The U.S. government stated that the COVID-19 outbreak could last until July or August of 2020 and CDC recommendation guidelines advised citizens to minimize public gatherings and practice social distancing. February retail sales have already declined and economic consensus points to a recession by the second quarter, according to Reuters. Certain retailers and restaurant chains have shortened operating hours, closed locations, outlined lost sales revenue and withdrawn forward guidance.

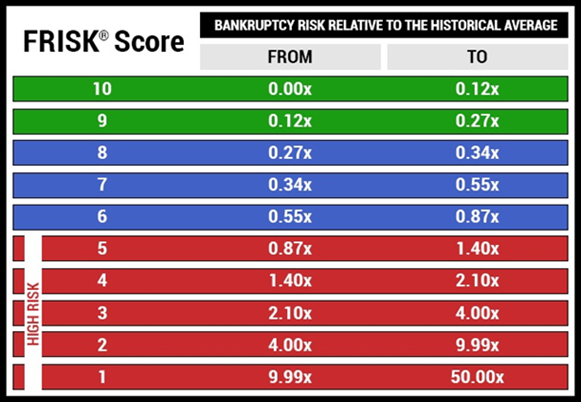

With steep losses of customer traffic, operators without significant liquidity buffers risk financial distress and bankruptcy over the course of 2020. CreditRiskMonitor’s 96%-accurate FRISK® score assesses public company bankruptcy risk within a one-year period. The FRISK® score is based on a “1” (worst)-to-“10” (best) scale, with "red zone" scores carrying above-average risk of bankruptcy relative to the typical public company:

Fragile Retailers

Unable to execute a successful turnaround strategy, Pier 1 Imports, Inc. filed for bankruptcy in February due to aggressive competition. More retail bankruptcies may unfold due to the prolonged impact of the coronavirus. Throughout February and March 2020, the three retailers below each recorded a FRISK® score downgrade into the highest risk categories. For context, 67% of all companies that enter bankruptcy decline into the lowest FRISK® score tiers of “1” and “2” prior to filing.

| Company | FRISK® score | Book Value Discount |

| Destination XL Group Inc. | 1 | 40% |

| Party City Holdco Inc. | 1 | 80% |

| GameStop Corporation | 2 | 50% |

All three operators have reported operating de-leveraging and continued sales losses will only accelerate that underperformance. What’s more, each company has also recorded negative trailing 12-month free cash flow and carries bottom-quartile liquidity (either being cash, quick or current ratios) relative to their industry peers. The peer analysis feature within CreditRiskMonitor’s service evaluates every comparable financial metric relative to industry competitors and can be accessed within the company’s commercial credit report. Lastly, an attempt to shore up capital is thwarted by massive discounts to book value, since it limits a company’s capability to privately raise equity capital or engage in secondary market offerings.

Collapsing Restaurants

Kitchens might not be closed, but across the world, dining rooms are shutting down.

Restaurants were already under immense pressure in late 2019 following broader traffic declines, and shortly thereafter, both Granite City Food & Brewery and Cosi, Inc. filed for Chapter 11 restructurings (this being Cosi’s second bankruptcy since October 2016). The coronavirus only adds to the woes for the restaurant industry. For example, New York City and Los Angeles local governments have forced restaurants to close down. Undercapitalized chains may pursue headcount reduction, rent concessions, and reduce advertising spending to stave off a liquidity crunch, but many are still nonetheless vulnerable to bankruptcy. Below are three financially distressed restaurants that received FRISK® downgrades:

| Company | FRISK® Score | Total Liabilities to Market Capitalization |

| Carrols Restaurant Group Inc. | 1 | 15x |

| Red Robin Gourmet Burgers, Inc. | 2 | 8x |

| Fiesta Restaurant Group Inc. | 3 | 3x |

Total liabilities significantly exceeding market capitalization is a signal that indicates stark pessimism from equity markets. Why might this be? These companies have shown recurring operating losses and even reported the following adverse performance trends in late February:

- Carrols Restaurant’s annual EBITDA declined by 36.5% year-over-year

- Fiesta Restaurant’s comparable-store sales declined by 8.1% last quarter

- Red Robin’s total guest count declined by 3.4% last quarter

These are highly concerning patterns that haven’t even reflected the empty tables related to coronavirus. Balance sheet weakness is also prevalent with each carrying bottom-quartile liquidity ratios versus restaurant peers. Making matters worse, each company’s off-balance sheet revolving credit facilities have already been exhausted by more than 50%. CreditRiskMonitor subscribers can access updates to this information every quarter through the section of the liquidity MD&A report. For example, Carrols disclosed a credit facility amendment where its maximum borrowings would be reduced from $125 million to $115 million, an exchange aimed to cap the lender’s risk exposure. If traffic remains poor, we can expect more of these credit amendments to transpire for other restaurants more broadly.

Bottom Line

The FRISK® score downgraded retailers and restaurants in February and March following the market sell-off stemming from coronavirus. CreditRiskMonitor subscribers should carefully review any counterparties falling into, or deeper within, the red zone as company liquidity will be tested over the course of 2020. We strongly recommend monitoring your company portfolio with immense scrutiny and be on the lookout for a rise in public company bankruptcy filings.