Popular retail conglomerate Sequential Brands Group Inc. declared bankruptcy on Aug.31, 2021. At summer’s end, CreditRiskMonitor produced a post-mortem Bankruptcy Case Study of the company's descent, outlining the warning signs that existed prior to the filing.

As you dive into the in-depth analysis provided by the study itself, here are five quick and important red flags you can first review – warnings that most certainly caused material concern for financial counterparties.

1. More Than a Year of Warning

A mark of "5" or lower on the "1" (highest risk)-to-"10" (lowest risk) scale covers the high-risk FRISK® score red zone, which 96% of all companies pass through before failing. Sequential Brands Group sunk into this scary range more than a year before the company ultimately filed its Chapter 11 petition. While the score slowly fluctuated over that span, Sequential Brands Group never did manage to escape the red zone. In other words, CreditRiskMonitor clients – with exclusive access to this FRISK® score as part of their annual subscription – were given ample warning of Sequential Brands Group's bankruptcy risk.

The AI-driven FRISK® score, which is updated daily, blends a public company's stock market performance, bond agency ratings from Moody’s, Fitch, and DBRS Morningstar (if available), financial statement ratios, and subscriber crowdsourcing research patterns, into a metric that determines bankruptcy risk potential with unrivaled accuracy – the aforementioned 96% capture rate. Combining these components in a non-linear fashion produces a highly effective and timely risk assessment compared to other risk analytics like Dun & Bradstreet’s PAYDEX® score. And it allows you to quickly screen your list of important counterparties, so you can focus your research efforts on businesses that pose the most risk.

2. Rising Leverage and Weak Performance

Once alerted to Sequential Brands Group's red zone FRISK® score, most risk professionals would rightly have looked at its financial statements. In this case, the numbers were troubling, where net income was negative in three out of the four quarters of 2020, including the all-important holiday season. Moreover, cumulative free cash flow was quite weak, where in the last two fiscal years, free cash flow only averaged $3.7 million relative to a debt load of $452 million. The company's returns on equity and assets were also negative for those periods.

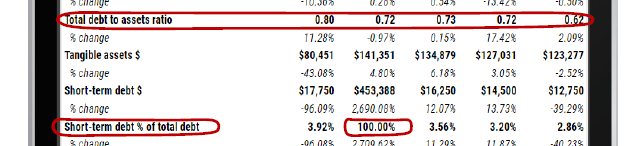

All the while, Sequential Brands Group's leverage was ticking higher, with total debt-to-assets and debt-to-EBITDA ranking deep in the bottom quartile of industry peers. Interest coverage was marginally above a factor of 1x in the last four sequential quarters before finally cracking beneath that critical threshold. All debt was also reclassified as short-term, given that the company did not receive a waiver that extended beyond one year of its third-quarter 2020 period – another warning sign that a company lacks financial flexibility.

3. Watch What Leadership Is Doing

In September of 2020, Sequential Brands Group announced that its Senior Vice President of Finance and CFO, Daniel Hanbridge, was departing. At that point, the company was facing material headwinds and staff turnover at such times is a sign that the trouble may be material. Less than a year later, in May of 2021, the company witnessed another high-level exit: this time the executive chairman and director of the board, William Sweedler, stepped down. Whatever efforts were being made to get the company back on track were likely being questioned by the board of directors. Such turbulence at the highest seniority levels of a company is a major warning sign.

4. Don't Ignore Accounting Issues

In December of 2020, the SEC questioned the company's accounting of goodwill, a move that would inflate operating income. Then, in March of 2021, the company announced that it would be delaying its annual 10-K report. Taken together with the departure of Hanbridge in September of 2020, it would be understandable if counterparties wondered whether the financial statements provided by the company could be relied upon. Such a concern would suggest that risk was even greater than may have been feared based on other traditional risk metrics, like payment history, which remained prompt all the way up to the company's bankruptcy filing.

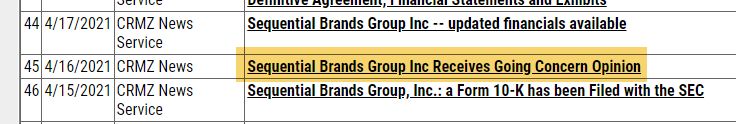

5. Going, Going, Going Concern

When Sequential Brands Group finally provided its annual 10-K, it included a going concern notice. This is an important warning that should never be overlooked. The going concern disclosure says that either management or the auditors, which have an inside view of the company's books, believed the company may not have the wherewithal to avoid a financial restructuring. Companies that must report such warnings don't always end up declaring bankruptcy, but it is a major red flag when they do. If such a warning coincides with other red flags, like a weak FRISK® score, turnover in the leadership, and potential accounting issues, it takes on even more importance.

Bottom Line

The bankruptcy of Sequential Brands Group would not have taken attentive CreditRiskMonitor subscribers by surprise: they were provided ample warning of the increasing risks led by the FRISK® score, and many red flags via email alerts in the year leading up to Chapter 11. With this broad backdrop, we encourage you to review Sequential Brands Group's bankruptcy case study to see the finer details of this company's descent into court protection.

Want to learn more? Contact CreditRiskMonitor today to see how you can pinpoint risks like this throughout the rest of your portfolio before you’re impacted.