Companies persistently face vital choices regarding their counterparties and the impacts of these choices are even more important during this coronavirus pandemic. Some of the most common supply chain decisions include:

- bolstering relationships with ailing suppliers,

- finding supplements, or

- considering outright replacements

With vendor bankruptcies on the rise, those judgments are not easy, yet they still have to be deliberated and executed with care. Vendor reliability has a correlation with financial risk given that capital resources support inventory purchases, operational reinvestment, and strategic growth. Below, we will examine the necessity of having timely financial risk scoring through the analysis of an auto industry portfolio to demonstrate the broader issues that supply chains are dealing with today.

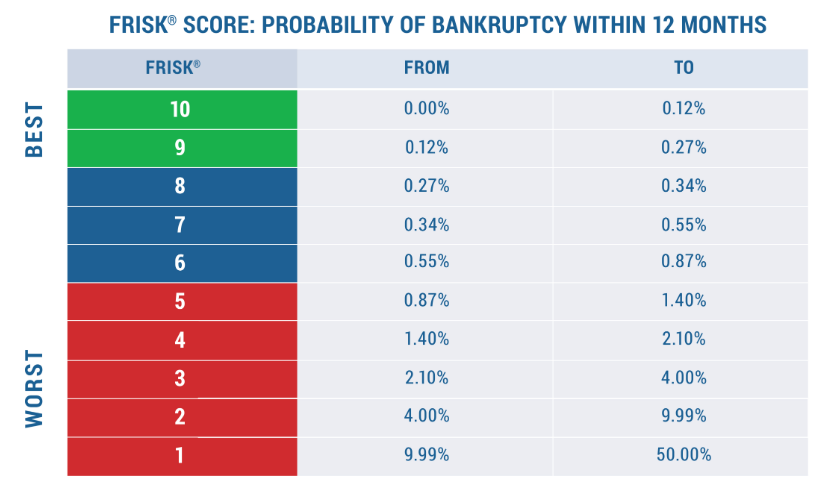

CreditRiskMonitor is a leading web-based financial risk analysis and news service designed for credit, supply chain, and other risk professionals. The core of the service is the FRISK® score, which provides an easy to use “1” (highest risk)-to-“10” (lowest risk) scale for assessing bankruptcy risk with 96% accuracy. With coverage exceeding 57,000 public companies around the world, risk professionals from nearly 40% of the Fortune 1000 rely on CreditRiskMonitor to consistently mitigate financial loss and business disruption.

Red Flags & Daily Updates

Every company should regularly review their supply chain counterparties for deteriorating credit quality. When vendors become financially distressed, corners are cut for the sake of cost reductions at the expense of product and service quality. For example, significantly lower core operating budgets, such as labor expenses, is a major red flag. It is also important to monitor if a manufacturer is limiting capital spend as a percentage of depreciation, investment into plant and equipment, or budgets for research and development. Such actions can lead to short-term disruptions and eventually inferior product offerings relative to competitors. One or more of these upsets will usually transpire in advance of a bankruptcy filing.

By identifying counterparty financial stress early on in the game, companies can improve their supply chain’s resilience by resisting, i.e. avoiding and containing, disruption and if unpreventable, being able to quickly recover from those disorderly events. By mitigating disruption, your company will circumvent revenue shortfalls, financial loss, and even reputational damage.

Regarding the workflow process, CreditRiskMonitor recommends evaluating your most valuable suppliers first (i.e. criticality, spend stratification, suppliers of suppliers, and customers of suppliers) and then assessing by financial risk. Total public company transactions typically represent a higher percentage of overall spend than private company transactions since public ones normally have significantly higher dollar values despite lower absolute numbers. The aforementioned FRISK® score enables users to address distressed counterparties first. Moreover, the FRISK® score provides supply chain professionals an edge compared to other risk scores because it is updated every day. Most other ratings and scores only reflect quarterly or semi-annual information, yet many unforeseen events can transpire in between reporting periods, with significant changes potentially including:

- Executive management

- Subsidiary divestment

- Financial guidance

- Special dividends or tender offers

- Credit agreements

- Litigation

- Strategic alternatives

- Plant shutdowns

The FRISK® score can capture all of these developments in real-time, not months after the fact. The model uniquely leverages four data factors including stock market performance, financial statement ratios, bond agency ratings, and our proprietary subscriber crowdsourcing data. All factors are dynamically structured to function together and offset the shortcomings of any individual component. Stock market performance and subscriber crowdsourcing in particular allow the FRISK® score to be refreshed daily. For example, senior executive departures in combination with other red flags might lead subscriber crowdsourcing to send a negative signal to the FRISK® score and those with that company in their portfolio would be immediately notified. The coronavirus pandemic is the perfect case example. The outbreak has hampered certain sectors much more than others, such as the automotive industry, and FRISK® scores have been updated accordingly.

