Unlock Financial Insights by Sharing Confidential A/R Trade Data

Unlock the true potential of your subscription by confidentially sharing trade receivables.

Get important bankruptcy alerts and stratify your portfolio to identify financial risk before it impacts your bottom line. When you give, our trade team helps you get a lot.

Get Demo

See for yourself how CreditRiskMonitor® delivers more clarity and control to help you avoid risk and grow your business.

Private Coverage Power

$3T We collect nearly $3 trillion annually in trade payment data to turbo-charge our private company risk analysis.

Drilling Into A/R Data

18 monthsWe can hold up to 18 months of A/R data for you to explore a robust history of payment performance to identify risk trends.

Learn more about our confidentiality processes here.

Dollars-At-Risk Coverage

~90%Our proprietary analytics cover roughly 90% of subscribers dollars-at-risk, including all public companies worldwide.

Share, compare, execute. What you will see on your trade demo:

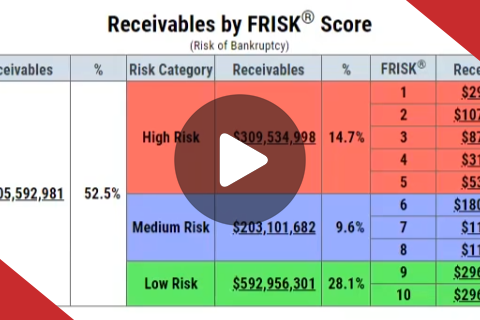

Receivables Snapshot

When receivables are stratified across our predictive models, including the FRISK® and PAYCE® Scores, users can see where the risk lies within their portfolio. This page is where we essentially organize your A/R data and allow users to hold up to 18 months of this data within the feature. There are specific sections provided for public or private companies, even companies to where there is no score available. The purpose of this report is quite simple: all we are doing is highlighting companies that are at high risk, given the FRISK® and PAYCE® Scores, which are valuable and tie into organizing dollars in each model that we offer in the program. This section emphasizes the key areas of how the program can be hugely effective in streamlining your process and best understanding risk among your accounts across the board.

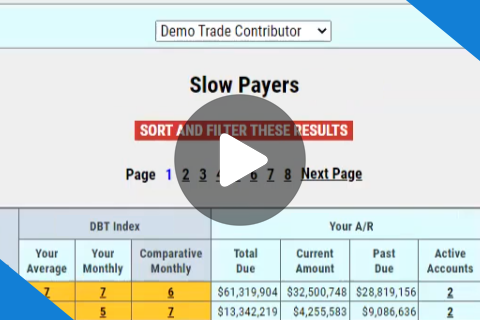

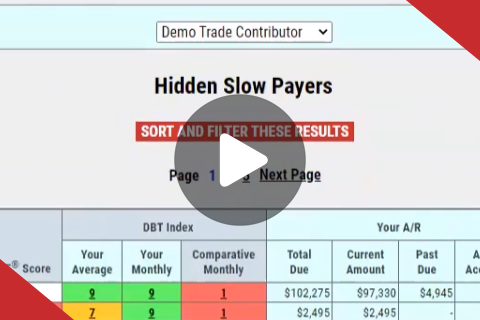

Slow Payers

This report is focused on and highlights which customers are paying you slowly, and how quickly each company is paying other trade contributors for the current month. This report also provides information you can leverage to manage your collections better. You can click on company names and we will provide a link to that parent company leading you to our fundamental service. This information can be very helpful in doing a simple compare and contrast to either the payment performance or the terms that are displayed, even the credit limits that are showing. If you wanted to investigate further into a trade provider’s full experience and account details, this video will walk you through how to get to a full 18-month view for as many months as the company has been submitting.

Analysis By Country

The Analysis By Country report offers an interactive geographical view of your A/R file by region, allowing you to easily analyze the performance of your receivables based on past due and total due metrics. You can also gain valuable insights by focusing on month-over-month and year-over-year comparisons. To unlock the full potential of this report, we recommend providing three to six months of data from your A/R file, enabling in-depth trend analysis and more accurate assessments.

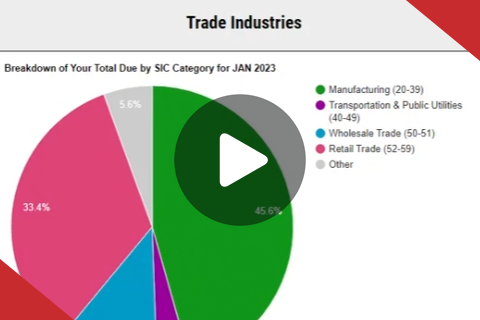

Analysis By Industry

The Analysis By Industry report shows an interactive pie chart of your A/R file with SIC and NAICS codes based on total due amounts, past due amounts, and customers of the industries you are doing business with. The slider on the right-hand side allows you to choose by month. This option can allow you to view month over month as well as year over year if we have the data collected from your AR file, which is why providing three to six months of data is beneficial.

Customer Summary

We offer custom reporting options under "Customer Summary." If you happen to not find the information you are looking for under where action reports are displayed, this is the section to come to in order to customize your own report. This report is sorted by past due (largest to smallest), so you can prioritize which accounts to pursue first, but this information ca be organized in any way that best suits your needs. Once you filter the information, you will receive a solid report of accounts that you can pursue immediately provided the organization information.

Customer Bankruptcy Filings

In the Customer Bankruptcy Filing section, we make sure that our trade providers are in a unique position that should any of their customers, public or private, file for bankruptcy, you will receive notification regarding this. Our non-trade subscription holders get alerts only on the accounts within their portfolio that are FRISK® and PAYCE® Scored. A big bonus for our trade providers, since we're linking the A/R information to our bankruptcy database, we're able to provide you with a larger net of bankruptcies that occur with the lesser-known privately held companies and, of course, your publicly traded companies.

Download Accounts

We match up your accounts to the financial information within our database. We offer a variety of download options that enables you to pull and save your financials. This step-by-step walkthrough will let you know what data points are included on each download, whether you do a quarterly financial summary, annual financial summary, or pulling the data in full, as well as exactly how to download the data.

Receivables Trends

The Receivables Trends report shows the overall health of your A/R file and risk trends over time. All trade receivables are stratified into high, medium, and low-risk classifications based on the FRISK® Score, PAYCE® Score, and other risk metrics. Users have the ability to adjust the chart type while performing trend analysis. Also, users can swap to view customers or total due from the chart data drop-down. The slider at the bottom of the page adjusts the monthly range for comparison. Additionally, users can click on each data point to view specific accounts, which displays risk scores and trade payment data.

Confidentiality is Our Priority

Security and confidentiality are fundamental requirements for CreditRiskMonitor when handling trade receivables. Clients upload their accounts receivable data on their customers into the CreditRiskMonitor Trade Contributor Program for predictive financial risk and payment performance analysis.

Only client-approved users can access the confidential trade information and bankruptcy risk scores associated with their list of accounts. CreditRiskMonitor ensures strict confidentiality under a “need to know” standard.

Data is securely stored, encrypted at rest, and encrypted in transit for additional protection. Our data centers are SOC2 certified, and our platform is designed under ISO 27001 standards to ensure data protection.

Ready to get started?

Request a trade demo.

- Access to enhanced reporting

- Detailed receivable dollars-at-risk stratification

- Private company bankruptcy alerting