CreditRiskMonitor published a High Risk Report on WeWork Inc. (“WeWork”) on Nov. 21, 2022. The company operates a portfolio of flexible workspaces and has experienced extreme business pressure from the COVID pandemic and work-from-home trends. WeWork essentially takes on long-term lease obligations and then rents out space on a short-term basis, an inherent mismatch that was fully exposed during the pandemic. Although COVID has receded, office occupancy is still recovering and WeWork continues to struggle financially as revealed by the FRISK® score. This report will provide five quick and vital facts about WeWork and its elevated risk of bankruptcy over the coming 12 months.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

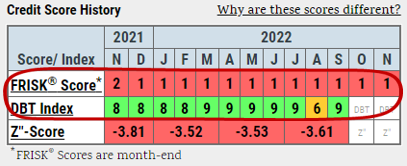

1. WeWork’s FRISK® Score Indicates Highest Risk for a Year

WeWork's FRISK® score is "1," which is the lowest rung on the "1" (highest risk)-to-"10" (lowest risk) bankruptcy risk scale. This score indicates that the company has a 10-to-50x greater risk of bankruptcy than the average public company over the coming year. The score has been stuck at this riskiest level since December 2021.

Credit professionals who are reliant upon payment-based risk scores to assess financial risk, however, would likely be unaware of WeWork’s perilous condition. WeWork has largely been paying its bills in a timely fashion, a common discordance since public companies often pay reliably right up until they declare bankruptcy. This is what is known as the "Cloaking Effect." CreditRiskMonitor strongly advocates that risk professionals rely upon the FRISK® score as the first line of defense against bankruptcy risk at public companies like WeWork.

The FRISK® score doesn't use payment history, but instead nonlinearly combines high-quality data inputs including financial statement ratios, credit agency ratings, stock performance, and subscriber crowdsourcing. This powerful blend allows the FRISK® score to correctly categorize 96% of companies in the high-risk “red zone” at least three months prior to filing bankruptcy, providing subscribers with adequate time to adjust their risk exposure.

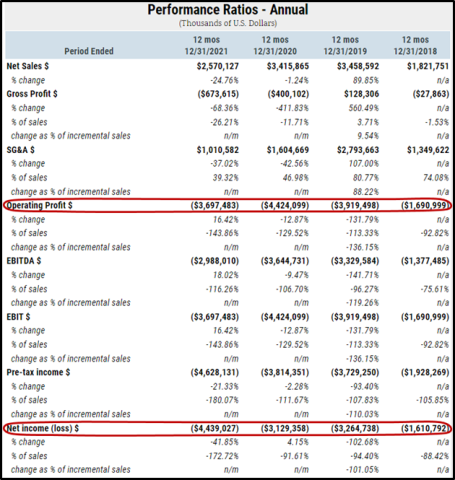

2. Losses on Losses and Burning Cash

WeWork has posted a negative operating profit every year since 2018. In the pandemic-hit 2020, the red ink increased dramatically as social distancing left people working from home. In 2021, operating losses improved, but the bottom line deteriorated further:

There was more improvement through the first nine months of 2022, but the run rate remains a negative $1.3 billion using Q3 financial results. Equally troubling, WeWork has been burning through cash, posting negative free cash flow through the first nine months of 2022 and for the last four fiscal years. With ongoing losses, the company has been forced to source external capital.

3. Intense Interest Costs

One of the key sources of capital for WeWork has been debt financing, but the company has not covered its interest expenses in the last five years. That places WeWork in the territory of zombie companies, which credit professionals must monitor closely.

The company also recently negotiated with its lenders, which involved a credit amendment with tighter terms. Amendments are usually used as a means of providing financial flexibility to the borrower or as a way to protect the lender, which can effectively lower the chance of bankruptcy and/or extend the timeline to bankruptcy. However, amendments frequently occur prior to bankruptcy and should be considered a red flag.

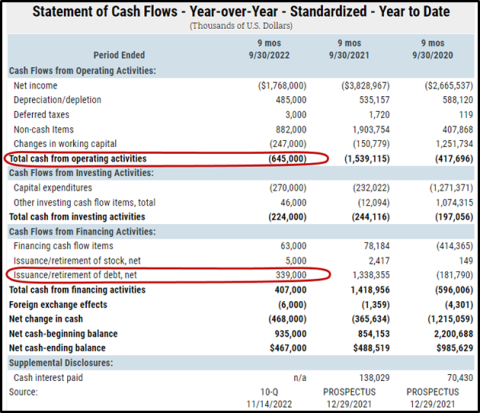

4. Taking on More and More Debt

Debt, meanwhile, is likely the only option for the company because its stock price has declined precipitously since it was taken public via a SPAC merger in late 2021. The cash flow statement looks bleak with recurring operating cash losses and continued reliance on external capital.

Since WeWork’s IPO, the company has made far more extensive use of debt financing, a significant benefit of being public is access to larger financial leverage relative to a private company, on average. Through the first nine months of 2022, the company has issued $339 million in new net debt. While that may not seem like a huge number, it comes on top of the $2.9 billion in debt it had on the balance sheet at the end of 2021 for a company that's already having trouble covering its interest payments and in a rising rate environment.

5. Shuffling the Chairs

WeWork's balance sheet struggles become even more worrying when you note that it has had three Chief Financial Officers in two years. Turnover in the executive suite is a key warning sign when it occurs at financially troubled companies. In addition to the CFO upheaval, the company has also experienced resignations at the board level. And then there's the contentious relationship WeWork had with its founder who stepped down after a failed IPO attempt in 2019. That very public affair should probably leave a bad taste in the mouths of anyone working with the company.

Top executives and board members “steer the ship” and frequent turnover can signal a lack of direction and reveal that key employees are fleeing a potentially sinking boat. Credit professionals working with WeWork need to carefully monitor such executive departures, particularly members like the CFO.

Bottom Line

WeWork’s business strategy continues to struggle and management hasn't quite figured out how to reach breakeven profitability in this environment. Based on the FRISK® score and other troubling signals, WeWork may ultimately be headed for bankruptcy. Contact CreditRiskMonitor today to see how we can help you identify your riskiest counterparties before they impact your portfolio.