CreditRiskMonitor recently published a High Risk Report on distressed movie theater chain Cineworld Group plc. If you work with this company in any capacity, this detailed report will provide a holistic financial evaluation. Before diving in, we are offering five quick and important facts that you need to know about Cineworld Group plc right now to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.

1. The Hunt for Red FRISK® Scoring

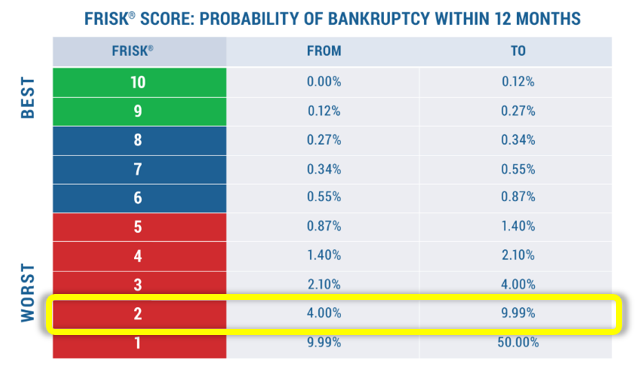

Cineworld Group's FRISK® score is "2", which is the next-to-the-lowest rung on the "1" (highest risk)-to-"10" (lowest risk) bankruptcy scale. A mark of "5" or lower falls into the FRISK® score "red zone," indicating that financial counterparties should be paying close attention. The company's score has been stuck in this dangerous territory for more than a year; today, the number indicates that the probability of bankruptcy is up to 10x greater than that of the average public company:

The FRISK® score, which incorporates financial statement ratios, stock market performance, bond agency ratings from Moody’s, Fitch, and DBRS Morningstar, and the researched click pattern behavior of our subscriber base, captures 96% of all publicly traded companies that eventually go bankrupt. By combining these four factors, the FRISK® score provides the most accurate bankruptcy risk evaluation in the marketplace, one that is consistently superior to what can be provided by any singular data source, such as financial statements or trade payments. Notably, Cineworld Group plc is paying its bills in a timely manner, which obscures the underlying financial risks faced by those who rely upon payment-based risk analysis, e.g. similar to Dun & Bradstreet’s PAYDEX® score.

2. Movie Theater Attendance Slowly Improving

The biggest issue for Cineworld Group relates back to the start of the coronavirus pandemic, which caused movie theater attendance to plummet in early 2020. In the following two years, movie chains have reopened their locations in a slow and staccato manner. Cineworld Group reported in Aug. 2021 that virtually all its theaters had at that point reopened. While that's generally good news, an open movie theater doesn't guarantee traffic. According to industry watcher Comscore, 2021's box office was a massive 60% lower than 2019 figures. Sure, the tally was up just over 100% from 2020, but that highlights the core issue for Cineworld Group and its peers: with the advent and growth of streaming services that are no longer blacked out from access to Hollywood’s latest offerings, there’s never been more incentive for film buffs to stay home for their entertainment.

Also of note, 67.6% of Cineworld Group’s consolidated revenue was derived from the United States, a nation whose local and state ordinances determine the scale of re-openings. With COVID-19 and the Omicron variant still present, bolstering admissions is likely to remain challenging for the foreseeable future, especially in other countries that have stronger national government decrees on lockdowns.

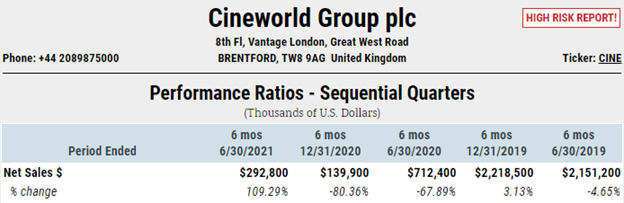

3. Depressed Revenue, Lacking Interest Coverage

Given that backdrop, Cineworld Group's revenues collapsed and remain soft. In the back half of 2019, the company's theaters brought in over $2.2 billion in revenue. In the first half of 2021, that figure had fallen to just under $293 million. While it is likely that the company will see improvement in the second half of 2021, the Omicron variant suggests that this recovery trend could remain capped.

With the sharp drop in revenue, meanwhile, Cineworld Group has been failing to cover net interest expenses and is bleeding red ink. While rising attendance levels will likely lead to improved financial results, it doesn't mean that the company will adequately cover the carrying costs of its debt load.

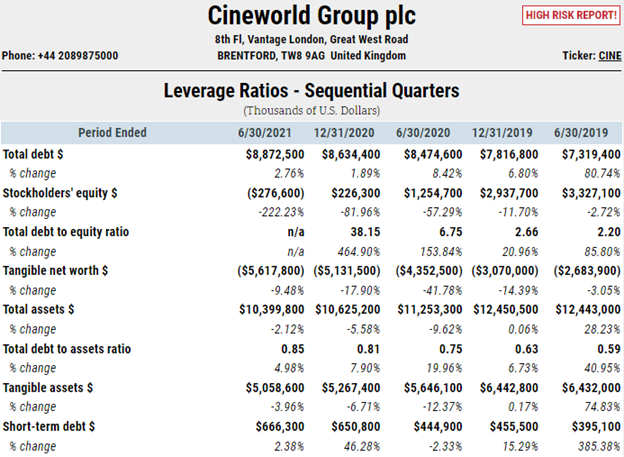

4. Rising Long-term and Short-term Debt

The debt issue is notable because Cineworld Group, like many companies, was forced to lean heavily on its balance sheet during the pandemic. Between the end of 2019 and the second quarter of 2021, it added roughly $1 billion worth of debt. It was simultaneously dealing with ongoing losses, which pushed shareholder equity into negative territory. The total debt to assets ratio has increased to a troubling 85%, up from 63% at the end of the fiscal year ending 2019.

Adding to the worry here, short-term debt increased from roughly $456 million prior to the pandemic to $666 million in the fiscal period ending June 30, 2021. That's just over a 45% increase. The fact that central banks in key markets around the world are either raising interest rates or indicating that they will imminently, complicates the issue further. Some of this short-term debt stems from a senior unsecured revolving credit facility, which has a contract that carries an adjustable rate using LIBOR. Rising rates combined with tight liquidity could spell trouble.

5. Weak Liquidity and a Court Loss

So far, the problems here have been largely related to the pandemic. But they set up what could be the biggest problem Cineworld Group faces, the scuttled acquisition of Canada's theater chain, Cineplex. There was good reason for that move, given the pandemic, but this perhaps avoidable decision has presented a major headwind. At the end of June 2021, Cineworld Group had $436.5 million in cash and cash equivalents and negative working capital of $214.2 million adjusting for short-term leases, fair value of warrants, and deferred revenue. That in and of itself is troubling.

Yet the failed acquisition attempt ended up being litigated. In late 2021, the company lost a case surrounding the deal and was ordered to pay $968 million in damages. That's more than double the company’s available cash and with an already heavily leveraged balance sheet, including notable amounts of short-term debt, there's a real risk that Cineworld Group will have trouble coming up with the needed funds. It is still fighting the case in court, but some form of payout seems likely.

Bottom Line

Cineworld Group PLC has so far managed to muddle through an incredibly challenging period. Its efforts to survive have left the company materially leveraged and still waiting for the movie business to rebound. Add in the recently lost lawsuit and the stakes get even higher. All of that said, CreditRiskMonitor subscribers have been closely monitoring this situation for some time, thanks to the timely warning provided by the FRISK® score. If you would like to see how this tool, and the many others contained within the CreditRiskMonitor service, can help you monitor and avoid major portfolio risks, contact us now and we'll provide you with a free demonstration.