Entering the second quarter of 2021, light vehicle sales have finally returned to pre-COVID-19 levels, providing stability to the auto & truck manufacturing industry. Despite upsets in semiconductor production causing delays and shutdowns of assembly lines at many major manufacturers, resilient supplier financing and consumer demand have supported the sector. Supplier financing has been particularly beneficial for growing pure-play electric vehicle manufacturers like industry leader Tesla, Inc., yet not all operators are thriving today. In this article, we explore how the 96%-accurate FRISK® score provides real-time insight into the opposing spectrums of the auto industry.

Calibrating Risk Trends

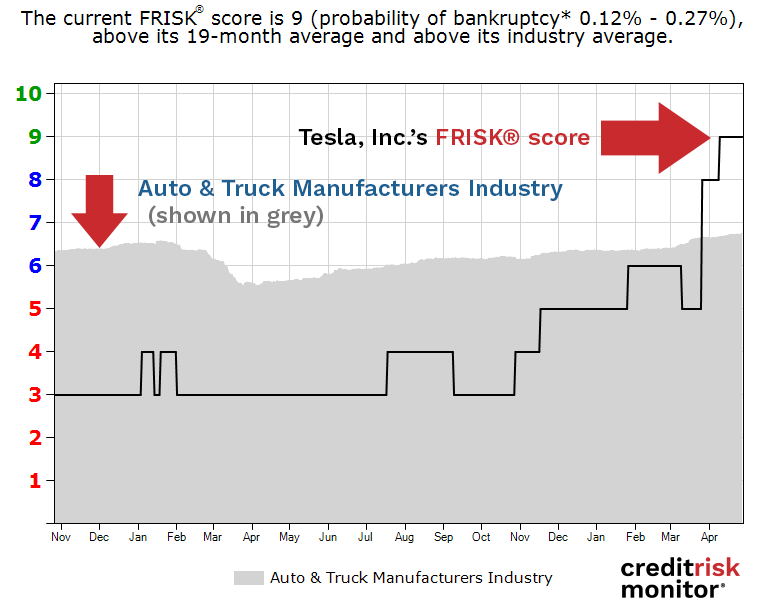

Tesla’s FRISK® score increased from an average of “3” in 2020 to a high watermark of “9” on Apr. 28, 2021, signaling a substantial improvement in its financial health. Several factors contributed to its higher grade, including:

- Subscriber crowdsourcing research patterns shifted away from indication of material concern

- Financial statements capturing improved operating performance, liquidity, and leverage

- Moody’s upgrading Tesla’s CFR from B2 to Ba3, while adjusting to a positive outlook

- Positive year-over-year stock performance and a massive premium to book value that provides a solvency cushion

CreditRiskMonitor’s proprietary subscriber crowdsourcing objectively measures the aggregated research patterns of the senior credit and risk officers that control the flows of corporate working capital. When Tesla struggled from constrained unit sales and high financial leverage, suppliers provided substantial interest-free trade credit financing for a successful production ramp. Looking back at FY20, outstanding accounts payable reached $6.05 billion and accrued purchases accumulated to $901 million. Tesla also raised over $12 billion in equity capital and retired $2.5 billion in debt, turning to a net cash position by Q4 2020.

With such positioning, Tesla planned capital expenditures of $9-12 billion over the next two fiscal years, a 62% increase versus previous annual periods. This spend is allocated for production at existing factory locations and continued construction on its Austin, Berlin, and Shanghai sites.

In Q1 2021, Tesla achieved record deliveries of 184.9K yet reverted to an operating loss when excluding gains from regulatory credits and Bitcoin sales totaling $619 million. The firm is also facing increased pressure in the Chinese market from some public relations blunders and more competition homegrown EV manufacturers like Nio Inc. (FRISK® “7”) Xpeng Inc. (FRISK® “9”), Li Auto Inc. (FRISK® “9”), and Geely Automobile Holdings Ltd (FRISK® “10”).

Tesla’s operating performance and overall positioning still compare favorably against all of these high-profile industry peers. Digging in on Nio Inc. specifically, this automaker is well-capitalized to expand production for its sedan and multiple SUV series, but reaching scale has been painful. Despite Nio’s FY2020 sales growth of 108%, its EBITDA margins remained negative, registering at -24.2%. The performance discrepancy between these two automakers shows in the FRISK® score.

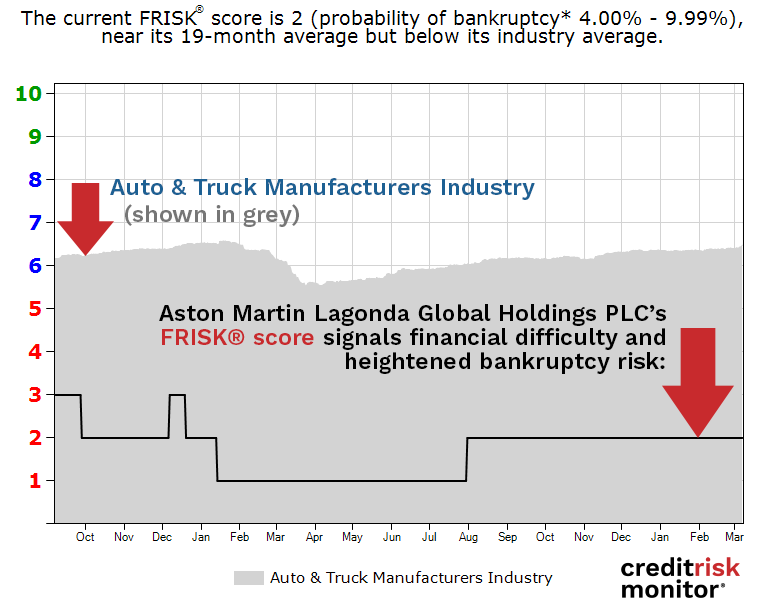

Less fortunate peers, meanwhile, include Aston Martin Lagonda Global Holdings plc. The luxury carmaker has fallen on hard times denoted by its FRISK® score of “2”, which trends far-beneath the auto & truck manufacturer industry FRISK® score average of “6.” The company’s lower-bound FRISK® score derives from the following factors:

- Financial statements, including TTM EBIT losses, limited net working capital, and high leverage

- Elevated stock price volatility offset by a premium to book value

- Moody’s Caa1 long-term rating, well within the highly speculative ratings category

Aston Martin Lagonda has big plans to achieve 90% electrification in its product portfolio by 2030 except its financials remain challenged. Annualized net losses are persistent, where FY20 reported SG&A deleveraging along with incremental impairment and operational restructuring charges of £81.8 million. Management guided for relatively neutral working capital swings in the coming year, which comes after recording a net working capital outflow of £109 million mostly stemming from payables. Management also acknowledged that its existing cash burn would persist through FY21, marking its fourth consecutive year of outflows. This trend pairs poorly against its steadily expanding debt position of £1.2 billion at the end of FY20 up from £821 million two years ago. Under these conditions, suppliers should continue to monitor Aston Martin Lagonda’s bookings, unit sales, and margin trends. For a comprehensive review, see our High Risk Report.

Bottom Line

Like many industries globally, auto manufacturing OEMs, along with their suppliers, are exhibiting divergences in FRISK® score trends amid choppy industry performance as supply chains normalize. The FRISK® score allows risk professionals to obtain real-time, highly accurate insights into their counterparties – whether an acting customer, vendor, partner, or third-party. Subscribers can streamline their time and resources effectively as shown by the different FRISK® scores of Tesla and Aston Martin Lagonda. To learn more about our integrated workflow solutions, contact us and we will walk you through the service to enhance your company’s processes.