When a corporation defaults on its debt, it’s a clear sign of financial stress and may precede a bankruptcy filing. According to CreditRiskMonitor research, only about one out of every four defaults will cascade into bankruptcy during normal economic periods. While the risk of default is important, bankruptcy risk is the more important issue for most business counterparties. Cutting ties with a customer or supplier too soon could lead to missed sales opportunities, while being too late could result in significant financial losses.

Why It Matters

When a highly leveraged business becomes distressed, conflicts of interests may arise between stakeholders and occasionally between creditors. This problem is especially prevalent in public companies that act as large customers or suppliers, where their failure creates a catastrophe for all counterparties involved. Default can be a first step along the often contentious bankruptcy process. However, there are typically three fundamental scenarios that can occur after a debt default:

- A business turnaround

- A buyout or merger agreement involving another company

- A bankruptcy filing followed by emergence or liquidation

A business can default once or even multiple times on its debt and actually never go bankrupt. The company could technically default on loans or securities and relevant parties can implement a waiver or distressed exchange in order to preserve their agreement. Although unconventional, a company could also pursue a default on its own accord for the purposes of obtaining alternative financing. Both of these situations matter for lenders; however, the net effect to vendors and customers is often limited.

For businesses that do actually go bankrupt, there can be a significant time lag between the date of default and the bankruptcy filing with the courts. The company may strategically cut costs, attempt to sell assets, obtain additional financing, pursue M&A or hire turnaround experts. If those actions are unsuccessful, then bankruptcy will become an increasingly likely outcome.

Action should be taken to mitigate counterparty risk leading up to bankruptcy, but there are options available to maintain business relationships prior to the filing. Some parties may eliminate exposure completely during this crisis period – unfortunately, this option can limit or significantly impair otherwise profitable business too early. Further, distressed businesses usually continue to operate while working through the restructuring process and look favorably on critical vendors and customers that provide support through difficult times. The key is to be prepared in advance so you can take the steps necessary to protect your company while still working with a financially weak customer or supplier.

In practice, credit and supply chain professionals fundamentally care more about bankruptcy risk than default since the former speaks to the sustainability of the company, rather than the viability of a specific security or loan. Since companies in default are statistically more likely to survive than go bankrupt, it’s important to differentiate between the riskiest situations requiring immediate remediation and those that require elevated monitoring. Doing so will minimize financial loss and increase profit for your company.

Financial models that look to predict default are not structured to measure bankruptcy risk. Therefore, a default model may provide some indication of bankruptcy risk, but the timing and probability of such an event may be unclear. CreditRiskMonitor's FRISK® score helps to solve that problem by specifically using probability of bankruptcy as the output metric rather than extrapolating default predictions.

The Virtual Credit Group (Subscriber Crowdsourcing)

At the core of our Fundamental Service is the 96% accurate FRISK® score, formulated to assess bankruptcy risk in public companies within the forward 12-month window. The FRISK® score incorporates a number of critical risk indicators including crowdsourced click patterns of credit professionals and other subscribers. Our subscribers are highly influential in the daily commerce of some of the world’s largest corporations, routinely making decisions that affect billions of dollars of purchase and sale transactions every month.

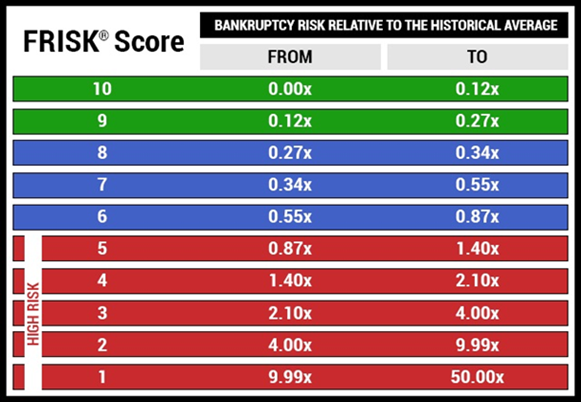

The FRISK® score uses a “1” (highest risk) to “10” (lowest risk) scale for measuring bankruptcy risk. A FRISK® score equal to a “5” or less, known as the “red zone,” indicates financial stress and an elevated probability of bankruptcy:

Credit risk professionals have the unique ability to identify and analyze financially stressed businesses due to their expertise and exception to Regulation Fair Disclosure (Reg FD), allowing them to discuss non-public information with the managers of public companies and current actions with competitors. These asymmetric advantages are reflected in the actions they perform as CreditRiskMonitor subscribers on our highly structured website. Behavioral data based on what’s being accessed and reviewed in our subscriber portal is aggregated in real-time and provides an additional new weight to the FRISK® score – improving the timeliness and accuracy of the score when it is most needed.

For example, if your sales department is making significantly larger orders to a business which has a weak FRISK® score, that may be an indication that other suppliers are cutting down credit issued or changing trade terms. High-risk subscriber crowdsourcing patterns will anonymously communicate that decision into the FRISK® score, effectively providing subscribers with access to the largest virtual credit groups in the world.

Once the FRISK® score has warned of financial stress, all options should be put on the table. We recommend that subscribers carefully monitor businesses that fall into the red zone. At minimum, subscribers should review the business, perform analysis and, if necessary, speak with company management. If the situation presents itself as risky, those controllable-yet-dangerous exposures should be mitigated. On the other hand, you may also decide to seize the opportunity to work with the distressed company, but under prudent and conservative terms. The FRISK® score and other tools within the CreditRiskMonitor service help credit and supply chain professionals mitigate financial risk while also revealing opportunities for growth.

Bottom Line

Given that global corporate debt stands at record highs, staying ahead of bankruptcy risk is more important than ever. Although companies that default on a debt typically survive rather than file for bankruptcy, it is vital for suppliers and customers to identify bankruptcy risk. Relying on default information by itself could mislead your decision making. The FRISK® score identifies financial stress and bankruptcy risk in U.S. public companies with 96% accuracy.

Subscriber crowdsourcing is a powerful incremental data component within this bankruptcy model, allowing subscribers to anonymously harness the view of their peers. That makes the FRISK® score an important model that all risk managers should have in their toolkit.