Mexican department store chain Grupo Famsa SAB de CV has met bankruptcy, hammered by a huge drop in sales due to COVID-19.

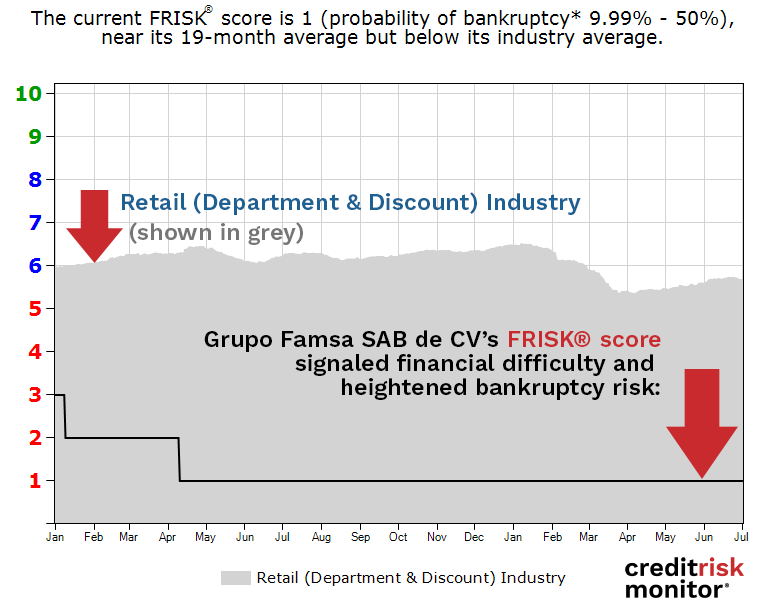

The company's FRISK® score, which is 96% accurate in predicting public company bankruptcy with a 12-month horizon, had been at a "1" for more than a year:

So what does having a FRISK® score of "1" actually indicate? It means that if you had this company in your portfolio, each day represented a 10-to-50x greater probability of a bankruptcy filing than the average public company.

We strongly recommend that if you conduct any business with a counterparty at a "1," you immediately review their most recent financials and get in touch with us: 845.230.3000.

Download the free report to learn more.

Our FRISK® Score model incorporates four powerful risk inputs:

- “Merton”-type model of stock market capitalization and volatility

- Financial ratios, including those used in the Altman Z”-Score Model

- Agency ratings

- Website click pattern data from CreditRiskMonitor® subscribers, representing key credit decision-makers at nearly 40% of current Fortune 1000 companies plus thousands of other large companies worldwide

Since the start of 2017, the FRISK® Score’s rate of success in capturing public company bankruptcy is 96%. In any given year, you can count on one hand the times we miss – and in those outlier cases, the circumstances deal with unusual, unforeseen events such as natural disasters and CEO fraud.

Download the free report to learn more.

About Bankruptcy Case Studies

CreditRiskMonitor® Bankruptcy Case Studies provide post-filing analyses of public company bankruptcies. Our case studies educate subscribers about methods they can apply to assess bankruptcy risk using our proprietary FRISK® Score, robust financial database, and timely news alerts.

In nearly every case, a low FRISK® Score gave our subscribers early warning of financial distress within a one-year time horizon. Our proprietary FRISK® Score predicts bankruptcy risk at public companies with 96% accuracy. The score is formulated by a number of indicators including stock market capitalization and volatility, financial ratios, agency ratings, and crowdsourced behavioral data from a subscriber group that includes nearly 40% of the Fortune 1000 and thousands more worldwide.

Whether you are new to credit analysis or have decades of experience under your belt, CreditRiskMonitor® Bankruptcy Case Studies offer unique insights into the business and financial decline that precedes bankruptcy.