The energy sector is slowly working its way back from the severe demand decline in 2020 due to the coronavirus pandemic. Energy services names have been particularly hard hit, with many falling into financial trouble and, ultimately, bankruptcy. Traditional risk models are failing to differentiate between healthy and distressed operators in this sector. Schlumberger N.V. and Seadrill Limited, at different ends of the risk spectrum, are prime examples that underscore the effectiveness of the FRISK® score in keeping an everyday watch on bankruptcy.

Payment History Hides Danger

One of the most common ways to track the risk of a counterparty is by evaluating how they pay their customers. Payments scores can be effective in showing if a private company is having trouble making payments and facing material financial difficulty. For public companies, however, there's much more important and informative data available.

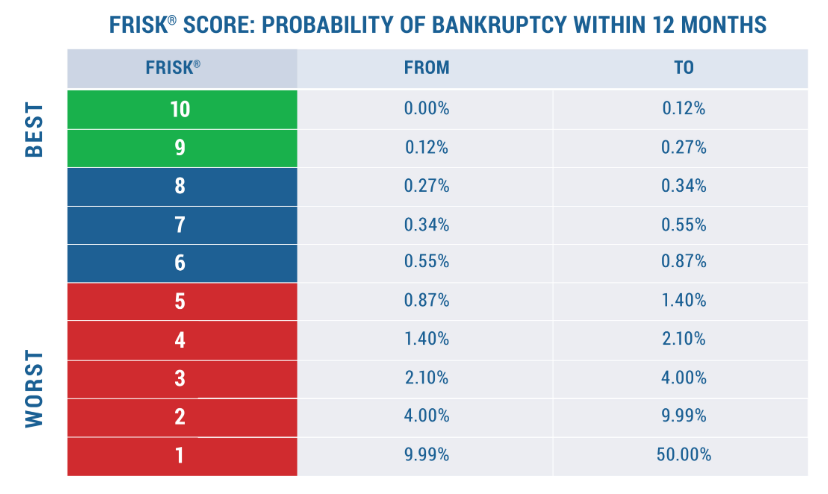

The AI-driven FRISK® score ignores payment history for public companies. Instead, each day the FRISK® score leverages four distinct data components, including stock market performance, bond agency ratings (Moody’s, Fitch, and DBRS Morningstar), financial statement ratios, and subscriber crowdsourcing research patterns, to accurately determine risk potential. Combining these components in a non-linear fashion produces a highly effective, accurate, and timely risk assessment compared to other risk analytics. The FRISK® score segments companies into easily defined risk categories, as shown below.

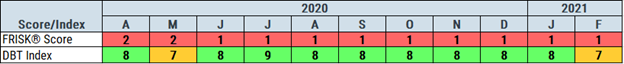

When Seadrill Limited declared bankruptcy in February – for the second time since 2016, if you’re keeping score at home – it consistently paid customers in a timely manner. That is evident by the high DBT Index, which measures dollar-weighted payment data that is similarly used in Dun & Bradstreet's PAYDEX® score. However, if you look at the figure below, notice that the FRISK® score was mired at a worst-possible "1," representing bankruptcy risk that is 10-to-50x that of the average public company:

Payment-based scores were completely missing the high bankruptcy risk potential of Seadrill as its financial situation deteriorated (read the company’s post-mortem analysis Seadrill Limited Bankruptcy Case Study). This “Cloaking Effect” arises as companies intentionally maintain prompt payments to avoid having their trade financing restricted given credit professionals are more inclined to target delinquent accounts. Investors are another category that monitors payment trends, in which slow payments are viewed negatively by a deterioration in days payable outstanding and working capital trends.

