Economic reopening and depressed worldwide rig counts have led energy prices to rebound. Yet this recovery hasn't resulted in an equal improvement throughout the energy patch. As oil and gas emerges as a sector, take heed of the CreditRiskMonitor FRISK® score; quick and quantitative, the FRISK® score pinpoints where energy is actually improving globally and where there's still trouble that needs to be monitored.

Monitor Industry Risk in Real-Time

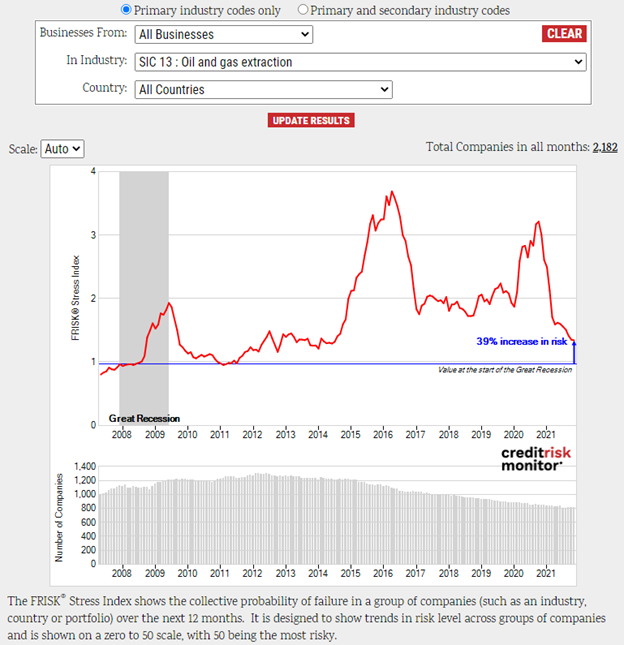

Related to the FRISK® score, our FRISK® Stress Index provides a composite view of the bankruptcy risk in industries, countries, or other groupings, such as a specific subscriber’s portfolio or custom folder. The tool effectively pulls together the 96%-accurate FRISK® scores for a collection of companies and creates a risk trend for the group – and what’s more, the data extends back nearly 15 years to the start of the Great Recession. This allows broader risk trends to be quickly visualized to show whether risk is generally increasing or decreasing.

The above FRISK® Stress Index for the global Oil and Gas Extraction Industry (SIC 13) shows that risk spiked sharply in early 2020, hit a high-water mark near the end of the year, and has fallen throughout 2021. This trend was correlated with the pricing dynamics in the oil and natural gas market, which were terrible in 2020 at the outset of the COVID-19 pandemic and drastically improved in 2021. The aggregate risk level is nearly back to where it was at the start of the Great Recession.

However, this top-most view of the situation only tells half of the story. Of the 2,182 public companies included in SIC 13, most fall into subcodes (SIC 131), Crude Petroleum and Natural Gas, and (SIC 138), Oil and Gas Field Services. Effectively, these two groups are exploration and production and energy services companies:

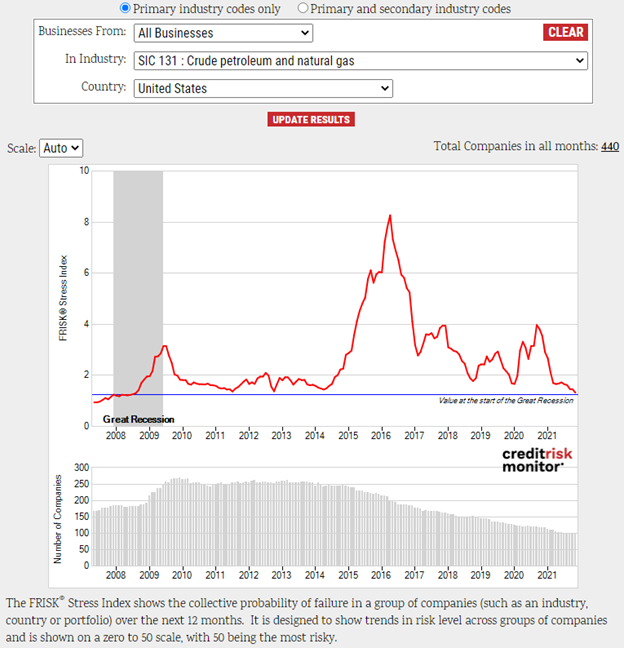

Delving into the U.S. exploration and production group shows that the aggregate bankruptcy risk in (SIC 131) has reverted to levels seen prior to the Global Recession. There are still individual names that are financially distressed, like W&T Offshore. This Houston-based firm has a worst-possible FRISK® score of "1," representing a bankruptcy risk that is 10-to-50% higher than that of the average publicly traded company over the next 12 months. The sector itself, however, has broadly returned to normal with oil and gas prices rejuvenating upstream profitability.

