According to the U.S. Census Bureau, seasonally adjusted sales for food services and drinking places declined by 50% in April and now sit at the lowest level since March 2005. The coronavirus pandemic forced U.S. restaurants to close their doors, which has negatively impacted all franchises; moreover, the largest damage affected the casual dining segment. Privately held companies FoodFirst Global Restaurants and Garden Fresh Restaurants recently filed for Chapter 11 and Chapter 7, respectively. Pervasive challenges also exist in the public company arena. The FRISK® score, 96%-accurate in predicting public company bankruptcy, has downgraded many restaurants, portending heightened failure risk over the next 12 months.

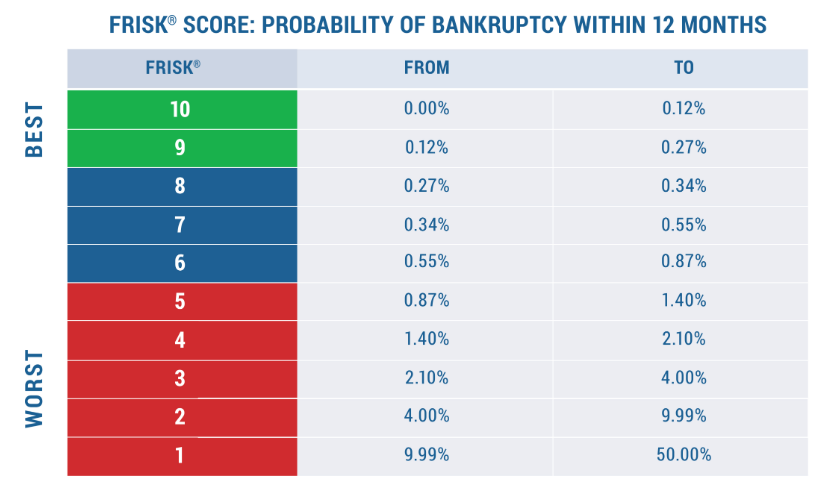

CreditRiskMonitor is a leading web-based financial risk analysis and news service designed for credit, supply chain, and other risk professionals. The core of the service is the FRISK® score, which uses a "1" (highest risk)-to-"10" (lowest risk) scale for bankruptcy risk. With coverage of more than 57,000 public companies globally and in-depth financial ratio and trend analysis, professionals use the service to monitor and evaluate financial risk before it damages their businesses.

Distressed Restaurants

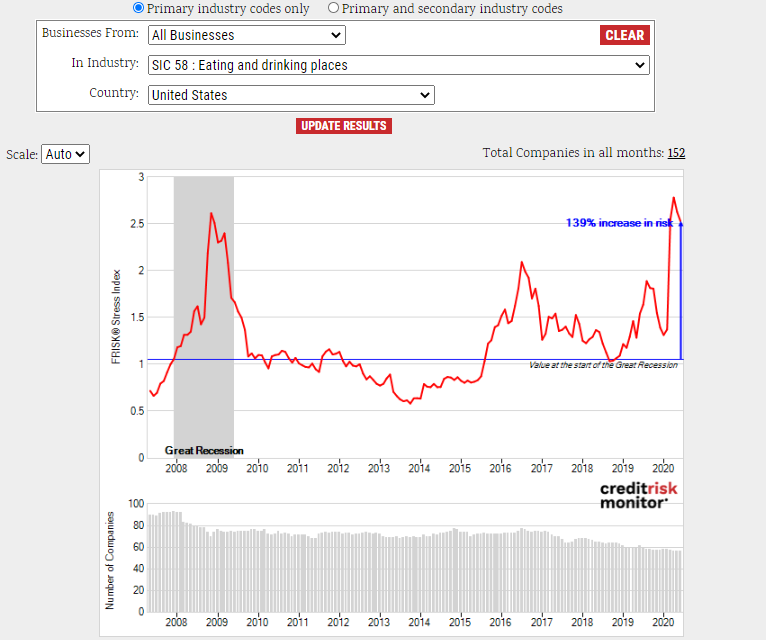

According to the FRISK® Stress Index, eating and drinking places (SIC 58) have experienced a severe and rapid increase in aggregated financial risk since the Global Financial Crisis. The FRISK® Stress Index shows the collective probability of failure in a group of companies (such as an industry, country or portfolio) over the following year.

While U.S. cities have slowly begun to reopen, restaurants are presented with the impending challenge of significantly reduced capacity. Depending on the floor plan layout, restaurants will operate at a fraction of their normal headcount throughout the remainder of 2020. Customers may also be less willing to dine-out, or may seek alternatives to sit-down formats. Based on CreditRiskMonitor data, the restaurant industry only reported a median net profit margin of 3.2% prior to the pandemic. As of Q1 2020, both operating and net profit margins turned negative.

