparty is in the “green zone” or “blue zone,” you can be more confident in engaging with that particular business. That helps to free up your time to examine private companies in the red zone, where thorough financial reviews should be conducted and reducing exposure may be prudent.

The time factor is vital. In mid-2018, we identified three specific companies where traditional payment behavior exposed increasing financial risk but with a lag relative to the PAYCE® score. In each of these cases, the PAYCE® score was deep within the red zone for approximately one year prior to the bankruptcy filing.

With the early warning, situations like these change from reactive emergencies to instances where a credit manager or corporate treasurer can investigate further and adjust terms preemptively to reduce risk exposure. Likewise, procurement professionals might avoid or switch from a supplier in the red zone due to solvency risk, which could eventually cause supply chain disruption.

Bottom Line

Risk management professionals need to deal with all sorts of financial risk on a regular basis. It is a time-consuming and difficult task that can result in reactive behavior instead of proactive efforts, as the time constraints of doing the necessary deep dives to monitor your portfolio are ever-present. Complicating things is the fact that public and private companies need to be evaluated in different ways. CreditRiskMonitor's proprietary tools allow you to focus your efforts where it will have the most impact on the public and private side.

Both the FRISK® score and PAYCE® score are timely, highly accurate predictive models that look one year ahead to pinpoint company financial stress. This gives you the time and the tools you need to do your job more effectively. With such resources, including CreditRiskMonitor’s proprietary subscriber crowdsourcing data, risk professionals like yourself can identify and avoid financial risk before it impacts your company.