Corporate debt in the United States has expanded by nearly $2 trillion during COVID economic downturn, punctuated with eclipsing the $12.6 trillion mark at the close of H1 2022. Importantly, corporate debt increased rather than fell through the recession, which is unprecedented. Therefore, the bankruptcy cycle was essentially cut short and consequences delayed into the future.

The outcome? Heavily indebted issuers and zombie companies are more widespread than ever. In this feature, CreditRiskMonitor examines broader risk trends for corporations occurring in both the U.S. and international markets. We also discuss collective high-risk “red zone” FRISK® score trends, which are deteriorating at a similar pace to the Great Recession and COVID pandemic, and the implications.

Tracking Economic & Policy Change

Several new economic and policy shifts are negatively affecting corporate profitability and debt servicing capacity. These factors are likely to compound the impact of an already difficult financial environment. We advise considering these factors when reviewing your portfolio and individual companies.

- The yield curve has flattened. Certain parts of the yield curve have almost no spread, which portends economic downturns. The New York Federal Reserve’s recession prediction model spiked to 25% in August of 2022. Recessions negatively affect corporate revenue and margins, e.g., EBITDA, which underpins interest coverage ratios

- Severe inflation volatility. Various input costs are rapidly changing and unpredictable. Companies without pricing power face higher cost structures and weaker operating margins

- The federal funds rate is targeting 3.4% by the end of 2022. Companies are in the highest interest rate regime since 2008, during the Great Recession. Variable rate loans and near-term bond maturities totaling trillions will result in higher interest burdens and further compress pre-tax profitability

- Reduced interest tax deductions. The Tax Cuts and Jobs Act of 2017 originally shrank interest deductions from 100% of EBITDA down to 30%. The level temporarily increased to 50% during the COVID-19 pandemic so companies could better service debt. However, the limitation is now set to 30% of EBIT, providing the smallest allowable deduction of any previous policy

Each item affects corporate profits differently, which can change under a mild or severe scenario.

| Economic & Policy Factors | Corporate Profit Impact | Mild Scenario | Severe Scenario |

| Recession | Revenue, Margins |  |

|

| Inflation/Deflation | COGS, OpEx, CapEX, Margins |  |

|

| Higher Interest Rates | Interest Expenses |  |

|

| Revised Tax Deductions | Effective Tax Rate, Cash Taxes |  |

|

In general, patterns of mild inflation allow average companies to raise prices enough to offset business costs, while modest deflation makes servicing creditors more difficult but still provides lower costs. However, severe inflation exacerbates capital requirements and lenders imbed higher rates to compensate for such risk. A lack of such price stability also moves policymakers to restrictive monetary policy and eventually tighter credit conditions. Conversely, severe deflation would offset cost benefits as it would be very challenging to service debt and the worst-case scenario would involve a deflationary depression.

One notable takeaway is that interest deduction, commonly referred to as a tax shield, has been broken. Between the lower deductions of 30%, the new EBIT-based variable, and higher interest rates, debt financing is significantly less attractive in 2022 compared to historical norms. Moreover, the revised tax deductions cut the deepest on sectors and industries with the widest spread between EBITDA and EBIT margins. The groups below stand to see the largest decreases in their historical tax deductions.

| Sector/Industry | TTM EBITDA% | TTM EBIT% | Interest Deduction △ | Impact Rank |

| Manufacturing (20-39) | 7% | 3% | -57.1% | |

| Electronic and other equipment (SIC 36) | 7.8% | 3.4% | -56.6% | 3 |

| Industrial and commercial machinery (SIC 35) | 11.9% | 5.5% | -53.9% | 4 |

| Transportation equipment (SIC 37) | 10.6% | 5.5% | -47.8% | 5 |

| Paper and allied products (SIC 45) | 14% | 8.2% | -41.4% | 8 |

| Primary metals (SIC 33) | 13.3% | 8.6% | -35.2% | 10 |

| Fabricated metal products (SIC 34) | 11.6% | 7.6% | -34.3% | 11 |

| Transportation & Public Utilities (40-49) | 20% | 11% | -45% | |

| Communications (SIC 48) | 17.2% | 5.5% | -67.8% | 2 |

| Transportation by air (SIC 45) | 11.2% | 6% | -46.4% | 7 |

| Transportation services (SIC 47) | 10.9% | 6.7% | -38.3% | 9 |

| Retail Trade (52-59) | 8% | 5% | -37.5% | |

| Mining (10-14) | 33% | 21% | -36.4% | |

| Mining and quarrying (SIC 14) | 13.4% | 2.6% | -80.5% | 1 |

| Oil and gas extraction (SIC 13) | 27.2% | 14.3% | -47.4% | 6 |

Many capital-intensive industries have significantly higher EBITDA margins than EBIT margins, which materially reduces annualized interest tax deductions. This change shrinks after-tax profit and operating cash flow while increasing financial leverage.

Companies that benefited from low-to-zero effective tax rates will see their tax burden increase toward the statutory rate of 21%. Depending on the current tax rate and level of earnings, the average company could see financial leverage increase anywhere from one to three turns, e.g., total debt/FCF expanding from 10x to 12x. More levered companies will likely add years onto their repayment schedules and further increase their odds of bankruptcy.

The proposed Inflation Reduction Act also includes a 15% minimum corporate tax rate for companies earning over $1 billion annually, subject to a variety of qualifications and exceptions. Although such companies would not necessarily become financially distressed, greater cash taxes could introduce downgrades and precipitate more expensive capital financing. This new rule may also produce an adverse incentive for companies to manage earnings beneath $1 billion.

