Confirmed cases of coronavirus infections surpassed 3 million worldwide in late April, with more than 1 million of those documented in the U.S., according to John Hopkins University of Medicine. American healthcare facilities, particularly hospitals, have been flooded with coronavirus patients and the Centers for Medicare and Medicaid Services have advised that all non-essential procedures be postponed during the pandemic.

Between elective procedures being delayed and many coronavirus patients lacking adequate insurance, hospitals are being dealt a two-pronged profitability headwind. On Apr. 7, Tennessee-based operator Quorum Health Corporation filed for Chapter 11 bankruptcy. Not but three days later did Envision Healthcare hire a debt restructuring advisor, according to Reuters.

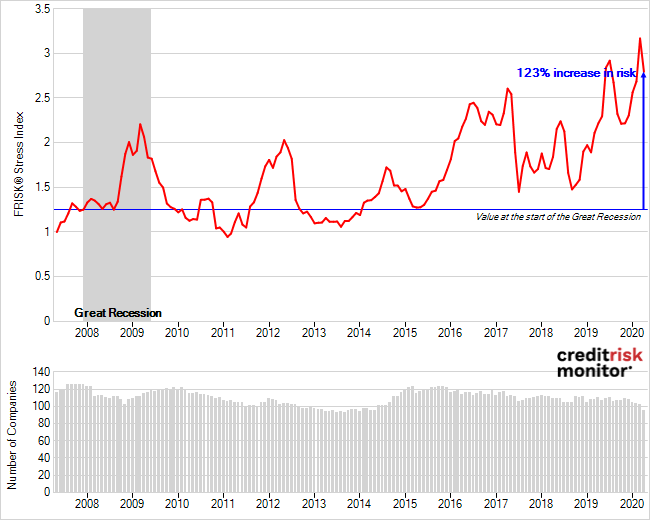

Based on CreditRiskMonitor’s FRISK® Stress Index for U.S. health services (SIC 80), aggregated financial risk in the industry has increased by 123% since 2007. The FRISK® Stress Index shows the collective probability of failure in a group of companies (such as industry, country, or portfolio) over the next 12 months. The industry's FRISK® Stress Index of 2.8 indicates collective bankruptcy risk today is significantly higher than the peak of the 2007 to 2009 recession:

To combat the damage, the CARES Act was passed to provide $100 billion in funding to healthcare providers. This assistance will help many companies navigate through the crisis, although allocations have yet to be determined and it still may not be enough to rescue highly leveraged operators.

Overwhelmed Hospitals

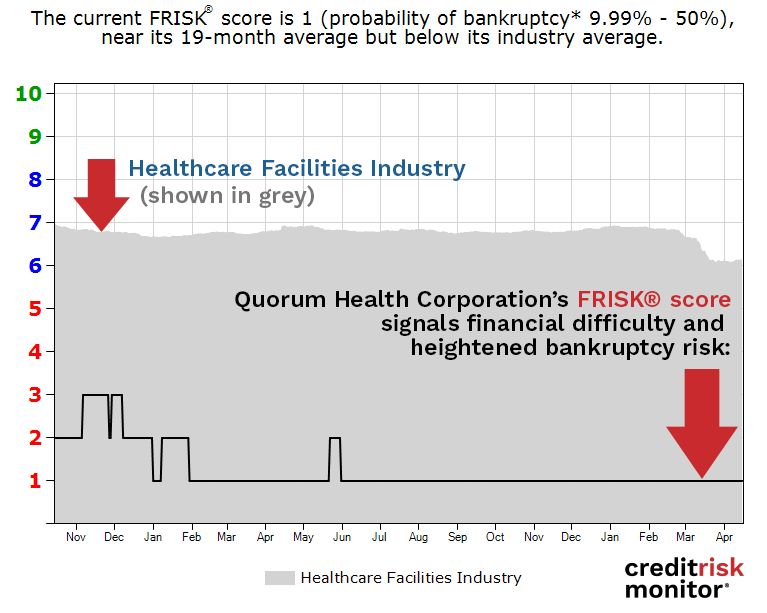

After spinning off from Community Health Systems in 2016, hospital operator Quorum Healthcare filed for Chapter 11 bankruptcy. CreditRiskMonitor preemptively identified the company’s distressed financial condition in a High Risk Report published on May 9, 2019. As a post-mortem analysis, we later released a Bankruptcy Case Study that provided a comprehensive examination of the company’s financial red flags, including the downward trend in its FRISK® score:

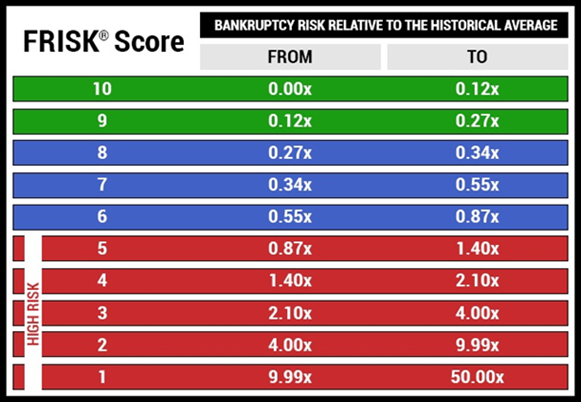

The 96%-accurate FRISK® score predicts public company bankruptcy over a subsequent 12-month period. Professionals employed by nearly 40% of the Fortune 1000 and thousands of other corporations worldwide use the FRISK® score to proactively monitor counterparty financial risk. Total commercial credit report coverage stretches to more than 56,000 public companies. The model uses a “1” (highest risk)-to-“10” (lowest risk) scale, with anything equal to “5” or less being in the high-risk “red zone,” as demonstrated below:

