The senior housing industry reported a significant share of the coronavirus illness cases, causing a collapse in occupancy. According to federal data released in May, the nursing home population declined by 10% in 2020. The occupancy downtrend is occurring across all parts of the industry, including nursing care, independent living, assisted living, and memory care. These developments have glaring consequences for senior housing operators that could push them into bankruptcy in the coming year.

CreditRiskMonitor is a leading web-based financial risk analysis and news service designed for credit, supply chain, and other risk professionals. The core of the service is the 96% accurate FRISK® score, which predicts public company bankruptcy. With coverage of more than 57,000 public companies globally and in-depth financial ratio and trend analysis, as well as access to vital news and regulatory filings, CreditRiskMonitor helps risk professionals navigate through crisis periods like the one we are facing today.

Senior Housing Downfall

Senior housing companies have carried an occupancy rate of about 85% and unit economic challenges can develop below 80%. The coronavirus has increased residential move-out trends and pushed move-in activity to a fraction of its 2019 level. CreditRiskMonitor has identified several operators in the senior housing industry that are financially distressed. Their occupancy trends and FRISK® scores are displayed below:

| Company | Pre-COVID Occupancy | Post-COVID Occupancy | FRISK® Score |

| Genesis Healthcare Inc. | 88% | 76% | 2 |

| Diversicare Healthcare Services Inc. | 78% | 76% | 2 |

| Capital Senior Living Corporation | 85% | 83% | 2 |

| Brookdale Senior Living, Inc. | 85% | 80% | 3 |

| Sienna Senior Living Inc. | 88% | 84% | 3 |

| Five Star Senior Living Inc. | 84% | 82% | 5 |

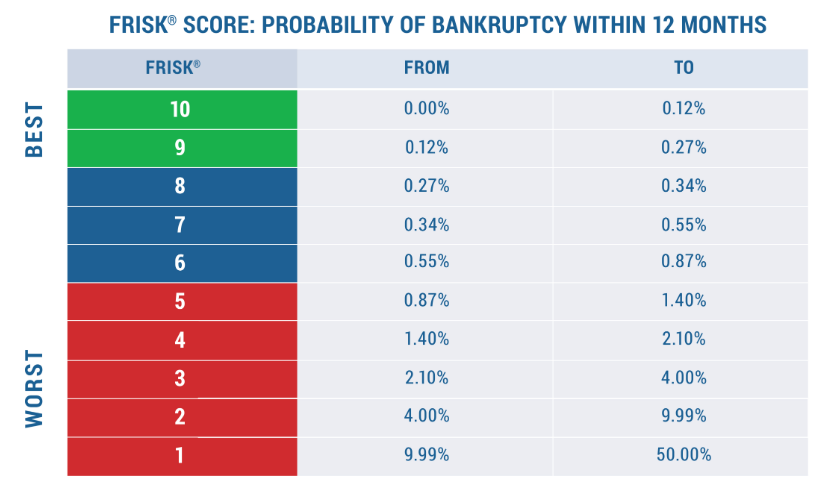

The FRISK® score is based on a “1” (highest risk)-to-“10” (lowest risk) scale, with anything trending between “1” and “5” being classified into the “red zone.” Companies with FRISK® scores in the lower half of the scale are more vulnerable to bankruptcy, as shown in the chart below:

Senior housing companies have been tasked with preventing the spread of coronavirus in their facilities by obtaining personal protective equipment, changing facility usage protocols, and increasing sanitation. However, these recent initiatives come at a significant cost. In early June, industry executives requested more than $5 billion in emergency relief to support these efforts. According to industry estimates, three out of every four staff at senior housing facilities lack sufficient PPE. Another commonality in this crisis is operators have limited internal cash flows and liquidity to handle this increased cost burden.

