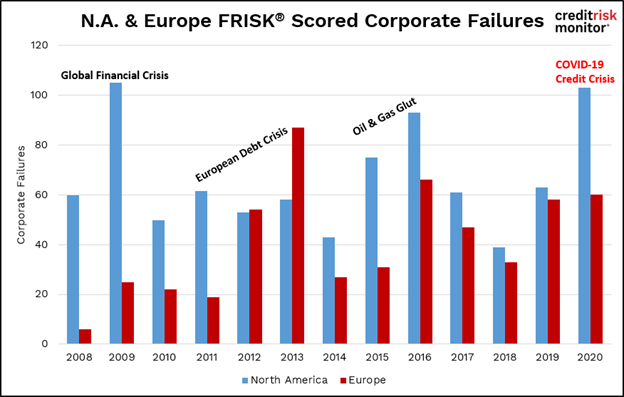

From the start of the coronavirus pandemic, CreditRiskMonitor subscribers have experienced an increase in public company FRISK® scored corporate failures* throughout North America. For longtime clients, the wave of corporate failures even comes close to levels not seen since the Global Financial Crisis. Additionally, FRISK® scored public companies in Europe have also experienced elevated corporate failures. Arguments can be made that financial risk in Europe is relatively lower than North America, yet S&P Global reported that total 2020 European corporate defaults nearly doubled the previous all-time high in 2008 and Eurostat indicated that EU Q3 “bankruptcies” rose to a six-year high.

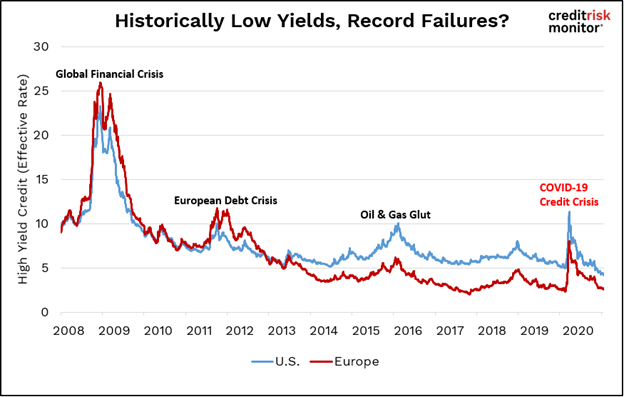

While global borrowing rates on bank loans and bonds remain historically cheap and equity market valuations lofty, numerous corporations are mired in financial restructurings and many more are struggling to stay afloat as the pandemic continues to cripple economies. U.S. nonfinancial corporate debt-to-GDP continues to trend at record highs, a historical leading indicator for spikes in corporate failures, setting the stage for a particularly frothy 2021.

Record FRISK® Score Corporate Failures

The COVID-19 pandemic decimated corporate profits overnight and created a stress test of balance sheet wherewithal, which many corporations have failed. While more iconic corporations failed in the Global Financial Crisis (also commonly referred to as the “Great Recession”), CreditRiskMonitor has observed an alarming number of large corporate failures during this crisis. Total FRISK® scored corporate failures (includes public companies, selected over-the-counter traded companies, and private companies) recorded in 2020 surpassed the quantities recorded during the Global Financial Crisis, European Debt Crisis, and the oil and gas glut, as shown below.

A review of this data begs the question, if corporate failures are up over 70% in North America, then why have European levels stayed relatively flat? Even with the articles from S&P Global and Eurostat references above, the main reason may be found in the changes made by European governments to directors’ duties and insolvency laws. In an excellent summary by DLA Piper published in December 2020, companies in Austria, Belgium, the Czech Republic, Finland, France, Germany, Luxembourg, the Netherlands, Poland, and Spain were granted extraordinary moratoriums on insolvency filing due to COVID-19 impacts. The Economist also reported that failed companies “mostly end in liquidation rather than restructuring” in many European countries, and so mitigating the disappearance of such firms due to a temporary event is an important outcome.

And yet, while FRISK® score corporate failures reached levels of the Global Financial Crisis, high yield credit conditions have never been easier. Which leads to the question: what happens if credit spreads or base interest rates increase, or both?

The scale of the problem is immense. For example, total obligations at U.S. zombie firms, or businesses that cannot service interest payments on their borrowings, rose to a record $2 trillion, according to Bloomberg. In other words, there is already $2 trillion worth of distressed debt at zombie companies that will become even further distressed and/or default when interest rates rise. The European experience isn’t any rosier with more than 4,300 firms joining the “Zombie Army” from Germany alone over 2020, as reported by the Financial Times. There are many reasons for why corporate debt levels remain so elevated:

- Failed companies are not writing down enough debt during a “restructuring” process

- Borrowers and lenders are conducting out-of-court transactions, such as distressed exchanges

- Distressed companies are requesting creditors to temporarily waive covenants

- Cash-poor companies have raised enough capital to sustain operations in the short-term

Public company balance sheet fragility is worse than ever before. With ongoing economic turmoil, CreditRiskMonitor anticipates the FRISK® scored corporate failures of 2020 are only the beginning. These challenges are not unique to the U.S. and Europe, either – other regions including APAC and Latin America have also show signs of pervasive distress.

Bottom Line

We’ve only seen the tip of the iceberg of the corporate debt bubble. There was a similar amount of FRISK® score public company failures in 2020 as the Global Financial Crisis despite historically low credit yields. If market participants suddenly reduce their risk appetite, corporations would immediately lose access to their most important lifeline – cheap capital. The COVID-19 credit crisis in 2020 was traumatic: a full bursting of the corporate debt bubble would be terrifying. You must know which of your customers, suppliers, vendors, and third parties could be at risk of failure when the tide finally goes out. Contact CreditRiskMonitor to learn more about the FRISK® score and how we help prepare risk professionals for this impending worst-case scenario.

*The term “corporate failure” throughout this article either refers to U.S. bankruptcy procedures or various legal proceedings in Canada, Mexico, and European countries that have some similarities to the U.S. Bankruptcy code, including Chapter 11 restructuring and Chapter 7 liquidation filings.