Business at casinos and resorts has picked up following an easing of travel restrictions after COVID-19, yet operators worldwide continue to be tested by steep fixed cost structures and debt-loaded balance sheets. CreditRiskMonitor’s FRISK® score reveals those casinos with the highest risk profiles located in the U.S., Europe, and Asia-Pacific. Despite broader improvement in the industry, financially distressed companies like Codere S.A., Mohegan Gaming & Entertainment, and Full House Resorts, Inc. continue to have an elevated risk of corporate failure.

Summer Warning Signals

Credit and supply chain professionals frequently leverage the FRISK® score to identify their highest risk accounts as a first step approach. The FRISK® score is based on a “1” (highest risk)-to-“10” (lowest risk) scale, within anything equal to “5” or less falling into the high-risk FRISK® score “red zone”. What’s more, a FRISK® score of “1” indicates a bankruptcy risk probability that is 10-to-50x higher than that of the average public company.

The eight operators below have consistently landed in the FRISK® score red zone during the last 12 months:

| Company | Country | FRISK® score |

| Codere S.A. | Spain | 1 |

| Mohegan Gaming & Entertainment | U.S.A. | 1 |

| Imperial Pacific International Holdings Limited | Hong Kong | 1 |

| Full House Resorts, Inc. | U.S.A. | 2 |

| Boyd Gaming Corporation | U.S.A. | 3 |

| Wynn Macau Limited | Macau | 3 |

| Century Casinos, Inc. | U.S.A. | 4 |

| Playahotel & Resorts NV | Netherlands | 5 |

Casino and resort operators carry high-risk FRISK® scores due to sluggish industry recovery and cumbersome debt loads.

Spanish private-gaming operator Codere S.A. reported cumulative operating losses of $242.5 million in the last 12 months, leaving its interest coverage negative for four consecutive quarters. Its liquidity position also deteriorated, as total cash and short-term investments declined by $102.1 million. According to Fitch Ratings' June 17 research note, Codere was assigned a long-term issuer default rating of "C" following the announcement of a capital restructuring. Fitch further detailed that the company’s ability to maintain its existing debt structure is challenged: “Refinancing risk will remain high as Fitch does not expect a full recovery until 2023. Intermittent lockdowns, social distancing measures, and point-of-sale closures in multiple operational jurisdictions will continue to put pressure on upcycle trends. This may continue until vaccination rollouts are more advanced.”

Mohegan Gaming & Entertainment’s traffic trends are in the process of stabilization but remain beneath pre-pandemic levels. According to the liquidity section of its most recent management, discussion, and analysis (MD&A), the company completed a series of refinancing transactions to secure a liquidity runway. According to the disclosures: “we completed a series of refinancing transactions, including (i) entering into a new senior secured credit facility, (ii) issuing new senior secured notes, (iii) prepaying our prior senior secured credit facilities, (iv) prepaying our Main Street term loan facility and (v) repaying our Mohegan Tribe subordinated loan.” However, net debt reached a new high of $2.1 billion and its interest coverage remains within a range of 1-2x even after adjusting for one-time expenses.

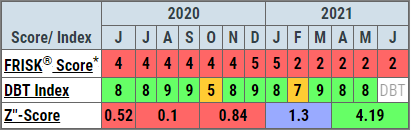

Full House Resorts, Inc. saw its FRISK® score drop to a “2” in February 2021. That diverged from the company’s Altman Z”-Score trend, which actually saw an improvement to 4.19, indicating financial soundness. In this case, there is a catch: the company recently issued an 8.25% senior secured bond and completed a public equity offering, which significantly boosted liquidity. However, several of its Q1 2021 leverage ratios sank deeper into the bottom quartile of industry peers. So while the Z”-Score is financially driven, it doesn't offer as comprehensive a review of risk as the FRISK® score does. With the FRISK® score, you get a more holistic blend of financial performance indicators, also factoring in stock market trends, bond agency ratings, and subscriber crowdsourcing patterns.

Put another way, the FRISK® score never gets thrown off the scent of financial stress:

Another “tell” that the Z”-Score might be artificially boosted could be found when reading over Full House Resorts’ MD&A disclosure, which indicated outright that a significant portion of the proceeds would be used for project financing: “$180 million of the debt proceeds into a construction reserve account dedicated to the construction of Chamonix.” And even upon completion of this casino project, deleveraging will likely be difficult given Full House Resorts' consistently low-to-mid single-digit free cash flow margins.

Bottom Line

Casino and resort operators have been undergoing prolonged operating challenges, which have necessitated refinancing transactions and/or incremental debt issuance throughout the first half of 2021. Depending on how industry conditions fare, one or more of these operators could end up in a financial restructuring given weak industry conditions. Subscribers are reminded to remain diligent in monitoring the daily-updated and 96% accurate FRISK® score, as alternative risk models, such as payment information and certain financial models, simply cannot identify risk or measure it as effectively.

Contact us to learn more about the FRISK® score and how it can provide daily updated risk evaluations for all industries worldwide.