The COVID-19 related delays of elective procedures and insurance coverage challenges in the healthcare industry have also inhibited patient traffic to nursing homes. Since nursing homes are receiving less short-term Medicare patients, their economic structures have been destabilized. According to an industry journal review, the reduced interplay of the Medicare subsidy brings profitability challenges along with it: “Medicare is a relatively generous payer, whereas Medicaid often pays below the cost of caring for these frail and medically complex individuals. Thus, the economics of nursing home care hinges on admitting enough short-term Medicare beneficiaries to cross-subsidize the care of long-term residents with Medicaid coverage.” In other words, we’re seeing a domino effect transpiring from primary healthcare facilities into secondary markets. One operator that has a disproportionate dependence on both Medicare and Medicaid over private market payments is Genesis Healthcare.

Prospective Bankruptcy

Genesis Healthcare Inc. has a FRISK® score of “2,” which reflects a potential of 4-to-10x greater risk of bankruptcy when compared to that of the average public company. The estimation of this bankruptcy risk probability derives from three data sources:

- Financial statement ratios, such as the ones found in the Altman Z”-Score

- Stock market volatility data, and

- CreditRiskMonitor subscriber crowdsourcing

In the past year, Genesis has actually only been reporting an operating profit by divesting properties. Looking at the balance sheet, shareholders’ equity is negative and financial leverage remains very high. Its working capital deficit has become substantial and is now in excess of $200 million. Stock market trends remain poor based on high share price volatility, a negative year-over-year market capitalization return, and a total liability-to-market capitalization ratio of 40x. Subscriber crowdsourcing has also provided an exceptionally negative signal throughout the course of 2020. These aggregated research patterns by subscribers within the credit report reflect concern about Genesis Healthcare’s increasing risk profile.

In the first quarter, Genesis announced that more than half of its facilities reported cases of the coronavirus and occupancy nosedived. Operating costs have also increased, including compensation to boost retention, and product and servicing costs. Sequential quarter operating deleveraging was 110 basis points, a trend that will steepen headed into the second quarter. Genesis Healthcare reported trailing 12-month negative free cash flow and liquidity ratios rank in the bottom quartile versus industry peers. The company has already drawn down nearly one-third of the borrowing base on its credit revolvers, which leaves limited cash flexibility. To help alleviate liquidity risk, management has been divesting its owned facilities during the first and second quarter of 2020. However, after such transactions are completed, Genesis will only have ownership in about 20% of its remaining properties.

The debt capital structure remains lopsided. Presently, debt financing costs sit at a weighted average interest rate of 10%, with secured borrowings running at 7.8%. One of Genesis’ largest real estate loan deals, with bellwether healthcare real estate investment trust Welltower Inc., carries an interest rate of 12%, while 5% of that annualized fee is paid in kind. Although this arrangement provides Genesis more cash flexibility, it stretches the life of the borrowing term and amortization costs. In addition, two-thirds of total debt will need to be refinanced within the next three years.

When examining Genesis’ first quarter Management, Discussion, and Analysis (MD&A) report, red flags arise pertaining to its compliance with existing credit agreements. For instance, the financial covenants subsection indicated that the company received a waiver for a breach on one of its master leases on May 4, 2020. The waiver provided a grace period of at least one year for the company to regain compliance. However, management then disclosed another possible outcome: “the ongoing uncertainty related to the impact of the COVID-19 pandemic and ongoing healthcare reform initiatives may have an adverse impact on our ability to remain in compliance with covenants.” If profitability headwinds become severe enough, the company could trip cross-default provisions and have lenders pursue a broader financial restructuring.

Bottom Line

The coronavirus pandemic has had a demonstratively negative impact on healthcare operators. The bankruptcy of Quorum Health Corporation and other recent credit defaults are a clear cause for concern among creditors, particularly as the coronavirus upends normal business operations for senior housing operators. Risk professionals can use the daily updates of the FRISK® score to pinpoint counterparties that are most susceptible to bankruptcy. Contact us to receive a free risk assessment so you can see our bankruptcy prediction models in action.