Among CreditRiskMonitor’s FRISK® and PAYCE® Scored businesses, bankruptcies in 2023 were about 2.4 times greater than in 2022, and 1.9 times higher than in 2020, which featured the COVID-19 lockdown recession. In 2024, CreditRiskMonitor’s FRISK® Stress Index is signaling a continuation of this bankruptcy trend as interest rates continue pressuring “zombie” companies, those with an interest coverage ratio below 1. Our clients – including nearly 40% of the Fortune 1000 and thousands of additional companies worldwide – are prepared with the right tools to assess bankruptcy-prone companies and implement risk mitigation strategies.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

2023's Major Failures

In the Spring 2023, the U.S. banking system cracked with the failures of Signature Bank, SVB Financial Group, and First Republic Bank. Those failures mainly occurred due to asset-liability duration mismatches and the Fed created the Bank Term Funding Program (BTFP) to provide support. Notably, however, BTFP borrowings increased by $50+ billion, or approximately 45% since the end of November 2023.

In Summer 2023, China’s real estate crisis produced the colossal bankruptcies of China Evergrande Group and Sunac China Holdings Limited, and the industry remains highly distressed. In February 2024, the IMF wrote regarding the real estate slowdown that “property activity has slowed dramatically but home prices have fallen only modestly, pointing to potential unresolved pressures…housing investment is likely to fall almost 45% on average and remain subdued thereafter.”

Finally, the largest nonfinancial U.S. bankruptcy in 2023 was shared workspace operator WeWork Inc. Below is a list of the largest nonfinancial FRISK® Scored bankruptcies:

| Company | FRISK® Score | Country | Industry | Assets (USD, Billions) |

| China Evergrande Group | 1 | China | Real Estate Operations | $257.4 |

| Sunac China Holdings Limited | 3 | China | Real Estate Operations | $152.6 |

| Casino Guichard Perranchon SA | 1 | France | Retail (Grocery) | $24.8 |

| WeWork Inc. | 1 | U.S. | Real Estate Operations | $15.0 |

| Cineworld Group plc | 1 | U.K. | Motion Pictures | $9.7 |

| Rite Aid Corporation | 1 | U.S. | Retail (Drugs) | $7.7 |

| Light SA | 1 | Brazil | Electric Utilities | $4.8 |

| Bed Bath & Beyond Inc. | 1 | U.S. | Retail (Home Improvement) | $4.4 |

| Avaya Holdings Corporation | 1 | U.S. | Communications Services | $3.8 |

| Diebold Nixdorf, Inc. | 1 | U.S. | Computer Peripherals | $3.1 |

The FRISK® Stress Index Warning

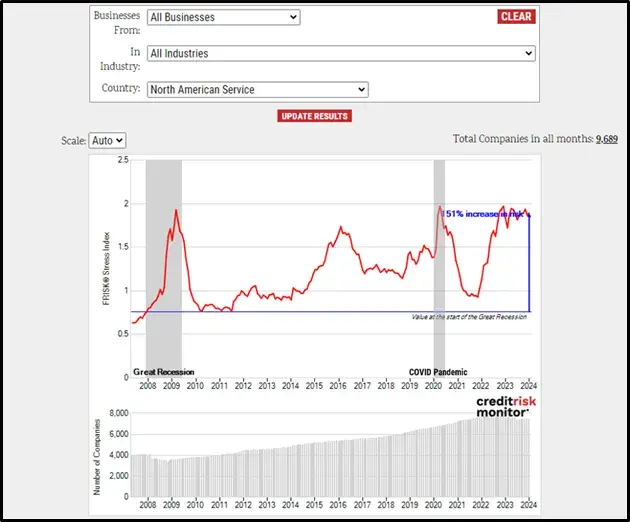

Risk professionals assess macro-bankruptcy risk using CreditRiskMonitor’s FRISK® Stress Index. The FRISK® Stress Index shows the collective probability of failure in a group of companies (such as an industry, country, portfolio, or some combination therein) during the coming 12 months. In 2024, the FRISK® Stress Index for North America still reflects the 2023 trend, indicating the potential continuation of higher bankruptcy rates.

The FRISK® Score is measured on a "1" (highest risk)-to-"10" (lowest risk) scale, with "1" to "5" being the high-risk "red zone," indicating heightened risk of bankruptcy. Of all FRISK® Scored companies that file bankruptcy, about 67% are scored as “1” or “2” before filing. With about 15% of North American companies trending in these risk classifications, clients should proactively monitor such companies in their portfolios. However, North America is only one region of such high-risk trends.

Zombie Companies by Sector

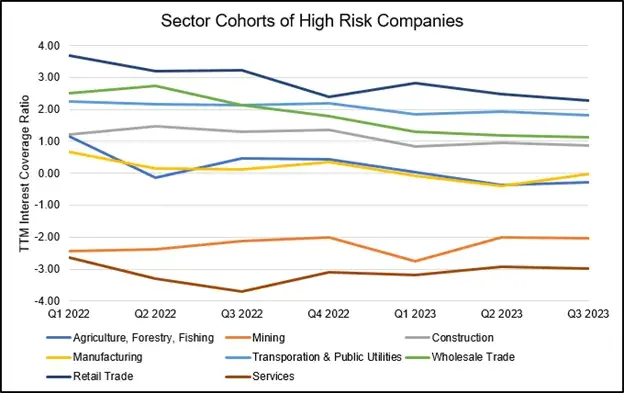

Among the FRISK® Score red zone companies, zombies are most likely to file bankruptcy given their limited debt servicing capacity. For each sector, CreditRiskMonitor measured the median TTM interest coverage ratios of FRISK® red zone companies globally. Since Q1 2022, nearly every high-risk group reported a deterioration in TTM interest coverage. Mining and services ranked among the worst, but other sectors are also exposed to cyclical downturns that can produce sudden, adverse impacts to interest coverage.

With higher interest rates, declining interest coverage, and broadly elevated commercial bankruptcy filings, clients should regularly evaluate their counterparty portfolios for:

- Risk rating downgrades into the high-risk category

- Counterparties already trending in high-risk, especially FRISK® Scores of "1" and "2"

- Outsized dollar exposure tied to high-risk companies

Bottom Line

According to the Bank for International Settlements, total credit to the nonfinancial corporate sector reached $89.3 trillion in 2023. With this dormant debt powder keg, risk professionals must take a multi-faceted approach to financial risk evaluation including reviews by region, industry, and unique accounts. Controlling risk exposure to even one counterparty bankruptcy will shield your business from substantial losses. Contact CreditRiskMonitor to learn more about our best-in-class bankruptcy prediction models and how we provide better outcomes for our clients.