Three Key Things to Know at the Start:

- The FRISK® Score highlighted the increasing financial strain at JOANN Inc. in March 2023, providing CreditRiskMonitor subscribers ample time to adjust their exposure to the troubled specialty retailer.

- JOANN's top- and bottom-line performance has been weak and it is an industry laggard on key financial metrics.

- JOANN has been without a permanent CEO since May 2023, which creates uncertainty around its corporate direction.

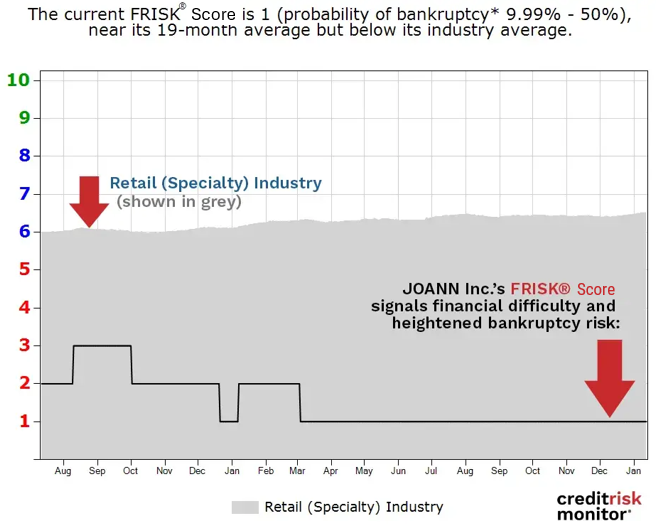

JOANN Inc. ("JOANN"), a fabric and crafts specialty retailer, has been struggling for more than a year, highlighted by the fact that it has a worst-possible score of "1" on the FRISK® bankruptcy risk scale. The FRISK® Score alerted CreditRiskMonitor subscribers to rising risks, including ongoing losses, weak interest coverage, and elevated leverage levels. Our High Risk Report on JOANN was published on Dec. 27, 2023, providing a deep review of the company's perilous situation.

This article will provide five quick and vital facts about JOANN highlighting how CreditRiskMonitor subscribers and prospective clients can identify counterparties within their portfolios where bankruptcy risk is trending higher.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

1. Hanging By A Thread

CreditRiskMonitor subscribers were given a warning in 2022 as JOANN's FRISK® Score trended within the scores of “5” and “4,” indicating that credit risk evaluators needed to pay close attention. Then as the score moves into “2” and “1,” credit professionals will typically take action such as adjusting trade terms or pivoting to a different customer to protect against a potential bankruptcy. For context, JOANN's FRISK® Score landed at "1" in March 2023, indicating 10-to-50x higher bankruptcy risk than the average public company. In the 10 months thereafter, the company has remained fastened to the bottom rung.

The FRISK® Score correctly identifies 96% of public companies that file for bankruptcy at least three months beforehand by combining four high-quality data components:

- Crowdsourcing, or the aggregated risk sentiment of CreditRiskMonitor® subscribers indicated by their collective research actions on the platform

- Stock market performance, including volatility and market capitalization trends

- Agency ratings

- Financial statements, factoring in ratios similar to, but in excess of, the Altman Z’’-Score

FRISK® Score | Probability of Bankruptcy Within 12 Months | |

| From | To | |

| 10 | 0.00% | 0.12% |

| 9 | 0.12% | 0.27% |

| 8 | 0.27% | 0.34% |

| 7 | 0.34% | 0.55% |

| 6 | 0.55% | 0.87% |

| 5 | 0.87% | 1.40% |

| 4 | 1.40% | 2.10% |

| 3 | 2.10% | 4.00% |

| 2 | 4.00% | 9.99% |

| 1 | 9.99% | 50.00% |

The proprietary combination of these four metrics within the FRISK® Score consistently outperforms any individual metric and payment data in the prediction of bankruptcy. Counterparties should not ignore the warnings being given by the FRISK® Score about JOANN today.

