Credit and financial professionals leverage CreditRiskMonitor’s Trade Contributor Program to evaluate their accounts receivables every day at no charge. In fact, our trade contributors send us a total of ~$3 trillion of receivables to process annually. Our give-to-get proposition involves you contributing trade every month and we provide free and unlimited access to our entire collection of trade data, covering millions of companies and trillions of dollars of annual receivables. Furthermore, with four tailored action reports, contributors gain insight into bankruptcy risk, payment delinquency, impending delinquency, and hidden high-risk customers. It has never been more important to scrutinize customers who have the potential to file for bankruptcy.

Constantly Improving Trade Review

Back when commercial bankruptcy filings surged due to the COVID-19 pandemic-induced recession, nearly every industry was negatively impacted with some much more than others. Full credit extensions have had material repercussions as financial recoveries have significantly deteriorated, where trade credit has been fortunate to receive 10% of the money owed in the case of bankruptcy. CreditRiskMonitor’s data insights have one goal: to significantly improve risk management by improving your portfolio’s credit quality and collection activity. All of the action reports and overviews in the free Trade Contributor Program either contain CreditRiskMonitor's proprietary PAYCE® score, Days Beyond Terms (DBT) Index, or both.

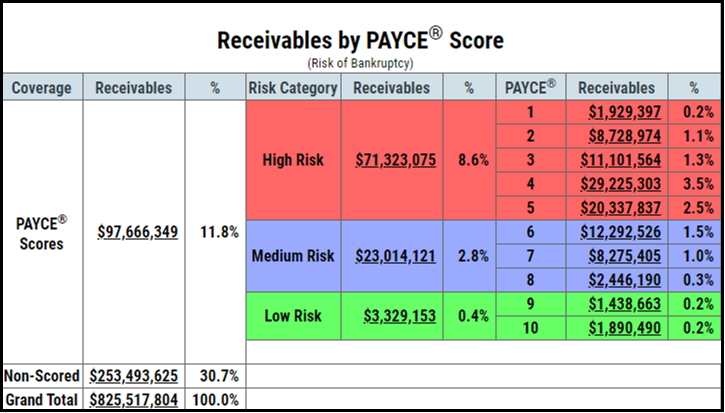

The forward-looking, 80+% accurate PAYCE® score was created specifically for predicting private company bankruptcy risk based on trade payment patterns and U.S. federal tax lien data. The model utilizes artificial intelligence and machine learning technology to calculate the probability that a company will file bankruptcy within a 12-month time horizon. By using a “1” (highest risk) to “10” (lowest risk) scale, with anything equal to “5” or less landing in the high-risk “red zone,” users can conveniently address their riskiest customers on a consistent basis. With the advantage of AI, the PAYCE® score recognizes high-risk information that traditional models and human pattern recognition cannot replicate. What’s most unique is that the PAYCE® score will usually signal high risk before a customer company even exhibits modest payment delinquency. CreditRiskMonitor subscribers utilize the PAYCE® score to stay ahead of high-risk private companies and implement risk mitigation, often several quarters in advance of potential bankruptcy.

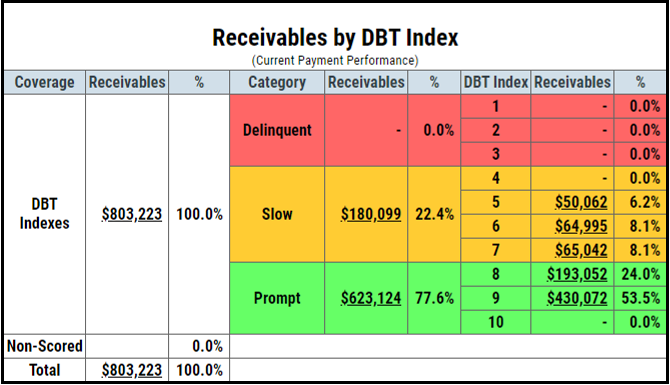

The DBT Index, quite similar to Dun & Bradstreet’s PAYDEX® score, is a backward-looking descriptive score that measures prompt or late payment performance in the past. Based on that data aggregation, the information is standardized into a “1” (highly delinquent)-to-“10” (always on time) scale. Since this payment behavior is calculated monthly, users can evaluate payment behavior in the most recent month against its historical trend and relative to other customers. In instances where enough trade lines are available to calculate a PAYCE® score, CreditRiskMonitor recommends relying upon the predictive PAYCE® score over the descriptive DBT Index for evaluating risk patterns.

Report Views and Other Data

CreditRiskMonitor provides four standard Action Reports to Trade Contributor Program members to help in managing their receivables, including:

Action Report | Purpose |

Receivables at Risk | Shows customers in danger of bankruptcy, as indicated by high-risk PAYCE® scores |

Slow Payers | Shows customers that are paying you slowly as compared to how promptly those customers are paying other trade contributors |

Hidden Slow Payers | Shows customers that are paying promptly, but are paying other contributors slowly |

Hidden High Risk | Shows customers that are paying on time, but considered to have high bankruptcy risk as indicated by predictive scores |

Users will also receive a monthly Receivables Snapshot, which evaluates your entire counterparty portfolio. This view stratifies receivables by risk (PAYCE® score) and payment performance (DBT Index).

With the PAYCE® score, users can see how much of their receivable dollar exposure lands within the low-, medium-, and high-risk categories, based on the bankruptcy probabilities of all scored customers.

Users can then further examine each of these categories, particularly the high-risk segment, and customers within can be considered for potential risk mitigation. These reports are only a handful of many others that are available in the Trade Contributor Program, including the ability to build-your-own reports using the PAYCE® score and DBT Index.

With the payment behavior stratification, the user can observe which receivables have potential credit and collection issues by investigating the delinquent and slow categories:

We can help your collections by identifying customers who have been paying our other contributors more promptly than they have been paying you. They have the money, why are they paying you slowly? Point being, all of this data will help you fight back delinquency, improve collections, and avoid write-downs.

Bottom Line

The Trade Contributor Program is a cost-free option that allows companies to join a robust community that includes thousands of corporations worldwide. The reports are not only quick and convenient to use, but they also provide deep insight into every contributor’s receivable portfolio. Users gain deep insight into their receivable portfolios by slicing their own data, comparing against other contributors, and leveraging artificial intelligence. During a time of swelling commercial bankruptcies and trade creditor financial losses, there has never been a better time to leverage these resources to your advantage. Interested in learning more about the program’s benefits? Contact us today.