Earlier this summer, CreditRiskMonitor highlighted nine retailers that the 96%-accurate FRISK® score had pegged as having heightened risk of bankruptcy relative to public companies at large. Venturing deeper into Q3, three of the nine companies listed have filed for bankruptcy. Here is a recap of what went wrong, which will help in identifying the next major retailers that will file for bankruptcy.

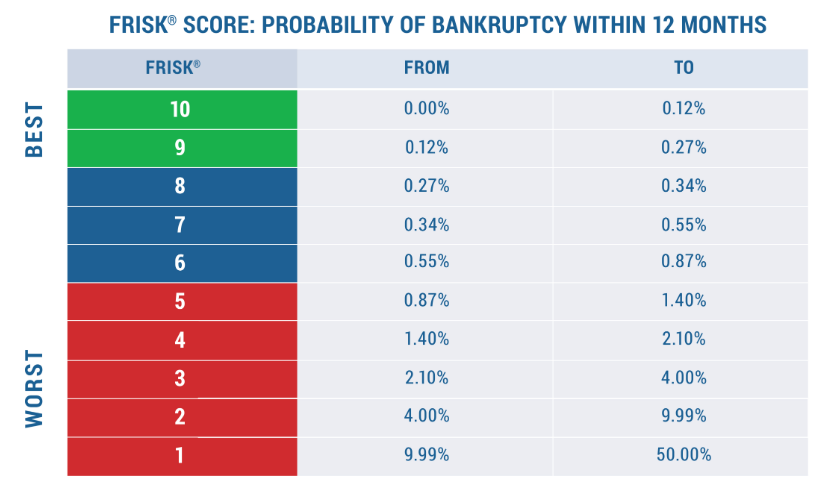

CreditRiskMonitor is a leading web-based financial risk analysis and news service designed for credit, supply chain, and other risk professionals. At the core of the service are the FRISK® and PAYCE® score, which accurately predicts public and private company bankruptcy using a "1" (highest risk)-to-"10" (lowest risk) scale. With coverage of more than 57,000 public companies globally and in-depth financial ratio and trend analysis, as well as access to vital news and regulatory filings, CreditRiskMonitor helps risk professionals navigate through even the most turbulent times.

Suddenly Things Changed

Consumer buying habits have been slowly shifting entering the 20’s and although this phenomenon is largely known as the "retail apocalypse" and blamed on the increasing prevalence of online shopping, it's really a much bigger issue. Many major retailers have been able to change along with their customers through desirable product innovations, successful cross-selling, physical store remodels, expansions, inventory management, renewed e-commerce websites, sizable advertising budgets, etc.

Others have been laggards to change, and instead, are experienced declining market share and ever-increasing debt to fund their operations. These firms were able to limp along as they dragged out the pain by taking restructuring measures like closing stores and cutting costs as well as loading up on cheap capital to preserve runway.

The COVID-19 Catalyst

With stores forcibly shut down as the coronavirus moved west in 2020, revenues for poorly positioned companies withered to a trickle. That loss of cash flow, combined with heavy debt loads, pushed many once-proud retailers over the edge. Some of the names include J. C. Penney Company Inc., J.Crew Group, Inc., and Neiman Marcus Group Ltd LLC, among many other retailers. Pier 1 Imports, Inc., which filed for bankruptcy before COVID-19, was even forced into liquidation, shutting down for good rather than attempt a comeback.

Retailers continue to march into bankruptcy courts around the world in an attempt to lessen their financial obligations. Some of the more recent names that succumbed to bankruptcy include Reitmans (Canada) Limited, Ascena Retail Group Inc., Tailored Brands Inc., GNC Holdings Inc., and Grupo Famsa SAB de CV.

CreditRiskMonitor's proprietary FRISK® score forewarned of these imminent risks, providing subscribers with ample time to prepare. Of companies that eventually go bankrupt, 96% pass through the high-risk "red zone" of the FRISK® score, which is the lower half of the range. This unique score brings together four factors, such as stock market performance, financial statement ratios, bond agency ratings, and subscriber crowdsourcing, to provide industry-leading accuracy and timely bankruptcy warnings.

A quick review of each of these recent bankruptcies reveals similarities that cannot be ignored. For example, health-focused retailer GNC Holdings' FRISK® score fell from a "4" at the end of 2019 to a worst-possible "1" in March 2020. The Altman Z"-Score, on the other hand, didn't start warning of bankruptcy risk here until after the company's Q1 2020 financial statements were released, only two months before the bankruptcy filing date. The company's sales had been falling for years and free cash flow had continued to weaken. Losses were incurred in three of the previous five years. The biggest impediment, however, was the company's heavy debt load, with the total debt-to-assets ratio at 63% at the end of the first quarter. Lacking the financial room to maneuver in the face of the COVID-19 shutdowns, GNC filed for bankruptcy on June 23.

