The media and financial institutions, including the Federal Reserve, underreport the proliferation of zombie firms, a frightening reality you must not ignore. Learn how you can use the FRISK® score and other CreditRiskMonitor report features to protect your company from bankruptcy-prone zombies.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

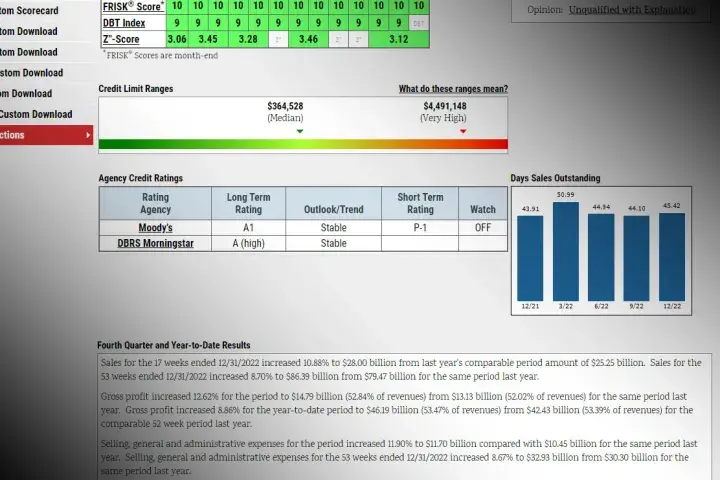

In preparation of future bankruptcies, credit professionals are using CreditRiskMonitor’s Credit Limit Ranges solution for automated monitoring on the size of credit lines.

The FRISK® score cuts through the “Cloaking Effect” by identifying financially stressed companies with a differentiated and proprietary method that doesn't rely on payment history.

Public and private companies need to be proactively evaluated in distinct, different ways by risk management professionals - fortunately, with the FRISK® score and PAYCE® score, CreditRiskMonitor has world-class solutions for both subportfolios.

CreditRiskMonitor® offers up five quick and important facts that you needed to know about now-bankrupt Rite Aid Corporation to have made a more solid business evaluation – or, more advisable, an alteration of credit extension or a pivot to a peer.

In a pandemic period when major public company bankruptcies are hitting hard daily, reliance on payment performance and/or financial statement analysis provides a whole new slew of dangers.