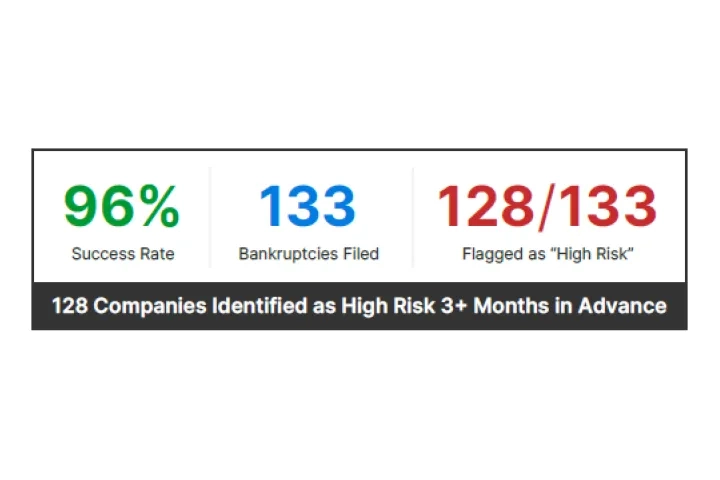

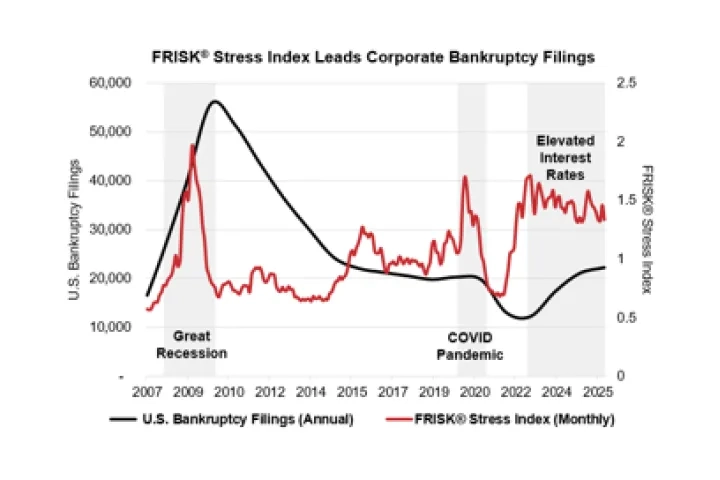

The commercial financial landscape is more unpredictable than ever and full of risk. CreditRiskMonitor® is a web-based risk monitoring platform that continuously tracks the financial health of your customers, alerting you to distress and bankruptcies that impact cash flow. You will get the most accurate and complete picture of financial risk, and the most thorough analysis of the companies you care about most.