With inflation running hot, the U.S. Federal Reserve has embarked on a rate hike agenda. The U.S. is not alone in traversing this path and companies across the globe are being forced to contend with increasing financing costs. Many will handle rising interest rates in stride, but financially weak names with material near-term maturities are struggling and, in some cases, bankruptcy could be imminent. Now is the time to prepare by identifying the weakest links in your portfolio of customers and suppliers.

This Trend Is Not Your Friend

The last U.S. Fed rate hike came in at 50 basis points and increases are expected to continue at similar step sizes. For context, the last time the U.S. Fed increased rates by 50 basis points or more was in 2000. Life will be more difficult for companies with high debt burdens, low debt-servicing capacity, and large amounts of short-term debt in need of refinancing.

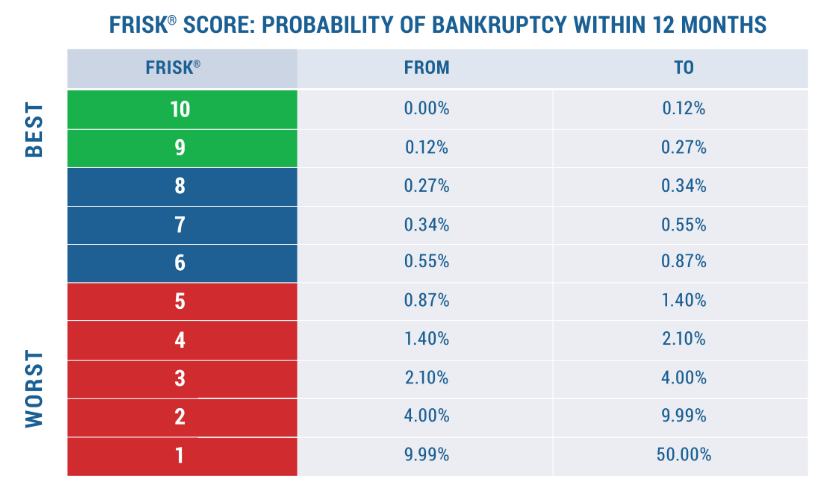

Subscribers can use the CreditRiskMonitor FRISK® score as their first line of defense to identify counterparties most vulnerable to bankruptcy. The FRISK® score incorporates financial statement ratios, stock market performance, bond agency ratings from Moody’s, Fitch, and DBRS Morningstar, and the aggregate risk sentiment of our subscriber base. The non-linear combination of these data sets allows the score to capture a baseline of 96% of all publicly traded companies that eventually go bankrupt within its high-risk category at least three months before they file.

The FRISK® score is measured on a “1” (highest risk)-to-“10” (lowest risk) scale, with anything equal to “5” or less belonging to the FRISK® score “red zone,” indicating an above-average risk of financial failure (red indicating the need to stop and look):

Some Painful Examples

In the transportation sector, operator Power Solutions International Inc. currently shows a FRISK® score of "1," indicating a probability of bankruptcy between 10-and-50% over the next 12 months, and short-term debt accounts for 85% of its overall debt load. The company has already received a going concern notice and has accepted financial bailouts from large investors. And with a negative tangible net worth, there's limited collateral or performance to back any new financing. The risks being highlighted by the FRISK® score are material and exacerbated by the high level of debt that must be refinanced, likely at higher rates, over the next year or so.

A cross-section of countries in the table below illustrates to what degree interest rates have increased, as well as how many publicly traded companies CreditRiskMonitor covers in those countries:

| Country | Rate Increase | Increase Date | Current Interest Rate | Company Coverage* |

| United States | 0.50 | May 2022 | 1% | 4,313 |

| Sweden | 0.25 | April 2022 | 0.25% | 719 |

| Canada | 0.50 | April 2022 | 1% | 2,384 |

| Saudi Arabia | 0.50 | May 2022 | 1.75% | 200 |

| Israel | 0.25 | April 2022 | 0.35% | 471 |

| United Kingdom | 0.25 | May 2022 | 1% | 1,134 |

| Brazil | 1.00 | May 2022 | 12.75% | 394 |

*pertains to FRISK® scored companies only

Moving to specific company examples, several entities below could be pushed into bankruptcy or corporate failure because of these rate increases.

| Company | Country | FRISK® Score | Short-Term Debt % |

| Power Solutions International Inc. | U.S.A. | 1 | 85.8% |

| SAS AB | Sweden | 1 | 22.4% |

| Hexo Corporation | Canada | 1 | 89.3% |

| Saudi Arabian Amiantit Co SJSC | Saudi Arabia | 2 | 99.5% |

| El Al Israel Airlines Ltd. | Israel | 2 | 60.3% |

| IG Design Group PLC | United Kingdom | 2 | 67.1% |

| Via SA | Brazil | 2 | 44.9% |

- SAS AB, a Swedish airline, stands out on the list because its short-term debt as a percentage of total debt is a more modest 22.4%. However, with a FRISK® score of "1," it remains quite volatile, and we noted in our recent High Risk Report on SAS AB that the company has stated that it needs to deal with heavy leverage or bankruptcy is a possibility. The airliner continues to lose money, and its total debt-to-tangible net worth skyrocketed to over 11 times. While short-term debt is relatively modest compared to others on the list, SAS AB is running up a steep, muddy incline in its attempt to become stable and solvent.

- El Al Israel Airlines Ltd., an Israeli airliner dealing with material headwinds, is also in bad shape, with short-term debt making up just over 60% of its total debt. Its total liabilities are 20x larger than its market cap, it has lost money in each of the last five quarters, and its tangible net worth is negative. The Israeli government has stepped in to help shore up the company's business, providing additional financing at the cost of the company having to sell a stake in its frequent flyer program. That amounts to selling the crown jewels and is a sign of severe distress that shouldn't be ignored.

- Saudi Arabian Amiantit Co SJSC is at the opposite end of the spectrum from SAS AB, with short-term debt making up almost all its debt. This pipe and water solutions company has lost money in each of the last five quarters, burned cash in three of those quarters, and, in the final quarter of 2021, tangible net worth fell into negative territory. Given that the company hasn't covered its interest expenses in more than a year, counterparties should be concerned that any rollover of existing short-term debt at higher rates will make the problems here even worse than they already were before Saudi Arabia's May 2022 rate hike.

Bottom Line

There are plenty of issues that can arise when a company falls into financial distress. Companies that are buying from you might start to delay payments to conserve much-needed cash. Troubled suppliers cut corners, including reduced quality assurance, to save money. Higher interest rates on near-term debt that are rolling over will only exacerbate such issues and push companies ever closer to the final breaking point.

You’ll want to be ahead of such early problems and prepared for potential bankruptcy situations, which can impact your credit, disrupt supply chains, and hurt revenue streams. Contact CreditRiskMonitor today to see how our global coverage can help protect your company from the impact that rising rates will have on your customers and suppliers.