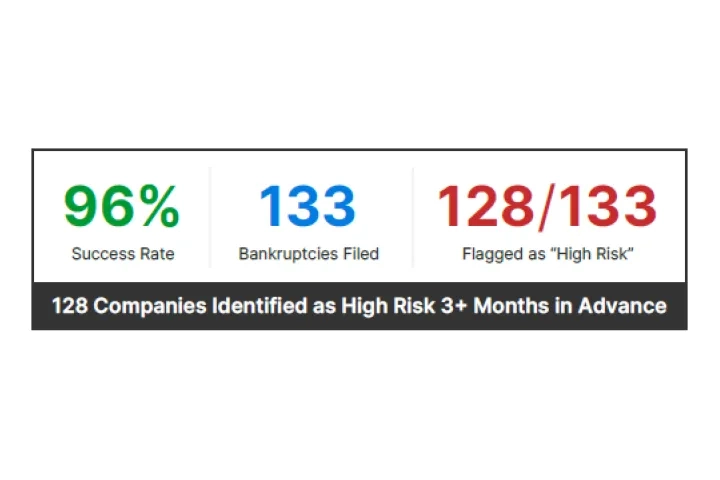

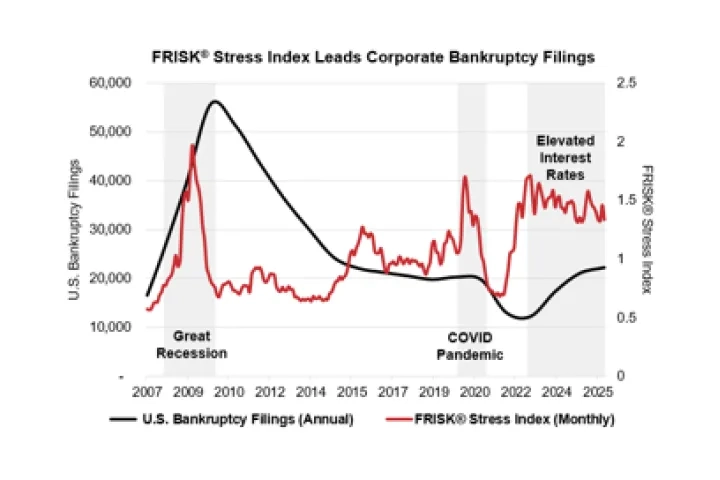

From January through December 2025, the PAYCE® Score predicted bankruptcies across North America, including many mega-bankruptcies with liabilities of $1 billion or more. These companies were flagged as “high risk” at least three months in advance. Importantly, nearly 50% of the largest company bankruptcies showed prompt or near-prompt trade payment behavior shortly before filing (the cloaking effect). Because of this, traditional trade-only models did not flag them. We expect private-company bankruptcies to remain elevated through 2026.