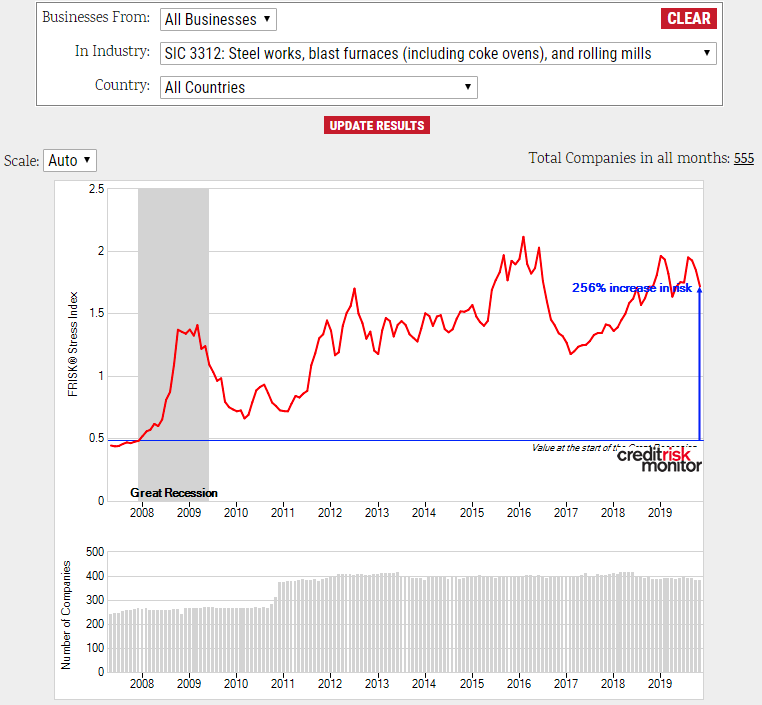

CreditRiskMonitor’s FRISK® Stress Index shows elevated financial risk within the global steel manufacturing industry. Supply chain and procurement professionals must be proactive, given that the index shows collective financial risk today is higher than during the Great Recession:

The FRISK® Stress Index includes companies that are scored by the FRISK® score, which uses a “1” to “10” scale to measure bankruptcy risk. The “1” through “5” category of the FRISK® score is known as the “red zone,” which indicates a company carries high risk of bankruptcy within a 12-month period. Here are three important trending factors within the FRISK® Stress Index for the broader steel industry:

- Approximately 47% of these steel companies are in the FRISK® score red zone

- Risk has increased by 256% since the beginning of the Great Recession in late 2007

- 40 unique manufacturers carry a FRISK® score of “1” or “2,” indicating an extreme uptick in bankruptcy risk probability compared to the median rate (1%) for public companies

Steel companies are seeing demand weakness across the globe. In fact, worldwide steel prices, including intermediate products of hot-rolled bands, cold-rolled coils and steel plates have steeply declined over the course of the last 18 months – according to SteelBenchmarker – undercutting profitability.

Demand Weakness

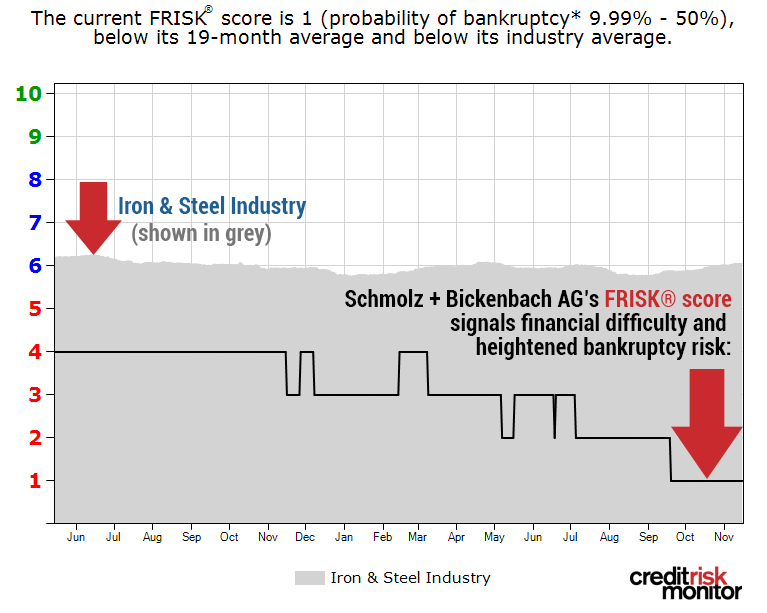

CreditRiskMonitor issued a High Risk Report on Swiss steel manufacturer Schmolz + Bickenbach AG in November 2019. According to CEO Clemens Iller, macro demand remains weak across its markets:

“In our sales markets, the downward trend continued in the third quarter. In the automotive industry, the Group’s most important end market, total passenger car production in Germany, China and the USA in the first three quarters remained well below the previous year’s level.”