Just a few days later, Mexican retailer Grupo Famsa SAB de CV also filed. This retailer’s FRISK® score had been mired at a "1" for more than a year, signaling bankruptcy risk that was 10-to-50x greater than the average public company. The company's debt load had continued to trend higher in the quarters preceding its bankruptcy with its total debt to assets ratio running at an excessive 84% for more than a year. Under normal debt market situations, the interest required to access additional creditor capital under this debt load would have become too expensive to tap, and that interest pressure finally caught up with Grupo Famsa in the first quarter of 2020 when it failed to cover those interest costs. Lacking financial flexibility and shuttered stores, bankruptcy was the only option left.

Ascena declared bankruptcy about a month later on July 23. This fashion retailer had been struggling for years, sitting at a FRISK® score of "1" for more than 12 months. It was taking drastic actions to right the ship, including closing and spinning off entire brand concepts (such as DressBarn). The company reported net losses in four of the five quarters leading up to its filing, notably including the holiday shopping season in 2019. Ascena already faced limited free cash flow generation and difficulty covering its interest expenses. Then the company crumbled under the weight of its debts which amounted to 41% of assets when non-essential businesses were forced to shut their doors to help slow the spread of COVID-19.

Tailored Brands filed for bankruptcy on Aug. 2, after the men's suit seller was dealt a strong one-two punch. First, there has been a long-term shift toward more casual attire at work. Second, when COVID-19 left many people working from home, virtually all demand for men's formal wear withered away. Online sales couldn't overcome the decline of in-store demand and when coupled with a high total debt-to-assets ratio of 57%, Tailored Brands was required to seek out court protection.

Private Bankruptcies

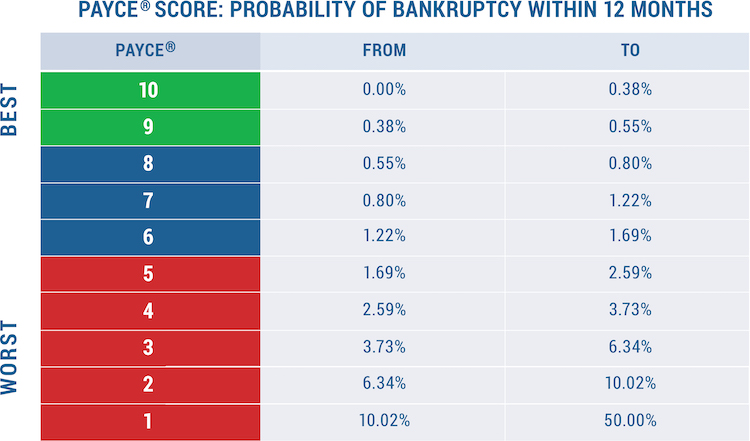

It's not only public retailers that are seeking out bankruptcy court protection. The same long-term secular and short-term COVID-19 related issues are present in the private space as well. CreditRiskMontior's PAYCE® score is specifically designed to highlight bankruptcy risk for private companies. The PAYCE® score leverages information such as payment histories and U.S. federal tax liens to achieve a 70+% accuracy rate. However, the PAYCE® score is not a standard linear payment-based credit model like D&B’s PAYDEX® score. Instead, the model uses deep neural network modeling technology, a type of artificial intelligence, which identifies high-risk patterns in payment trends several quarters before severe delinquency becomes detectable.

The PAYCE® score bankruptcy probability chart is shown below:

One notable private retailer that tumbled into bankruptcy on Aug. 2 was Lord & Taylor LLC. The company was sold to Le Tote, Inc. in late 2019, with the high-end apparel rental company hoping to use the iconic Lord & Taylor name, and its physical locations, to expand its reach. COVID-19 quickly upended this plan and Le Tote's Lord & Taylor subsidiary has been in the bottom half of the PAYCE® score for all of 2020, falling from a "3" in January to a worst possible "1" by May. That drop coincided directly with the impact of the fast-spreading coronavirus, but gave ample time for credit professionals to take protective actions ahead of the private company's bankruptcy filing.

Brooks Brothers is another private retailer with an iconic name that was forced into bankruptcy court. The company filed on July 8. Long known for providing suits to businessmen, the move toward more casual work attire had left the company out of step with the times. Brooks Brothers PAYCE® score had been trending between "4" and "5" before COVID-19, so it was already on watch lists as a heightened bankruptcy risk. However, when huge numbers of employees started working from home, and thus not wearing suits, the retailer's PAYCE® score dropped all the way to a "1" in May.

Bottom Line

The troubles plaguing the retail sector are far from over and the months ahead will feature more bankruptcies in both public and private firms if world consumer spending remains stiffled. If the above examples are any indication, retail counterparties with low FRISK® or PAYCE® scores need to be monitored frequently. Contact CreditRiskMonitor today so we can help identify your largest financial risks before they turn into bankruptcies.