Better… Yet Still Struggling

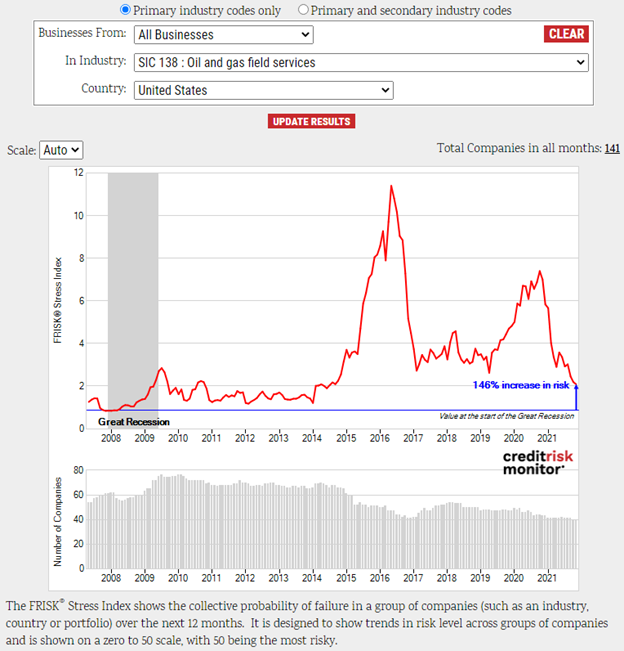

The same level of improvement in drilling hasn't run parallel within (SIC 138) Oil and Gas Field Services, as shown in the graph below:

Aggregate risk in this sector has improved compared to 2020 but remains 146% above where it was prior to the Great Recession. For context: the surge in risk correlates with oil prices collapsing in 2016, causing a slowdown in U.S. drilling activity. Things are not back to normal, largely because oil and gas drillers haven't materially increased their E&P spending, which drives the top and bottom lines for servicers.

In the table below, we spotlight two heavy-hitter service companies – Basic Energy Services, Inc. and Seadrill Limited – that filed for bankruptcy in 2021, as well as four operators that are on our radar as financially distressed:

| Company Name | Report Type | Publish Date |

| Basic Energy Services, Inc. | Bankruptcy Case Study | Aug. 17 |

| KLX Energy Services Holdings, Inc. | High Risk Report | July 21 |

| Nabors Industries Limited | High Risk Report | July 13 |

| Nine Energy Service, Inc. | High Risk Report | June 29 |

| Seadrill Limited | Bankruptcy Case Study | Feb. 10 |

| PGS ASA | High Risk Report | Jan. 18 |

As the table above illustrates, in (SIC 138), there are a host of companies that have been struggling or, worse, that have fallen into bankruptcy. Some of the highest risk names in the group today include KLX Energy Services Holdings, Inc. and Nine Energy Service, Inc., which both have bottom-of-the-barrel (no pun intended) FRISK® scores. While the Oil and Gas Field Services sector's biggest names have top-notch FRISK® scores, including Halliburton Company and Schlumberger NV at "10", there remain many risky operators that counterparties need to monitor regularly. As we approach 2022, to note, there's no sign that drillers are set to materially increase their spending.

Bottom Line

The improvement seen in energy prices has translated to a notable reduction of risk in the broader Oil and Gas Extraction space. But the FRISK® Stress Index and individual company FRISK® scores illustrate a different picture when looking into the groups that make up (SIC 13). Yes, oil drillers (SIC 131) are benefiting from improved energy prices, but they aren't materially increasing their spending and that's left energy services companies (SIC 138) facing ongoing weakness. Contact CreditRiskMonitor today to see how we can help you dig into the details of the risks you face, even when it may appear that risk is receding.