The Automotive Example

The automotive manufacturing industry has been hit hard by the coronavirus pandemic. Ford Motor Company reported more than $5 billion in operating losses and $5.6 billion in EBIT losses over the last four quarters. Moody’s latest research note stated that Ford carried a speculative Ba2 credit rating while maintaining a negative outlook. According to Moody’s analysis, Ford will continue to experience headwinds related to its operational restructuring and estimated cash flow deficits of $8 billion in 2020 and $3 billion in 2021. The analyst team further elaborated on its pervasive challenges: “Ford entered the downturn from a comparatively weak position, being in the early stage of an extensive and costly restructuring program that alone will cost around $7 billion in total…The negative outlook reflects the considerable operating challenges and downside risk that Ford will face through 2021 while implementing its restructuring plan and attempting to restore its competitive position in the face of the coronavirus pandemic.” As of August, Ford carried a FRISK® score of “5,” which lands in the high-risk “red zone” and falls beneath the auto and truck manufacturers’ industry average of “6.”

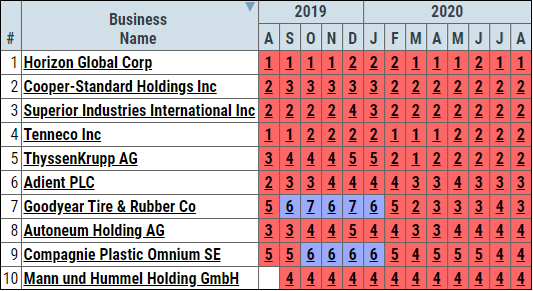

A section of Ford’s supply chain has also come under pressure during the coronavirus pandemic. While Ford has relationships with several hundred distinct vendors, some of its public companies receive a higher share of spend and likely have higher strategic value. The FRISK® score classified 10 of its domestic and international suppliers within the red zone, which indicates severe financial stress.

These manufacturers provide essential parts, components and modules in Ford’s production lines. Companies with a FRISK® score between “1” and “4” carry a substantially higher risk of bankruptcy compared to other scores shown within the scale below:

To demonstrate how impactful a couple of bankrupt suppliers could be on a customer, consider key suppliers Cooper Standard Holdings Inc. and Tenneco Inc. Together, these operators provide Ford components including shocks and struts, suspension and steering, engines, brakes, sealing, fuel delivery, and fluid transfer systems. Vehicles cannot be constructed without these parts and they feed directly into performance, functionality, and safety features. Furthermore, based on Ford’s fiscal 2019 cost of goods sold, excluding depreciation and amortization expenses, more than 2% of its total spend was allocated to Cooper Standard and Tenneco. If these suppliers were to file bankruptcy and substantially downsize production, Ford could suffer from slowdowns or a complete loss of deliveries for critical components. Without proper preparation, supply shortfalls could last several months without readily available alternatives. Armed with the FRISK® score warning, however, Ford could manage such disruption potential by implementing the following risk management steps, including:

- Increasing transparency and open communication

- Raising safety stocks and stockpiling inventory

- Creating a dual sourcing strategy with another vendor

- Opening discussions for contingency financial support

- Shifting the component production process in-house

- Forming an emergency proposal, such as acquiring the supplier in bankruptcy

The Peer Analysis tool provided to CreditRiskMonitor subscribers is another highly valuable resource. This interface allows users to compare any public company customer or supplier against a comprehensive list of competitors through sector or industry classifications (including SIC and NAICS). Subscribers can then choose from a multiplicity of prospective counterparties that have lower financial risk and better operating metrics. These alternative suppliers can serve different purposes such as supplemental sourcing, direct replacements, or be used as a means of negotiating discounts.

Bottom Line

Financial risk, especially during the coronavirus pandemic, should be a primary consideration among vendors and suppliers of those vendors as well as customers of those vendors as bankruptcy filings are skyrocketing. We have found that the median U.S. supplier has reduced capital expenditures into property, plant, and equipment by 33% and has increased their total debt to asset burden up from 26% to 30% in the last two years. Such actions only magnify vendor financial risk and create pitfalls in supply chains. While Ford operates with a highly diversified supplier base, bankruptcies at two strategic suppliers would have an enormous impact on production and materially worsen its already overwhelming operating losses. By using the daily FRISK® score, risk management best practices, and peer analysis, supply chain professionals can proactively avoid these sorts of disruption and save their firms precious time and resources. Contact us today for a free risk assessment to increase your supply chain’s financial durability and resilience.