Contract margins are depressed in the energy services industry in 2019 because exploration and production (E&P) companies – key customers – are pulling back. Financially troubled companies commonly make business extreme decisions under duress, like reducing spending and closing operations.

Today is the day for you to take action to reduce your exposure if indeed you are working with debt-laden oil & gas services providers. With a global debt problem growing in this benign credit cycle, you cannot afford to wait. Having seen hundreds of corporate bankruptcies happen in recent years – ones that everyone thinks that they see coming because they are looking at perhaps trade payment data – it’s not a stretch to say that you’re risking your company’s financial future if you hold dear to the canard that there’s no risk in public companies.

A Volatile Business

Volatile oil prices, still well off mid-2014 highs, are a huge problem for energy services companies: they are not directly reliant on oil prices, yet they work for companies that are. With oil prices hovering not far above the break-even point for many E&P names, drillers are pulling back on spending.

Basic Energy Services Inc. and Key Energy Services Inc. restructured in 2016, following the drop in servicing demand after the oil price decline that occurred between 2014 and 2015. Both have emerged from bankruptcy and oil prices have stabilized, yet contract margins are structurally staying lower. These companies are facing financial trouble again.

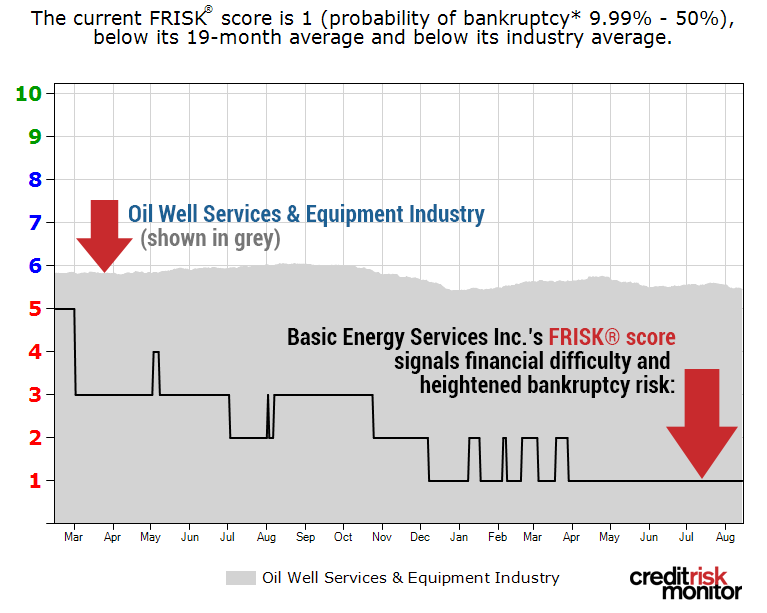

CreditRiskMonitor’s proprietary FRISK® score provides our subscribers an advanced warning system for public company financial distress, predicting bankruptcy risk 12 months out. Since the FRISK® score leverages the information provided by four key metrics – stock market capitalization and volatility, financial ratios, bond agency ratings and crowdsourced CreditRiskMonitor subscriber usage data – it is able to identify that public company risk with 96% accuracy.

What elevates the CreditRiskMonitor service is the blend of these factors, reaching a higher plane of analytical understanding. It’s one thing to have the data at hand. It’s another to harness the learnings from each of these metrics, synthesizing those findings into an easy-to-understand format and adding in crowdsourcing data when available. This methodology is what makes the FRISK® score an invaluable solution for risk professionals.

Basic Energy's FRISK® score has fallen from a "5" in early 2018 to a "1." Key Energy also declined, falling from "3" to a "1." Both are now in the highest risk category of the "10" (least risk)-to-"1" (highest risk) FRISK® score scale.

Neither are profitable, both are burning cash and leverage has increased materially since 2016. CreditRiskMonitor subscribers monitoring the FRISK® score have enjoyed ample warning about the two companies – with the FRISK® score updated each day – about their developing issues.

More Pain to Come

Companies in financial distress often make financially difficult decisions before they have to declare bankruptcy. Calgary-based New West Energy Services Inc. has seen its FRISK® score drop from a "3" to a "2" over the course of the past year, demonstrating increasing short-term bankruptcy risk. Net income has been negative for five years and cash flow has been negative for three years. The total debt to assets ratio has risen from 38% in calendar year 2016 to 83% at the end of the first quarter of 2019, with short-term debt a troubling 56% of total debt.

New West sold a 27% stake in its business to one of its lenders. It took out loans from its lead director. In addition, it recently shut down operations in the Grand Prairie region in Alberta to cut costs.

Bottom Line

Bankruptcy is a process that unfolds over time and corporate actions, such as a decrease in investment and operational shutdowns, leading up to a bankruptcy can prove problematic. The FRISK® score gives our subscribers advanced warning of trouble well before other credit and procurement risk evaluators in energy are blindsided by a bankruptcy restructuring or liquidation.

If you work in the volatile oil & gas industry, not a single day should go by where you do not have a read on corporate credit risk. It could save your company millions in the long run.