From January through December 2025, the PAYCE® Score predicted bankruptcies across North America, including many mega-bankruptcies with liabilities of $1 billion or more. These companies were flagged as “high risk” at least three months in advance. Importantly, nearly 50% of the largest company bankruptcies showed prompt or near-prompt trade payment behavior shortly before filing (the cloaking effect). Because of this, traditional trade-only models did not flag them. We expect private-company bankruptcies to remain elevated through 2026.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

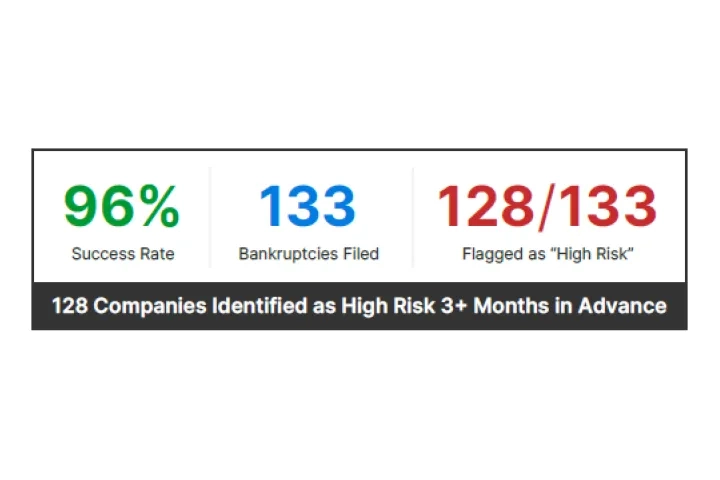

From January through December 2025, the FRISK® Score maintained its 96% success rate in accurately identifying public companies that declared bankruptcy. Of the 133 companies that filed during this period, 128 were flagged as “high risk” at least three months in advance. Explore how the FRISK® Score achieves its industry-leading performance and why nearly 40% of the Fortune 1000 use it in their daily workflows.

CreditRiskMonitor® is a powerful, web-based risk monitoring platform for credit, finance, treasury, and risk management professionals. It continuously tracks the financial health of all your customers and prospective customers, alerting you to emerging risks and bankruptcy threats so you can address them before they impact your accounts receivables and bottom line.

SupplyChainMonitor™ is a powerful, web-based risk monitoring platform for supply chain professionals. By continuously tracking and alerting you to changes in the financial health of every company in your supply chain, you can stay ahead of emerging risks. You can address potential bankruptcies, financial distress, geopolitical disruptions, climate events and compliance risks before they impact your operations.

Discover our Trade Contributor Program, where providers anonymously submit $3 trillion in trade receivables annually. Easily analyze the performance of your accounts receivable (A/R) portfolio, identify potential bankruptcies and high risk accounts, and gain valuable insights into payment behavior.

Learn how we combine cutting-edge technology with disciplined human oversight to deliver accurate, transparent data. AI and machine learning helps us bolster our industry-leading financial risk models, process financial statements quickly, and provide FAST Ratings at scale. We also adhere to responsible AI practices.

The Risk Level helps clients make faster decisions across 10+ million public and private companies by providing a summary view of their financial risk level.

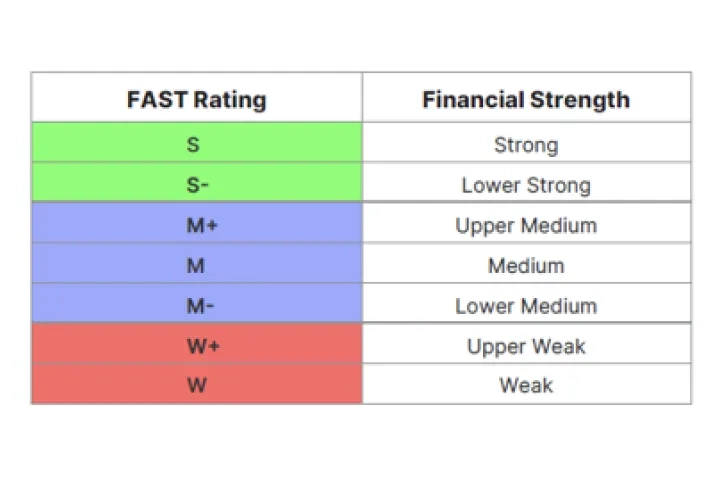

The Financial Analyst Strength Test (FAST) Rating assesses foreign private companies with limited financial data. This model combines advanced machine learning technology with the expertise of CreditRiskMonitor’s seasoned financial analysts to accurately predict a private company’s likelihood of financial distress.

Explore how the PAYCE® Score delivers industry-leading financial risk prediction on private companies without financial statements.