FRISK® Score Downgrade Avalanche

The increase of corporate financial risk is an international phenomenon, not just isolated to the US. In 2022, CreditRiskMonitor observes FRISK® score downgrades across many different regions, a pattern like the 2008 Great Recession and the COVID-19 pandemic.

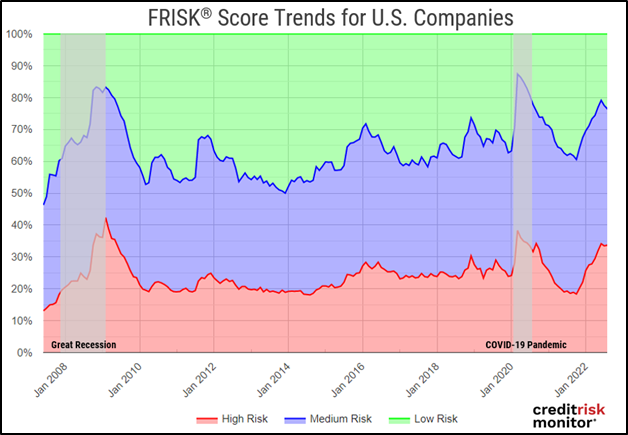

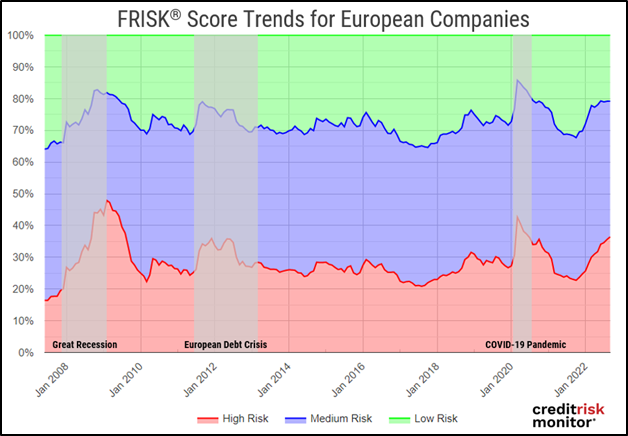

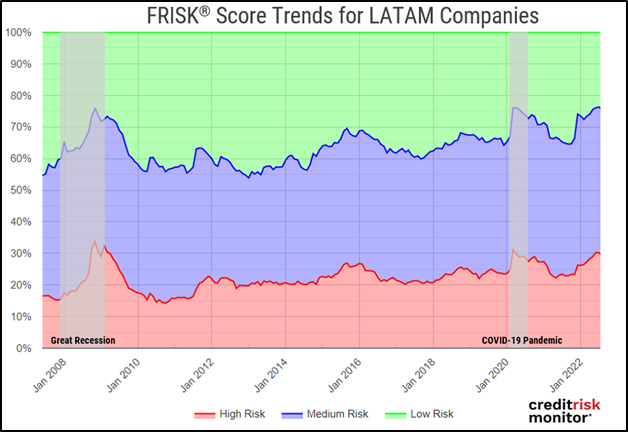

For the following three charts, notice in previous periods how the percentage of high-risk businesses was “lower” before the onset of a recession, i.e., the risky population primarily increased over the course of the recession periods. Next, see that the percentage trends of high-risk populations in 2022 have already reached similar levels to prior downturns. We think there is room for further expansion of high-risk companies due to rising interest rates and the overall debt outstanding being larger than in previous periods. This setup could result in the high-risk population topping 50% in an extreme stress scenario, triggering a massive surge of bankruptcies.

Observe how total U.S. high-risk companies (e.g., financially distressed) have recently increased dramatically:

In Europe, the total number of high-risk companies has also noticeably expanded. Note that all the downgrades shown below occurred prior to the European Central Bank raising interest rates by an unprecedented 75bps in September of 2022. The base borrowing rate now stands at 1.25%, like levels observed during the European Debt Crisis, which suggests that worse times are ahead for companies in this region.

Latin America has shown a parallel increase in high-risk companies. The three largest LATAM economies of Brazil, Mexico, and Argentina have all hiked benchmark interest rates significantly to combat entrenched inflation. Brazil is one of the largest contributors, accounting for nearly half of the high-risk companies in this country grouping today.

Other geographies globally, including Hong Kong and other parts of APAC, also continue to demonstrate rapid escalations of high-risk companies. Another channel for serious concern is China’s property sector, which is experiencing the active deflation of the largest corporate debt bubble in history.

It would be an understatement to say that the increasingly negative global backdrop is troubling. According to Cornerstone Research, U.S. bankruptcies alone totaled 289 between 2008 and 2009 and tallied up to 155 in COVID-hit 2020. Record levels of zombie companies and debt outstanding, restrictive monetary policy, and already negative economic outlooks will likely result in another major wave of corporate bankruptcies. The outcome will either be akin to, if not worse than, the Great Recession and the COVID-19 pandemic.

Bottom Line

Deep cracks are surfacing in the U.S. corporate debt markets and internationally. The timing of corporate bankruptcies is always difficult to predict, but FRISK® score trends show that the odds of a bankruptcy wave have measurably increased. CreditRiskMonitor strongly advises subscribers to review their portfolio, particularly FRISK® score red zone companies, with extra scrutiny in this environment. Contact CreditRiskMonitor to learn more about our predictive analytics and corporate bankruptcy trends.