Expanding digital media and news consumption continues to greatly impact the print world; newspapers are doing their best to hold steady but the industry as a whole has had its struggles. As of May 2018, the newspaper segment of the larger U.S. print industry has doubled in probability of bankruptcy risk since the Great Recession.

Of the American brands performing well, The New York Times Company is among the best with a strong FRISK® score of “8.” At the other end of the country – and of the risk spectrum – is the similarly well-known McClatchy Company out of Sacramento, Calif., with a worst-possible FRISK® score of “1.” Today, we predict that McClatchy has a 10-to-50% probability of bankruptcy in the coming 12 months. Given that roughly 60% of the companies are performing well in this changing industry, a look at what makes one company stand strong while another suffers is worthwhile.

First, the FRISK® Score

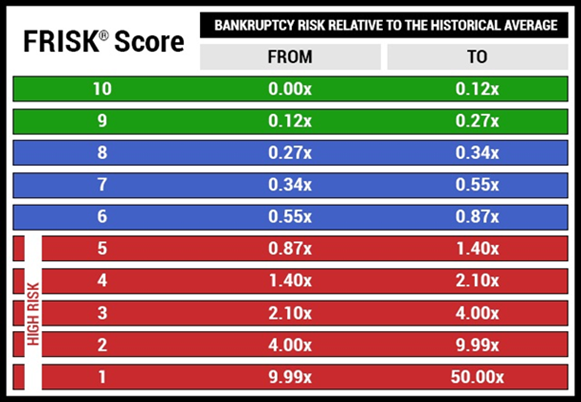

The FRISK® score is a preliminary indicator of a company’s long-term financial health. The “10” (safest) to “1” (highest risk) scale offers risk professionals a quick reference which can be used to determine whether or not a company’s financial condition warrants investigation. If a company falls into the FRISK® “red zone,” or the bottom half of the scale from “5” down to “1,” the percentage chance of potential bankruptcy is greatly elevated. In fact, 96% of all companies that file bankruptcy end up in the FRISK® red zone prior to filing.

McClatchy Co. produces well-known regional newspapers such as the Miami Herald and The Sacramento Bee. The company's financial weakness caught our attention in May 2017, and we took a look at the specific financial factors that were signaling heightened risk at that time. The New York Times, on the other hand, is a robust brand that has been able to withstand the decline of the newspaper market with relative ease. In each of the past 12 months, the company recorded strong FRISK® scores of “7” or higher.

A Look at the Numbers

Troubling figures highlighted in May of 2017 in McClatchy’s financial reports included staggering debt ($846 million at the close of 2016). Additionally, five consecutive quarters of negative tangible net worth and anemic rates of return were reported.

In 2018, some figures have improved while others continue to falter, which ultimately leaves McClatchy in a sustained state of financial distress. At the end of the first quarter of 2018, the company reported $688 million in total debt. Though an improvement, the debt load has made up more than 100% of the capital structure for the last three quarters because shareholder equity has fallen into negative territory. Tangible net worth is still deeply in the red at negative $1.16 billion – worse than it was at the period end Dec. 31, 2017.

The company hasn’t been able to solve its leverage problem or pull itself up from its FRISK® score of “1." As we can see, McClatchy has elevated bankruptcy risk. On the other hand, a select newspaper company like The New York Times strengthened performance by growing with digital subscriptions.

In fact, for The New York Times, the figures are drastically different from those of McClatchy when examining key financial risk metrics. Take for instance, The New York Times’ cash ratios, which are – and have been for the last five quarters – markedly higher than that of McClatchy, indicating that it has more financial leeway to deal with any short-term problems that may arise.

| Company | Cash Ratio | Tangible Net Worth | Debt to Assets |

| The New York Times Company | 1.39 | $812 million | 12% |

| The McClatchy Company | 0.11 | -$1.16 billion | 50% |

| Figures as of Period Ended Apr. 1, 2018 | |||

The New York Times has also avoided the issue of negative tangible net worth. In fact, tangible net worth at the end of 2017 was at its highest point in the past five fiscal years. This suggests that its creditors have ample protection for their financial claims, unlike McClatchy. One of the keys to The New York Times' stability in the newspaper industry is a modest use of debt, highlighted by a debt-to-assets ratio of 12%. McClatchy's debt-to-assets ratio is at a troublesome 50%, which further highlights the company’s leverage issues.

The Bottom Line

McClatchy and The New York Times represent two ends of the financial risk spectrum in the newspaper industry, highlighting the need for vigilance. Even though the industry has a number of financially strong companies, businesses exhibiting signs of financial difficulty are still a problem. Without proper monitoring, bankruptcy can catch risk professionals by surprise, causing unwanted stress and loss. The FRISK® score is warning of just such a risk at McClatchy today.