Financial Risk Report: U.S. Corporate Bankruptcies Hit 11-Year High

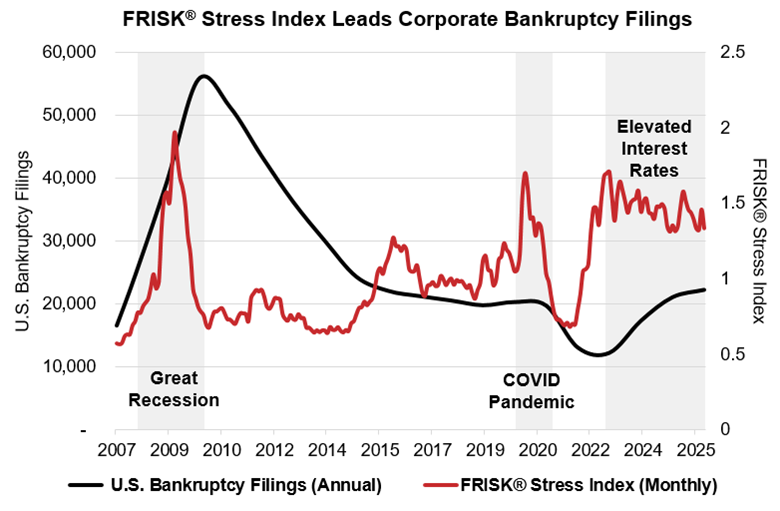

In 2025, U.S. corporate bankruptcies increased for the third consecutive year. Total Chapter 11 and Chapter 7 bankruptcies climbed above 22,000, about 18% higher than the 10-year average of approximately 18,700. Trailing 12-month Q3 2025 bankruptcy filings also reached a 11-year high, according to U.S. Courts data.

In this increasingly turbulent environment, the monitoring of financial risk at public and private companies is more critical than ever.

Chart of the Day: CreditRiskMonitor’s U.S. FRISK® Stress Index remains in high-risk territory. The FRISK® Stress Index aggregates public company FRISK® Scores to predict financial stress over the next 12 months (by industry, geography, or portfolio). In 2026, the U.S. FRISK® Stress Index reached 1.3%, above the average annual corporate bankruptcy rate of 1%.

High corporate debt levels and elevated interest rates have led to a swath of downgrades of U.S. companies into the “High” Risk Level. More recently, several economic markers show concerning patterns:

- Weakened Consumer. Consumer spending represents around 70% of US GDP, and consumer sentiment reached a multi-decade low of 51.

- Cost Inflation. Increased input costs, like commodities and labor prices, alongside tariffs continue to hamper profit margins. U.S. companies with a Risk Level of “High” reported a median TTM net profit margin of -11.5% as of Q3 2025.

- Mixed Credit Trends. Even as central banks ease credit conditions, the multi-trillion-dollar private credit market is seeing a sharp increase in payment-in-kind (PIK) structures. PIKs allow borrowers to pay interest by adding it to the debt principal rather than paying cash, preserving short-term liquidity but increasing leverage over time and postponing bankruptcy. PIK arrangements can be identified on High Risk Level companies via their SEC filings.

Largest 2025 Bankruptcies

The higher bankruptcy tally combined with the volume of “mega-bankruptcies” (total liabilities of $1+ billion) highlights the severity of the current environment. Below is a list of U.S. public and private mega-bankruptcy filings:

Stay Ahead of Commercial Bankruptcies

Key customers and suppliers file bankruptcy every day. It’s important to know your risk exposure and take steps to control such risk before it impacts your organization. Pandemic-era monetary and fiscal interventions dampened bankruptcy filings, but now bankruptcies are increasing materially.

Use the FRISK® Stress Index to understand the direction of bankruptcy trends broadly and for your unique business. By proactively monitoring bankruptcy, you will protect your organization’s long-term profitability, cash flow, and reputation.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.