Persistent inflation and higher interest rate policies worldwide are pressuring highly leveraged companies. Among those highly leveraged are “zombies” with TTM EBIT-based interest coverage ratios (ICR) below one, which are now 35% of all non-financial companies globally. The average company is also interest rate sensitive with nearly half of the total debt carried as short-term. CreditRiskMonitor® examines these factors and deteriorating corporate liquidity, which point to weaker debt servicing and a looming wave of new bankruptcy filings.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

Zombies by Sector

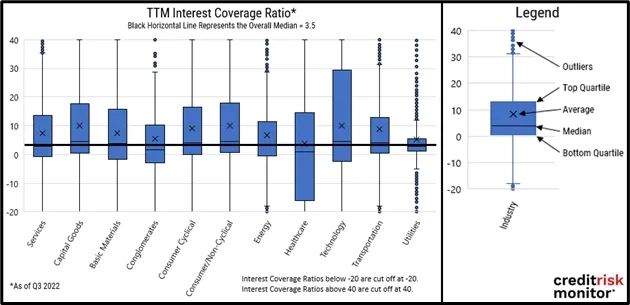

In 2022, CreditRiskMonitor determined that the Federal Reserve understated the proliferation of zombies given our estimates show 40% of U.S. publicly listed companies fell into the category. When expanding the analysis to a worldwide group of 30K+ companies, about 33% had a TTM EBIT-based interest coverage ratio under one by mid-2022 and 35% by Q3 2022. The median TTM EBIT-based ICR declined from 4.2x to 3.5x. When comparing sectors, some are more vulnerable than others, but all are troubling at the bottom quartile. The graphic below provides a distribution of their respective averages, medians, top and bottom quartiles, along with outliers.

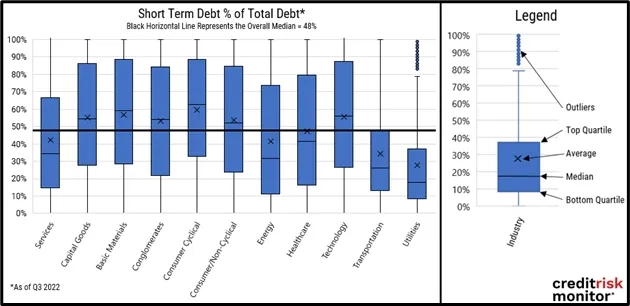

Today, almost every central bank is tightening and interest rates have increased at the fastest pace since the early 1990s. As higher policy rates flow into borrowing costs, interest coverage ratios have more room to fall. Examining short-term debt as % of total debt provides a gauge on sector interest rate sensitivity. In the graphic below, multiple sectors also have higher short-term debt relative to the overall median of 48%:

Rate sensitivity is slightly understated too because this ratio only considers one-year debt maturities. Companies also have exposure to medium-term maturities and variable-rate debt. Turning to specific groups, consumer cyclical is the worst positioned while utilities are the best positioned.

Since central banks started tightening, credit spreads have naturally widened. That also makes refinancing existing debt and incremental issuance more expensive. Effectively, debt servicing ratios are expected to decline further:

“Company interest coverage ratios will weaken from policy rates and wider credit spreads, not even factoring in the potential for earnings declines.”

As an indication of what could transpire more broadly, S&P 500 earnings estimates are expected to decline in Q4 2022, which would represent the first year-over-year decline since Q3 2020. If both earnings and interest expenses are negatively impacting interest coverage ratios, then it will be a much quicker turn of events.

More Dependent on Trade Credit

Trade credit is the lifeblood of corporate working capital and is ever more important headed into 2023. In December 2022, UNCTAD’s Global Trade Update stated that worldwide trade finance reached an estimated $32 trillion. Most trade credit financing essentially comes in at a cost of zero when factoring in both discounts and late fees, which is significantly cheaper than debt financing.

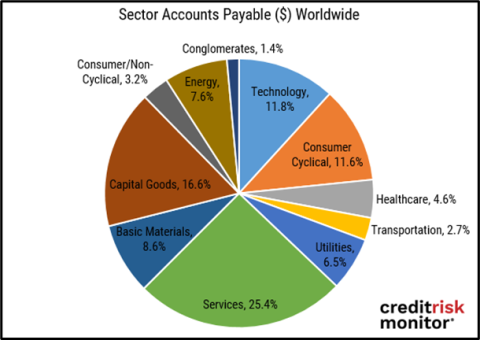

As borrowing costs rise, companies are hard-pressed in maintaining trade credit access. Trade credit carries a cost of 0% whereas the cost of debt will be the countries’ policy rate plus a risk premium. Even the world’s cheapest bank lending rate of 1.4% from Japan is still more expensive. Based on CreditRiskMonitor® data, the chart below demonstrates how accounts payable play a role in every sector.

Trade credit is also increasingly important given corporate cash liquidity is steadily draining. For example, North American companies reported a median cash ratio of 1.00 at peak in 2021 that fell to 0.63 in 2022, or a decrease of 37% year-over-year. However, the riskiest group of companies had their median cash ratio collapse at an even faster clip:

“North American companies with high-risk FRISK® scores reported an even steeper deterioration from 0.78 in 2021 to only 0.34 in 2022, a decline of 56%.”

In short, trade credit underpins every sector and is massive in size. However, that also means trade creditors are left with tremendous exposure. Credit professionals should take appropriate steps to identify zombies today, especially as the next corporate bankruptcy cycle approaches.

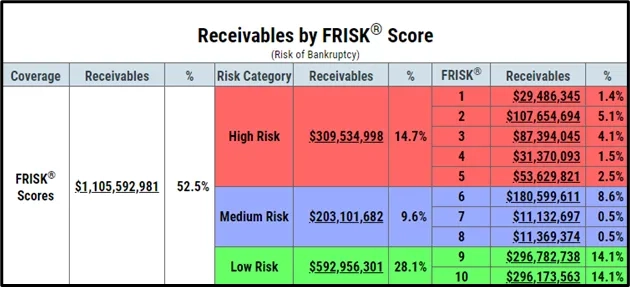

To help address this ongoing problem, CreditRiskMonitor’s Trade Contributor Program has grown to collect accounts receivables in excess of $2.5 trillion annually. Trade providers leverage the daily-updated FRISK® score to stratify their receivables into risk buckets. The FRISK® score funnels the riskiest zombie companies into the “red zone”, which are scores of "5" or below on the "1" (highest risk)-to-"10" (lowest risk) scale.

The sample portfolio above shows $309.5 million of high-risk exposure or 15% of total dollars. Subscribers are often prompted to perform different procedures at certain FRISK® score buckets. For example, subscribers will deeply research and analyze companies with scores of “3”, “4”, and “5”, while the worst scores of “1” and “2” require credit policy actions, such as tightening terms. The high-risk category demands attention overall, representing 96% of all public company bankruptcy filings, but the group scored as a “1” or “2” specifically accounting for about two-thirds. These action reports and distilled highest-risk group help users optimize their workflows to minimize bad debts and improve cash flow.

For supply chain professionals, we also provide steps to identify zombies to maintain a more resilient supply chain: How to Catch Zombie Vendors in Your Supply Chain to Mitigate Disruption.

Bottom Line

The FRISK® score routinely identifies zombies across all industries. In fact, total high-risk companies worldwide have increased by nearly 50% since October 2021, which indicates another wave of bankruptcies is on the horizon. Risk professionals should review their most distressed counterparties and take appropriate steps to manage exposure. For industry best practices, contact CreditRiskMonitor® to learn how you can use the FRISK® score and other report features to guard against zombie counterparties.