Casual dining chains essentially lost all of their on premise sales, only partially offset by curbside pickup and delivery. Such shortfalls required highly leveraged restaurants to seek rent concessions and incur even more debt. In the chart below, the casual dining restaurant chains selected have troublingly low FRISK® scores and they have drawn down on their credit revolvers. The liquidity available metric shown was retrieved from the Management, Discussion, and Analysis (MD&A), and is calculated by comparing the total borrowing base between all credit facilities to the amount left available.

| Restaurant Chain | FRISK® Score | Liquidity Available |

| CEC Entertainment Inc. | 1 | 76% |

| Bloomin' Brands Inc. | 2 | 5% |

| Dave & Buster's Entertainment Inc. | 2 | 22% |

| Brinker International, Inc. | 2 | 30% |

| Carrols Restaurant Group Inc. | 3 | 7% |

| Cheesecake Factory Inc. | 3 | 23% |

| Denny's Corporation | 3 | 16% |

| Dine Brands Global Inc. | 3 | 1% |

| Ruth's Hospitality Group Inc. | 3 | 0% |

| BJ's Restaurants Inc. | 3 | 0% |

| Fiesta Restaurant Group Inc. | 3 | 50% |

| Red Robin Gourmet Burgers, Inc. | 3 | 47% |

In June, CEC Entertainment (which operates Chuck E. Cheese restaurants), Bloomin’ Brands (parent company of Outback Steakhouse and Carrabba’s Italian Grill), Dave & Buster’s Entertainment, and Brinker International (which operates Chili’s Grill & Bar) are among the most distressed names in the CreditRiskMonitor database. These four operators carry a bankruptcy risk range that trends between 4x-to-50x higher than the average public company, as demonstrated in the chart below:

Digging Deeper

Franchise chains carry multiple layers of financial leverage within their business structure: at the corporate level, at the franchise level, and through operating leases. Therefore, traditional ratios of debt-to-equity and debt-to-assets are actually understating true financial leverage. One way to better measure actual financial leverage is to use total liabilities-to-total assets, one of the crucial computations used within the FRISK® score. As the table below shows, when using this metric these major brand names no longer appear to have well balanced capital structures. They are, in fact, highly leveraged. Liabilities to assets greater than 70% is typically considered excessive.

| Restaurant Chain | Debt-to-Assets | Liabilities-to-Assets |

| CEC Entertainment Inc. | 44% | 90% |

| Bloomin' Brands Inc. | 38% | 97% |

| Dave & Buster's Entertainment Inc. | 27% | 93% |

| Brinker International, Inc. | 56% | 122% |

CEC Entertainment Inc., operator of Chuck E. Cheese’s and Peter Piper Pizza, appears likely to default and may file for Chapter 11 bankruptcy in the near future. Headed into the fourth quarter, total cash and short-term investments declined from $105 million to $35 million, in part due to a steepening burn rate. Its senior secured credit facilities carried a hefty weighted average interest rate of 7.5%, up from 6.4% in the previous year. According to a May Form 8-K filing, the company requested that the SEC allow it additional time to release its first quarter earnings statement. Management specifically needs to address COVID-19 related disclosures and to perform impairment testing. Additionally, the company is seeking rent concessions and has temporarily closed nearly 12% of its locations based on sales underperformance.

Brinker International, Inc., operator of Chili’s Grill & Bar and Maggiano’s Little Italy, carried an interest coverage ratio of 3.6x. However, the coronavirus pandemic led the company to breach its debt covenants, which led to a waiver of compliance with all covenants until fiscal 2021. Additionally, the company priced a secondary public offering of seven million shares of common stock, which netted proceeds of $121 million to help shore up liquidity. However, default risk remains a concern upon entrance into the first quarter of 2021, with the real prospect of its fixed charge ratio remaining below 1x. What’s more, the company needs to refinance its revolving credit facility that matures in the third quarter of 2021, which could lead to materially higher interest rates. Moody’s Investors Service has the unsecured notes rated at B3, while maintaining a negative outlook – deep within the highly speculative category.

Bottom Line

Quick service and fast casual have for the most part held up fairly well with their off-premise food service options, so not much risk adjusting has been required on that front. Yet the casual dining space faces pressure throughout the course of 2020 and 2021 as customers gradually return to dining-out. Among the most likely to file bankruptcy in the near-term is nation-wide operator, CEC Entertainment. For more information, or to get in touch with one of our staffers for a tailored demo, contact us today.