CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) is pleased to announce that its SupplyChainMonitor™ solution has been recognized as a top procurement technology in the Spend Matters Fall 2024 SolutionMap.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

In this Bankrupt Supplier Report, the recent bankruptcy of Unique Fabricating, Inc. is explored: why this supplier was in trouble, which SupplyChainMonitor features provided early warning of the company's various risks, and what procurement professionals could have done - and must do in the future - to keep their supply chain intact when faced with financially distressed suppliers.

CreditRiskMonitor.com, Inc., a global provider of financial risk analytics and business intelligence, today announced the successful completion of its first System and Organization Controls (SOC) 2® Type I report for cybersecurity.

CreditRiskMonitor is announcing the launch of SupplyChainMonitor, a brand-new sister platform serving the company's rapidly expanding clientele working in procurement, at the Institute for Supply Management's ISM World 2022 event on May 23.

Supply & Demand Chain Executive Webcast: Predictive Analytics

Our very own Dr. Camilo Gomez, CreditRiskMonitor Senior Vice President, Quantitative Research, spoke about the value that predictive analytics is providing to procurement professionals in this webinar.

German-based manufacturer SGL Carbon SE provides carbon fiber materials to various end markets of automotive, wind energy, and aerospace. Despite customers steadily recovering, the company continues to struggle with thin margins and high leverage.

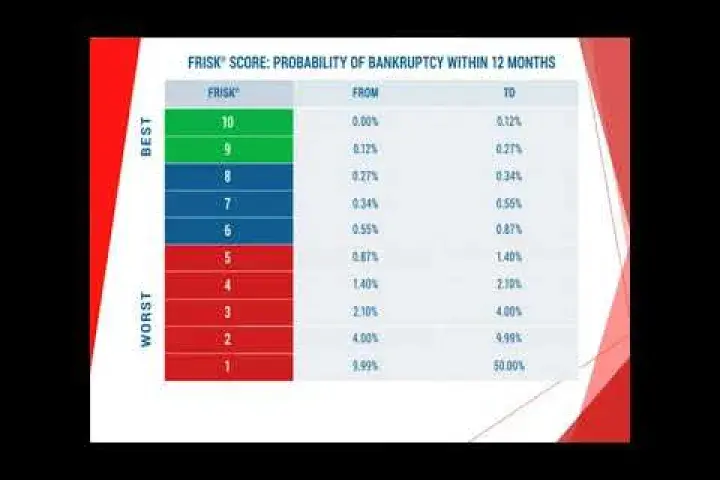

Telecom leader Windstream Holdings, Inc. paid their bills on time right up to their bankruptcy filing – while payment data analysis missed their troubles, the FRISK® score noted their elevated risk level for years.

CreditRiskMonitor is proud to announce a new partnership with Esker, a worldwide leader in AI-driven process automation software used by more than 6,000 companies worldwide.

CreditRiskMonitor and Allianz Trade, the world’s leading trade credit insurer, are pleased to announce the approval of CreditRiskMonitor as a Discretionary Credit Limit (DCL) report provider in the U.S.