Floral delivery service FTD Companies, Inc. wilted under the pressures of enormous debt and growing industry competition, culminating in a Chapter 11 filing on June 3rd.

“With the advice and support of our outside advisors, we have initiated this court-supervised restructuring process to provide an orderly forum to facilitate sales of our businesses as going concerns, and to enable us to address a near-term debt maturity,” said CEO Scott Levin.

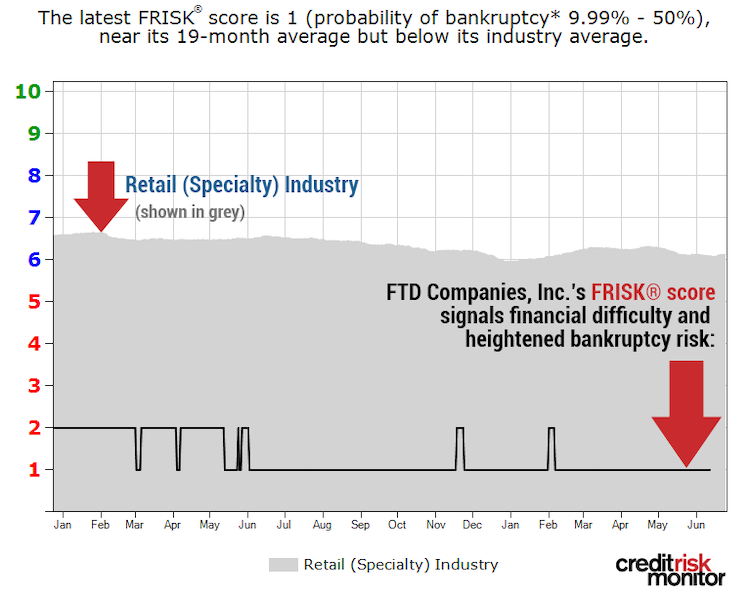

CreditRiskMonitor's FRISK® score smelled danger in the suburban Chicago company in spite of the fact that they were paying bills on time. FTD Companies' FRISK® score sunk to a "1" - indicating up to a 50% chance of bankruptcy in the coming 12 months - for the first time in June 2018:

We previously touched on the danger found within FTD Companies in an April 2019 High Risk Report.

Download the free report to learn more.

Our FRISK® Score model incorporates four powerful risk inputs:

- “Merton”-type model of stock market capitalization and volatility

- Financial ratios, including those used in the Altman Z”-Score Model

- Agency ratings

- Website click pattern data from CreditRiskMonitor® subscribers, representing key credit decision-makers at nearly 40% of current Fortune 1000 companies plus thousands of other large companies worldwide

Since the start of 2017, the FRISK® Score’s rate of success in capturing public company bankruptcy is 96%. In any given year, you can count on one hand the times we miss – and in those outlier cases, the circumstances deal with unusual, unforeseen events such as natural disasters and CEO fraud.

Download the free report to learn more.

About Bankruptcy Case Studies

CreditRiskMonitor® Bankruptcy Case Studies provide post-filing analyses of public company bankruptcies. Our case studies educate subscribers about methods they can apply to assess bankruptcy risk using our proprietary FRISK® Score, robust financial database, and timely news alerts.

In nearly every case, a low FRISK® Score gave our subscribers early warning of financial distress within a one-year time horizon. Our proprietary FRISK® Score predicts bankruptcy risk at public companies with 96% accuracy. The score is formulated by a number of indicators including stock market capitalization and volatility, financial ratios, agency ratings, and crowdsourced behavioral data from a subscriber group that includes nearly 40% of the Fortune 1000 and thousands more worldwide.

Whether you are new to credit analysis or have decades of experience under your belt, CreditRiskMonitor® Bankruptcy Case Studies offer unique insights into the business and financial decline that precedes bankruptcy.