The financial fallout from the most recent holiday season may not provide comfort or joy for Conn’s, Inc., a specialty retailer of furniture, mattresses, home appliances and electronics.

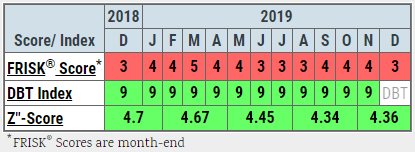

Most of the Texas-based company’s product sales are financed with in-house consumer credit programs whose interest rates average 22% for its typical credit-constrained customer. In the last year, the company’s FRISK® score has consistently fallen in the “red zone;” indicating above average risk of bankruptcy. By combining stock market volatility data, financial ratios, bond agency ratings and analysis of CreditRiskMonitor subscriber click patterns, our proprietary FRISK® score reveals financial risk that other metrics cannot readily see:

The FRISK® score pins Conn's, Inc.’s bankruptcy risk at roughly four times higher than the retail industry average. This warning signal runs in contrast to the DBT Index which measures monthly dollar-weighted invoice payments, and the Z”-Score which assesses bankruptcy risk based on financial statement ratios as shown in the above table. These non-FRISK® metrics are signaling prompt payments and strong financial health, respectively. What is going on?

Business Risk

According to fiscal period ended Oct. 31, 2019, total accounts and notes receivables for Conn’s, Inc. were $1.33 billion. Most of these receivables utilize Level 3 accounting (asset and liability fair values that are estimated by the company) given the complexity and variability of customer contract payment structures. About 59% of those receivables were: 60+ days past due, re-aged (modification of payment terms), or restructured. The fine print suggests that Conn's, Inc.’s customers are having trouble keeping up with their payments. Additionally, the retailer's cash conversion cycle has elongated over the years, thanks to slower inventory turnover:

| 2019 YTD | 2018 | 2017 | 2016 | 2015 | 2014 | |

| Cash Conversion Cycle | 240.1 | 213.8 | 207.3 | 202 | 190 | 167.7 |

| % Change | 12.3% | 3.1% | 2.7% | 6.3% | 13.3% | 15% |

In addition, Conn's, Inc.’s third quarter filing disclosed that the newly approved FASB accounting standard which mandates that management account for expected credit losses over the remaining life of a financial asset rather than just the current year could impact its performance. This change doesn’t impact cash flow outright but it could reveal higher risk or increase the allowance for doubtful accounts due to Conn’s, Inc. typical sub-prime clients. The new standard is expected to be implemented by the first quarter of 2021.

With three quarters of 2019 in the books, same-store sales have declined at an average rate of 6.3%, mostly driven by tighter credit underwriting standards. Management affirmed that even more conservative credit underwriting will be rolled out in the future. Such strategies are aimed at reducing charge-offs (falling to 11.3% last quarter, the lowest in five years, but still exceeding 10% annually).

The trade-off is reducing retail sales growth, with management guiding to a 12-to-16% decline in fourth quarter comparable store sales.

| Q4E | Q3 | Q2 | Q1 | |

| Comp Store Sales | -14% | -2% | -11% | -6.8% |

Although supportive to the credit portfolio (especially in advance of the new accounting rule), the fourth quarter would mark the steepest decline since fiscal period ended July 2017.

Financial Risk

Trailing 12-month gross debt-to-EBITDA was about 4x, which is commensurate with moderate leverage. Yet third quarter interest coverage was 3x and may deteriorate below 2x into the fourth quarter for what has been Conn’s, Inc.’s strongest seasonal period. Its debt covenants require a sustained interest coverage ratio above 1x, but continued weak retail performance or an uptick in charge-off rates should be monitored carefully.

CreditRiskMonitor also recommends diving into the MD&A section for identifying key risk trends as communicated directly by a company’s management. For example, trailing 12-month free cash flow deteriorated to its lowest level since October 2016. The following from Conn’s, Inc.’s management team provides an explanation on nine-month year-over-year operating cash flow trends: “The decrease in net cash provided by operating activities was primarily driven by a decrease in cash provided by working capital, which was primarily due to timing of receipts and payments on inventory, and the collection of an income tax refund of $34.5 million during the nine months ended October 31, 2018, partially offset by an increase in net income when adjusted for non-cash activity.” A swing to negative cash flow would be detrimental given its most recent cash ratio stood at 0.02, well below the industry median of 0.27.

Bottom Line

The FRISK® score signals fiscal danger for Conn’s, Inc. Now is the time to start implementing risk mitigation. In recent years, we have observed a plethora of giant retailers that have already converted from a restructuring into a liquidation, including The Bon-Ton Stores, Inc., Sears Holdings Corporation, and Toys “R” Us, Inc., causing millions in losses for trade creditors.

In late 2019, discount retailers Fred’s, Inc. and Destination Maternity Corporation also filed for bankruptcy. Credit professionals must exercise special caution with FRISK® score red zone retailers like Conn's, Inc. as we move deeper into 2020 to avoid unnecessary exposure.