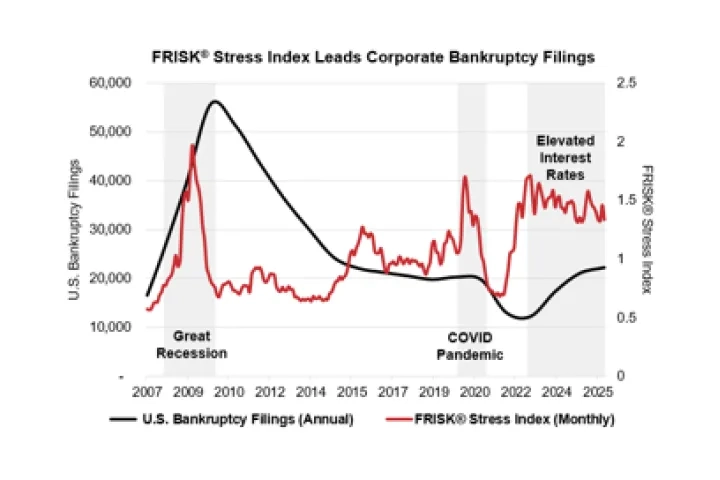

Our bankruptcy case study of FAT Brands, parent company of Johnny Rockets, shows that the FRISK® Score flagged elevated bankruptcy risk more than a year before the filing. The FRISK® Score identified elevated bankruptcy risk 12 months prior to its filing. Most importantly, crowdsourced intelligence triggered a downgrade to a FRISK® Score of "1" using insights from the credit community, including risk professionals from nearly 40% of the Fortune 1000.