The company’s FRISK® score recently trended to “1,” indicating a 10-to-50x probability of bankruptcy relative to the average public company’s bankruptcy risk of 1% within a 12-month horizon.

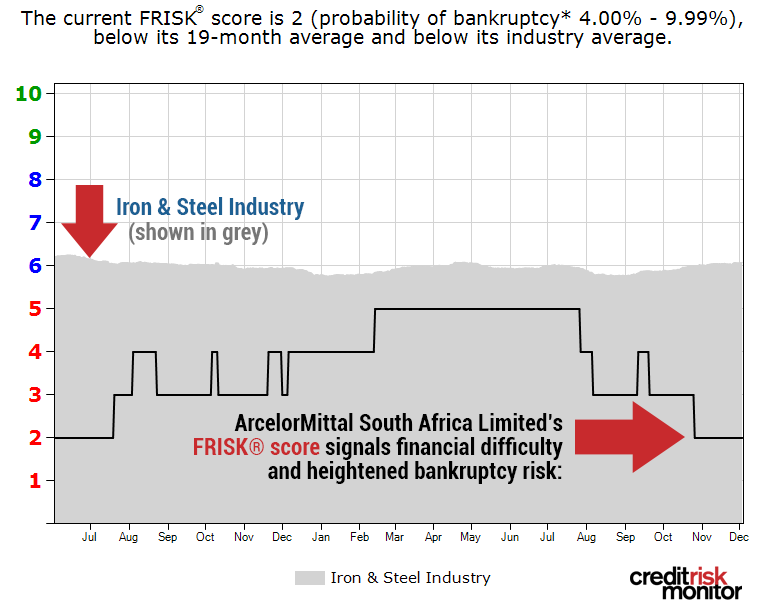

Within Africa, ArcelorMittal South Africa Limited is another worrisome situation. South Africa’s 2018 GDP growth was 0.8% and GDP growth has been muted so far in 2019. The steelmaker provided a negative outlook on South Africa’s steel demand:

“Apparent steel consumption decreased by a further 2% for the period and is now at 70% of the apparent steel consumption of the first half of 2008 – a 10-year low.”

ArcelorMittal South Africa Limited carries a FRISK® score of “2” into December 2019, which reflects a 4-to-10x greater risk of bankruptcy relative to the average public company within the next 12 months:

This outlook is troubling given that the company has reported:

- Operating losses in six out of the last eight semi-annual reporting periods.

- Negative free cash flow in eight of the last nine semi-annual periods.

- An interest coverage ratio, comparing trailing 12-month EBITDA to interest expenses, of 2.5x.

- Cash and quick ratios of 0.18 and 0.45, respectively, for latest fiscal period ended Jun. 30, 2019.

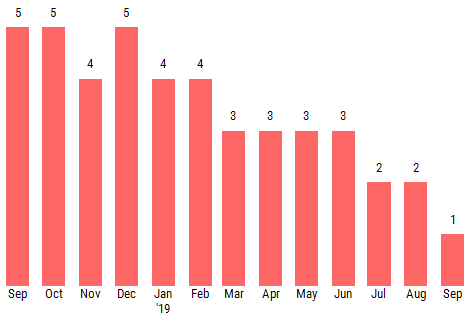

In the U.S., Bayou Steel BD Holdings, L.L.C. filed for bankruptcy in October 2019. CreditRiskMonitor’s PAYCE® score, which looks at private company bankruptcy risk, indicated elevated risk for a full 12 months prior to its filing. As time progressed, Bayou Steel dipped further into the red zone:

Although this steel maker's eventual plant shutdown came as a surprise to many, the PAYCE® score provided relevant counterparties with a warning that a bankruptcy was likely to transpire. The PAYCE® score has identified 70% of private company bankruptcies across our private company coverage by leveraging neural networking technology, a type of artificial intelligence.

Bottom Line

The FRISK® Stress Index is showing severe financial stress across the cyclical steel industry. As risks of an economic downturn increase, more public and private steel manufacturers will be exposed to bankruptcy. CreditRiskMonitor provides unique monitoring solutions, including the FRISK® score and PAYCE® score, which identify bankruptcy with high accuracy well before it hits the news headlines. Contact us here if you would like more information to bolster your company’s risk management toolkit.