Ferrellgas Partners, L.P. is a good example of what to look for as a counterparty spirals toward bankruptcy and seeks out court protections. Our proprietary FRISK® score is alerting subscribers that the clock is about to strike midnight for Ferrellgas. Here are some of the key factors speeding up the clock and increasing the bankruptcy risk.

Midstream Misstep

At its core, Ferrellgas delivers propane and that business is pretty predictable. Although there is a long-term trend of customers shifting to natural gas or electric heat, it's a slow trickle that industry participants have so far been able to offset by making serial acquisitions of smaller competitors. Given the industry’s high fragmentation, Ferrellgas’s large size, and, therefore, greater access to capital gave it a great advantage in pursuing such a strategy.

The problem is that rolling up the industry like that requires access to capital. This was not an issue until 2014 when the partnership decided to make a material business shift and use sizable debt-funded acquisitions to diversify into the midstream energy space. Between 2014 and 2017 the partnership's debt load increased by about 45.5% as it built this new division. That diversification effort didn't pan out as relatively weak oil prices lingered and demand for the acquired assets didn't hold up. By early 2019, Ferrellgas had sold the majority of its M&A-assembled midstream business but was left with a 72.6% higher debt load and a 87.8% higher interest expense than at the start of 2014, despite the five-year period of historically low rates.

CreditRiskMonitor first highlighted Ferrellgas as a bankruptcy risk in early 2019 and the situation has continued to decline in the 18 months following. Taking a look at what's gone wrong over the past two years helps illustrate what warning signs to watch for when protecting your portfolio from financial loss.

Train Wreck in Slow Motion

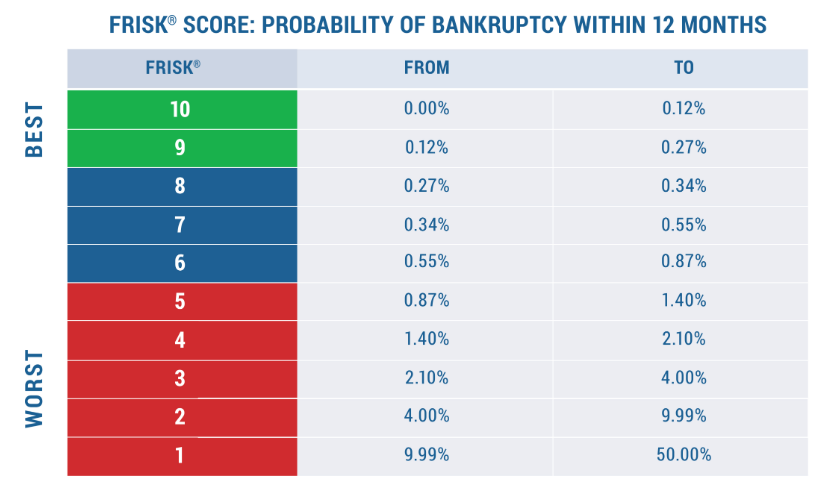

By October 2018 Ferrellgas' FRISK® score had fallen to a worst-possible "1," indicating a 10-to-50x greater chance of bankruptcy than the average company. Ferrellgas has remained mired at that highly troubling level since. Note that 96% of public companies that go bankrupt first pass through the high-risk "red zone", which represents the bottom half of the FRISK® "1"-to-"10" scale (see the table below). A red zone score is an important warning sign and one for which CreditRiskMonitor subscribers will receive email alerts whenever there is a downgrade.

Behind Ferrellgas' low FRISK® score is a number of equally troubling facts:

- Ferrellgas carries a junk rating from bond rating agencies. Notably, Moody's appended a limited default designation to the partnership's probability of default rating in July after the partnership missed a debt payment and entered into a forbearance agreement with lenders. Subscribers were alerted to these events as they happened. Default is often one of the last steps before bankruptcy.

- Ferrellgas' Chief Operating Officer, Patrick Chesterman, resigned in May. When a company starts to struggle financially it is common to see its top leaders exit. The COO position, meanwhile, was not filled until August, with the partnership's Chief Information Officer taking on the role after joining the company in 2019. Again, CreditRiskMonitor subscribers received timely email alerts about these events.

- Total debt was already a trouble spot and increased every quarter over the past year. The total debt-to-assets ratio has remained worryingly high at more than 100% over that span. Total debt-to-trailing-12-month-EBITDA has been stuck at alarming levels, hitting 14x at the end of April. Ferrellgas' business is seasonal, but with a total-debt-to-trailing-EBITDA of 10.6x in January of 2020, it’s clear that the partnership's leverage position has worsened at an alarming rate.

- Ferrellgas exhibits a weak bottom line, with the most recent quarterly net income falling to a loss of $15.4 million from a profit of $20.5 million in the previous year. Working capital has been negative for four consecutive quarters as well, suggesting that Ferrellgas is running out of viable options if it wants to avoid bankruptcy court. The partnership's Management Discussion and Analysis (MD&A) from this recent filing (conveniently accessible on the CreditRiskMonitor service) specifically note that Ferrellgas has engaged outside financial advisors as it works to deal with upcoming debt maturities, a clear indication of serious financial distress.

Bottom Line

These are some of the signs that the risk of bankruptcy at Ferrellgas Partners, L.P. is increasing, all of which were preceded by the early warning provided by CreditRiskMonitor's highly accurate FRISK® score. Subscribers have been well aware that careful attention is required here and that prudent risk management practices require reduced exposure. There's always a chance that Ferrellgas manages to avoid bankruptcy court, but that outcome looks more and more unlikely with every passing day. Contact CreditRiskMonitor today to see how you can obtain an early warning about risks like this in your portfolio before they spiral out of control.