Credit professionals use CreditRiskMonitor®’s Trade Contributor Program to gain quality, real-time insights into their accounts receivable portfolio. We collect in excess of $2 trillion in trade data annually from our trade providers. After processing this data, we work with credit professionals to be more proactive and tactical with their accounts receivable to make healthier business decisions.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

CreditRiskMonitor and Allianz Trade, the world’s leading trade credit insurer, are pleased to announce the approval of CreditRiskMonitor as a Discretionary Credit Limit (DCL) report provider in the U.S.

CreditRiskMonitor.com, Inc. (OTCQX: CRMZ) reported revenues of $4.9 million, an increase of approximately $63 thousand or 1%, for the first quarter of fiscal 2025 compared to the same period of fiscal 2024.

CreditRiskMonitor.com, Inc. today announced that its Board of Directors has appointed Shyarsh Desai as Chief Operating Officer, effective March 19, 2025 and previously reported in the Company’s Form 10-K filing on March 20, 2025.

One Year In: The COVID-19 Pandemic Pushes Financial Risk to the Limit

Join CreditRiskMonitor's President & COO Michael Flum and Sr. VP of Data Science Dr. Camilo Gomez for a look back at the volatile year that was in 2020 and how the FRISK® score was instrumental in making financial risk evaluators aware of potential bankruptcies far earlier than by using other models.

CreditRiskMonitor today announced that its Board of Directors has appointed Jennifer Gerold as Chief Financial Officer and David Reiner as Chief Accounting Officer, effective May 23, 2024.

CreditRiskMonitor's PAYCE® score is providing advanced warning on some high-profile private company bankruptcies already in 2023, with Simmons Bedding Company at the top of the list.

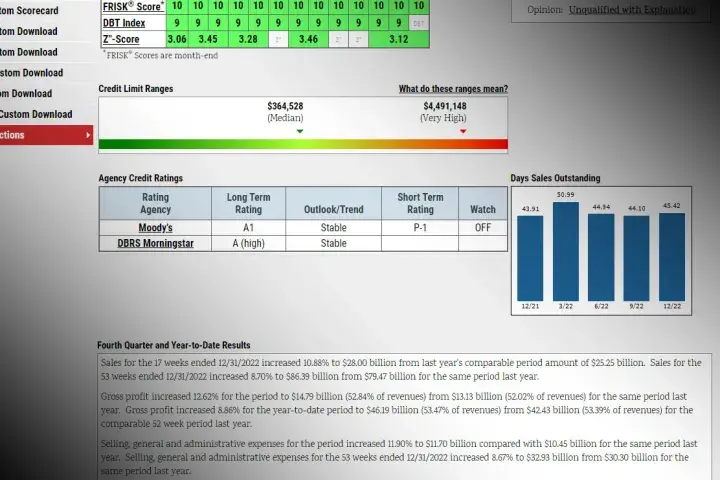

In preparation of future bankruptcies, credit professionals are using CreditRiskMonitor’s Credit Limit Ranges solution for automated monitoring on the size of credit lines.

The FRISK® score routinely identifies zombies across all industries. In fact, total high-risk companies worldwide have increased by nearly 50% since October 2021, which indicates another wave of bankruptcies is on the horizon.