With interest rates being at extreme lows these days, trade credit is an invaluable lifeline: a gratis loan offered by the supplier. The fact is, CFOs need trade credit in the way our lungs need oxygen to breathe, and they will do what they can (legally) to protect that lifeline. On the flip side, we’ve all heard of the news reports where if a supplier isn’t being paid it can cause quite a stir for the delinquent borrower. Negative publicity certainly does not go away overnight. Therefore, there are several reasons in which companies will pay their vendors on time – but again, we must remember that payment behavior on *public companies* is inherently misleading for bankruptcy risk analysis. The act itself is just as performative as it is practical: it signals to counterparties and investors alike that things are “business as usual.”

The FRISK® score, however, cuts through the superficiality; it accurately warned of the increasing risk in Seadrill Limited more than a year before they filed, which provided ample time for counterparties to adjust exposure.

Financial Risk That Does Not Exist

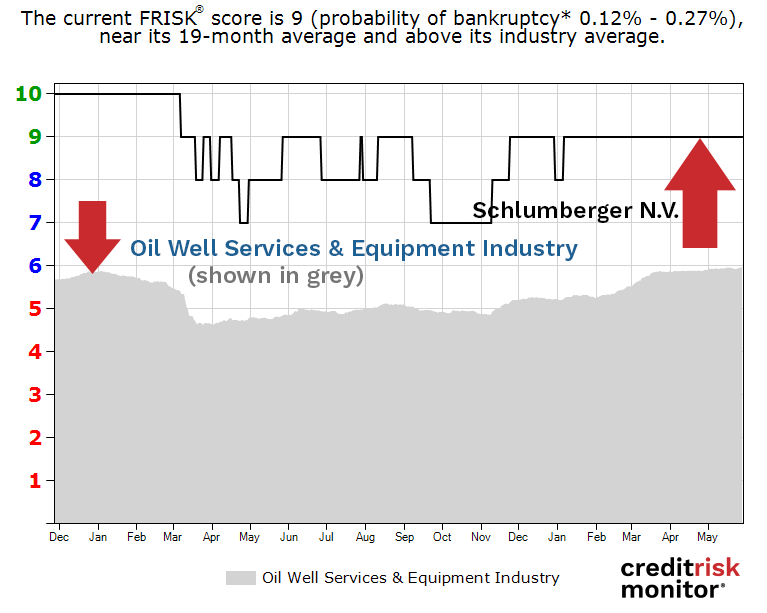

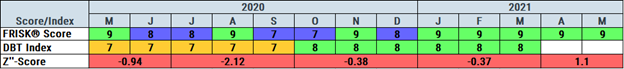

Conversely, Schlumberger N.V. is an energy services giant muddling through the current industry downturn in relative stride. The FRISK® score shows immaterial risk. Indeed, even during the worst of the energy sector downturn in 2020, the FRISK® score never dipped below "7," which was two steps above the industry average of "5" at the time. In other words, Schlumberger was resilient in handling the industry fallout.

However, the Altman Z"-Score, which is based solely on financial statement ratios and like other models, would have signaled risk without good reason. Schlumberger's Altman Z"-Score indicated extreme bankruptcy risk, as denoted by its red zone score that even turned negative. Operating performance was challenged through the period due to one-time charge-offs, yet cash flow remained consistently positive and its balance sheet remained strong.

Long-time industry bellwether Schlumberger is accustomed to such extreme cycles. Its investment-grade credit rating, large equity cushion, and the lack of concern from subscriber crowdsourcing, all offset the weakness in the financial statement ratios to show that Schlumberger didn’t pose material bankruptcy risk.

Bottom Line

The FRISK® score has an incredible track record in identifying bankruptcy risk before it strikes, as it did with Seadrill. That is enough for most subscribers to put their trust in the 96%-accurate score. However, much less discussed is the fact that the FRISK® score can also warn you of times when other assessment tools are overstating bankruptcy risk, as is the case today with Schlumberger. Screaming fire when there isn’t one is a waste of any professional’s time. Contact CreditRiskMonitor today to see how we can help you pinpoint distressed counterparties and bypass the wasted time of researching low-risk ones in your portfolio.