Several operators that were already loss-making or barely profitable withdrew their financial guidance for 2020, including Community Health Systems, Surgery Partners, and Tenet Healthcare Corporation. Below are their respective FRISK® scores and Z’’-Scores in April, which indicate fiscal danger:

Company | FRISK® Score | Z"-Score |

Quorum Health Corporation | 1 | -7.07 |

Community Health Systems, Inc. | 1 | -0.27 |

Surgery Partners, Inc. | 3 | 0.66 |

Tenet Healthcare Corporation | 2 | 0.24 |

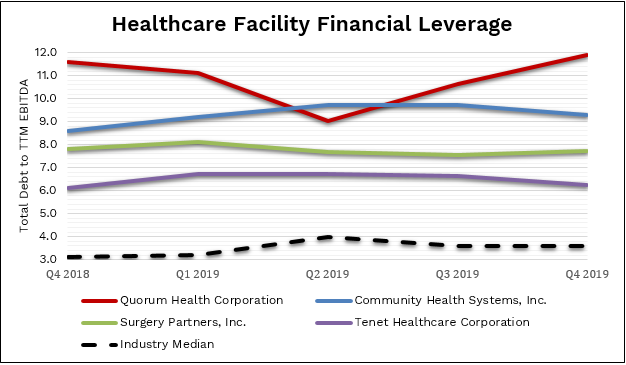

Reviewing the four comparisons below, financial leverage and debt coverage are measured using trailing 12-month EBITDA, which excludes one-time charges such as impairment charges, losses on asset disposals, litigation, and debt extinguishment. Even after all of these adjustments, credit quality is strikingly poor. All four companies are well above the hospital industry's median total debt-to-TTM EBITDA of 3.5x.

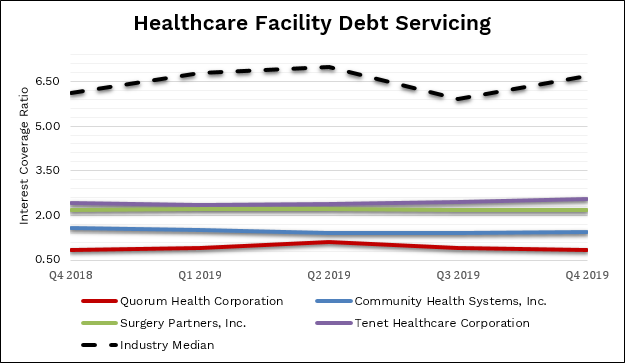

Furthermore, each operator is well below the industry's median interest coverage ratio of 6.5x.

Quorum’s total debt-to-TTM EBITDA was trending between 9x and 12x, whereas interest coverage was trending below 1x before its bankruptcy filing. The remaining operators have fragile capital structures that are compounded by limited ability to generate internal cash flows:

- Community Health has two consecutive years of negative free cash flow

- Surgery Partners’ minority interest distributions have eliminated two years of cash generation

- Tenet’s free cash flow margin was reduced to less than 1% from minority interest obligations

With the coronavirus impact in full effect, hospitals have been issuing debt to bridge ongoing cash burns in the first and second quarters of 2020. Tenet Healthcare issued $700 million in senior secured first-lien debt at an interest rate of 7.5%, significantly boosting its cash position to well over $2 billion. For now, Tenet should be able to manage through the coronavirus rough patch. That benefit, however, comes at the expense of increased leverage and higher interest costs. Surgery Partners remains in a relatively weaker position, after drawing down on a $120 million credit line, as it only holds $206 million in liquidity. A 15% reduction to annualized EBITDA would increase Surgery Partners’ financial leverage from 7.7x to 9.4x year-over-year. Given the company’s heavy exposure to elective procedures, its cash burn could last throughout the course of 2020.

Community Health Systems, meanwhile, issued an incremental $462 million of new debt (post retirement of $1 billion) in February with a 150bps higher coupon rate. Community Health carries the weakest liquidity profile with only $216 million in cash and equivalents while holding less than 44% of total funding availability on its Asset Backed Loan Facility. Risk professionals need to review each company’s latest liquidity portion of the Management Discussion & Analysis (MD&A) section of their latest 10-Qs to get insights into these liquidity concerns. Doing so, for example, would divulge Community Health’s springing covenant of the fixed charge ratio if total availability on its credit revolver drops below 10%. Therefore, continued cash hemorrhaging would push the company’s debt-to-EBITDA in excess of 10x and fixed charge below 1x, triggering a breach. After already engaging in two distressed exchanges in 2018 and 2019, lenders may be less inclined to provide additional concessions as the coronavirus slashes profitability further.

Bottom Line

The longer the coronavirus persists, the harder it will be for health services operators to avoid bankruptcy, quite similar to what transpired with Quorum Health. Subscribers use the insights provided in the CreditRiskMonitor service to evaluate and stay ahead of public company bankruptcy risk like this every day. Presently, CreditRiskMonitor is providing warnings on thousands of companies worldwide that could trend into bankruptcy as we progress through 2020 and 2021 under the cloud of COVID-19. Some of the most exceptional features on individual companies include access to the 96%-accurate FRISK® score, detailed financial analysis, industry comparisons, timely news alerts, and the MD&A report, among many other troves of data. Contact us today for a free trial of these tools and more.