2. A Run On Red Ink

Having been warned of the increasing risk at JOANN, one of the first things that should have been examined is the retailer's profitability – or lack thereof, in this case. The company posted a net loss in fiscal 2023 after a couple of years of profitability. That included red ink during the all-important holiday season, which is never a good sign for a retailer. JOANN has continued to lose money each quarter through the first nine months of fiscal 2024:

Although JOANN's sales only fell 4% year over year in the fiscal third quarter of 2024, the net loss increased 23%. And while the company highlighted that it was increasing its full-year revenue guidance when it reported fiscal third-quarter earnings, it is still looking for a fiscal 2024 decline of 1% to 2%, which includes a 2% benefit from an extra week. Management is highlighting the positives, as you would expect, but fiscal 2024 is likely to end up being the fourth consecutive year of decline on the top line. And, unless it has a very strong holiday season, there's likely to be more red ink in fiscal 2024 than there was in 2023, as well.

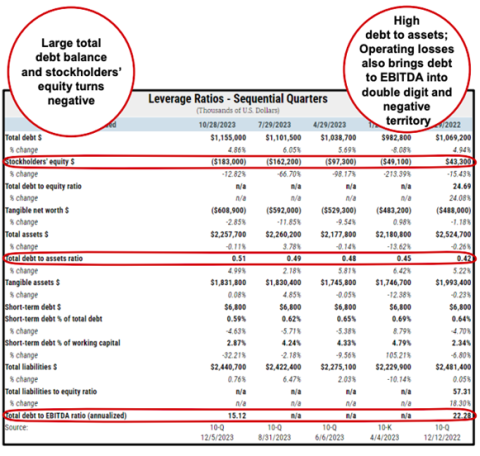

3. High Leverage, Weak Interest Coverage

Given the ongoing losses, another important factor to consider is JOANN's leverage. The company's total debt to assets ratio and its total debt-to-EBITDA ratio are both in the bottom quartile of its peer group, a worrying sign. Debt-to-assets has increased steadily over the past five quarters, while debt-to-EBITDA trended into the double digits during fiscal Q3 2024, a troublingly high level.

With the weak top- and bottom-line performance and the leverage issues, JOANN has been unable to adequately cover its interest costs. Its interest coverage ratio has been below 1 for more than a year. This is not a sustainable trend, noting that the company warned in its MD&A that modest changes in gross margins or costs, among other things, could force the company to reduce the carrying value of the JOANN trade name.

4. Lapped By Its Peers

JOANN's FRISK® Score is far below the norm in the retail (specialty) industry. The difference is dramatic, with the average for that industry sitting at "6" while JOANN remains at a worst-possible "1." Taking a look at the retailer's relative standing in another way, the risk within miscellaneous retail stores (SIC 5999) is at levels last seen during the early days of the COVID-19 pandemic and the Great Recession. And JOANN's FRISK® Score indicates that it is among the riskiest names in that grouping.

While it is always recommended to monitor financial counterparties during times of broadly increasing risk, it is most important to focus on the weakest counterparties. Within that group, the ones that present the largest exposure, which will most often be public companies like JOANN, should be monitored particularly closely.

5. Who's Captaining the Ship?

In May 2023, the JOANN's CEO, Wade Miquelon, retired. Executive departures aren't uncommon in the business world, but when they come at financially troubled companies, they take on special meaning – quite often it is an indication that the company's current business approach isn't working.

In this case, the CEO left without a replacement having been lined up, suggesting that the management transition in the company's most important role, CEO, wasn't handled particularly well. The company has yet to find a full-time CEO, either, leaving the task of leading the company in the hands of two high-ranking executives. The inability of the board to appoint a replacement not only leaves the company without a clear direction for the future and that bodes poorly for the business looking forward. When – or perhaps if – a new CEO is found, the company's business direction could potentially change materially.

Bottom Line

JOANN's business has been struggling with weak top- and bottom-line results, onerous leverage, and far below peer rankings across key financial metrics. It is one of the highest risk companies in the U.S. retail industry and lacks a permanent CEO. The FRISK® Score has provided CreditRiskMonitor® subscribers ample warning of the increasing bankruptcy risk. If you count JOANN as one of your customers, time is of the essence as you look to mitigate your exposure to this troubled retailer.

Contact CreditRiskMonitor today to see how we can help you avoid high-risk companies like JOANN that may be lingering in your portfolio right now.