In this audio interview, CreditRiskMonitor CEO Jerry Flum speaks to SupplyChainBrain's Bob Bowman about crowdsourcing and the unique nature of credit managers' behavioral data.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

Pump the brakes on credit extension? Sustained demand weakness and cumbersome debt load have us thinking twice about auto parts manufacturer Cooper-Standard Holdings Inc.

The end credits could roll on Cineworld Group, the parent company of several large movie theater chains including Regal Entertainment Group. Will COVID-19 ultimately annihilate the industry?

Online automotive retailer Carvana is rapidly burning through cash and sought out private equity financing as banks were unwilling to carry the risk. Before you extend credit, you may want to pump the brakes.

Alas, bankruptcy was the best fit for Sequential Brands Group, Inc., owner of Jessica Simpson, Joe's Jeans, And1, Avia, and other apparel brands. The company filed for Chapter 11 protection after failing to comply with the amended credit agreement.

When the soda machine eats your money, you get frustrated. When a machine vendor like Frigoglass S.A. racks up major debt, creditors must adjust fast before the machine gobbles up millions in extended credit, never repaid in full.

Major discount retailer, Big Lots, Inc. filed for bankruptcy on September 9, 2024. Importantly, both payment-based (DBT Index) and financial-only based models (Z’’-Score) failed to warn about this company’s bankruptcy risk. Conversely, the FRISK® Score provided warning for more than a year, enabling clients to mitigate their trade credit exposure.

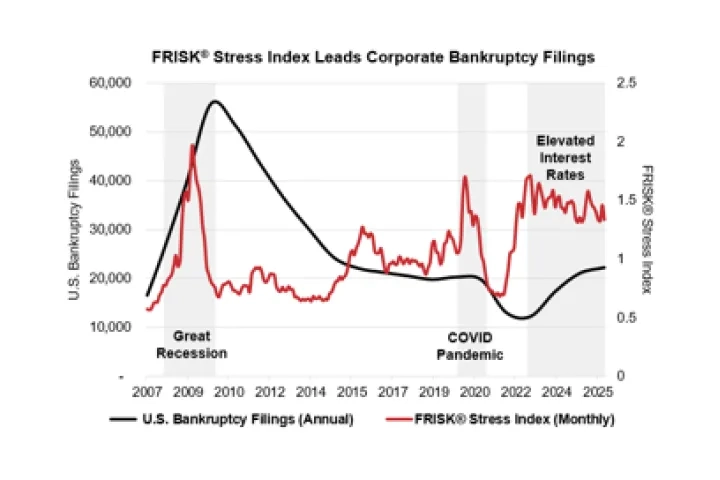

In 2025, U.S. corporate bankruptcies increased for the third consecutive year. Total Chapter 11 and Chapter 7 bankruptcies climbed above 22,000, about 18% higher than the 10-year average of 18,700. Trailing 12-month Q3 2025 bankruptcy filings also reached a 11-year high, according to U.S. Courts data.

CreditRiskMonitor recently interviewed Patrick Spargur, an experienced commercial debt collections executive, and former credit manager, on the economic downturn and relevant credit industry best practices to use in this challenging environment.