CreditRiskMonitor’s integration of subscriber crowdsourcing into the FRISK® score continues to prove itself as a unique enhancement, unavailable in any other bankruptcy prediction model. Subscribers have effectively gained access to a proprietary global "Virtual Credit Group" that identifies highly distressed public companies in a more accurate and timely fashion. Recently, the Virtual Credit Group highlighted the elevated risk of coal miners Peabody Energy Corporation and Alpha Metallurgical Resources Inc. Here we walk through what these in-the-know risk professionals are concerned about.

The Subscriber Crowdsourcing Advantage

Risk professionals confidentially share information with each other and are outside of SEC Fair Disclosure regulations granting them access to counterparty executives and non-public information. This information helps to inform the choices risk professionals make when dealing with their business counterparties. CreditRiskMonitor assesses these subscriber interactions by objectively tracking their aggregate research patterns. With nearly two decades of accumulated data, big data analytics and artificial intelligence modeling were applied to determine exactly which research patterns indicate heightened concern and bankruptcy risk. While this information predicts bankruptcy in its own right, these signals have been rolled into the 96%-accurate FRISK® score to enhance timeliness and accuracy.

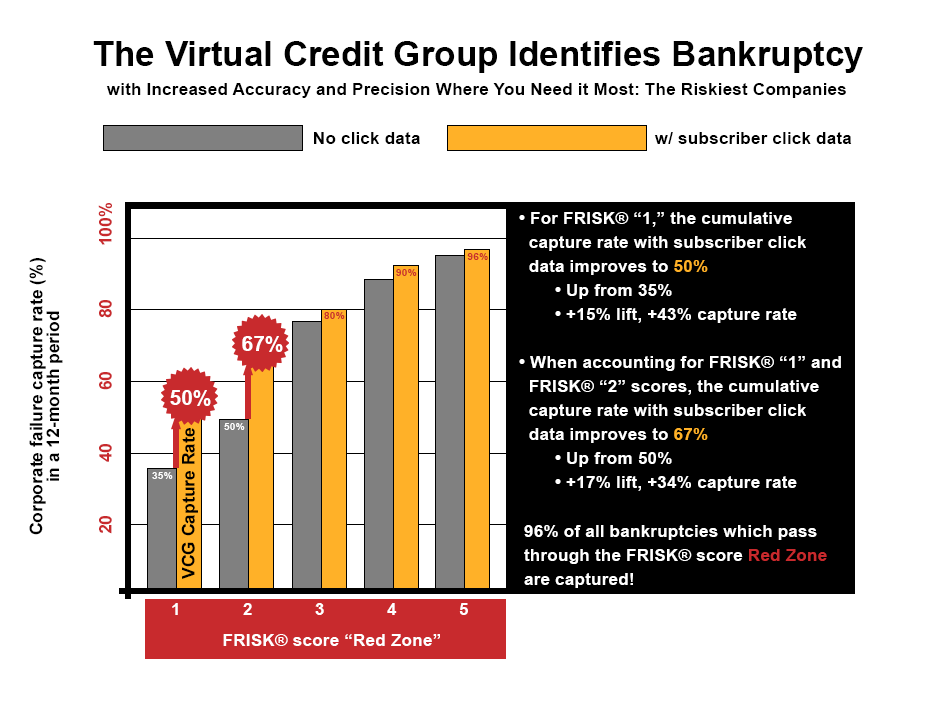

After integrating subscriber crowdsourcing along with the other components of the score (financial statement ratios, stock market performance, and bond agency ratings), the model categorized risk cohorts more precisely. The proportion of bankruptcies captured by the lowest FRISK® score groups of "1" and "2" increased to 50% and 67%, respectively, as shown in the chart below. Said another way, subscriber crowdsourcing provides a direct line into what senior risk professionals are concerned about in real-time.

This delta provided by subscriber crowdsourcing allows risk evaluators to make better business decisions when it matters most, e.g. in the final quarters before a broader debt restructuring or bankruptcy filing.

Crowdsourcing on Coal Miners

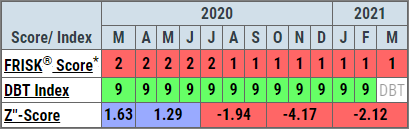

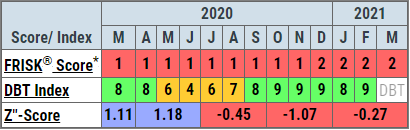

Basically, as concern about a company increases, subscribers will often perform additional research, including conducting further analysis, discussing with their peers, and potentially taking action for risk mitigation. In recent quarters, subscriber crowdsourcing has picked up and incorporated this type of activity from subscriber research patterns, indicating concern for Peabody Energy Corporation and Alpha Metallurgical Resources, which carry scores of “1” and “2”, respectively. When the AI-driven FRISK® score provides a score of "5" or lower, or what we call the high-risk "red zone," further research on the company is required. If you aren't looking at these coal miners, you need to do so today.

Both companies have made prompt payments on their invoices, which CreditRiskMonitor tracks with the DBT Index, quite like Dun & Bradstreet's PAYDEX® score. However, the FRISK® score indicates that Peabody and Alpha continue to struggle both on operating performance and are dealing with highly leveraged balance sheets.

Subscribers also examine a financially distressed company's quarterly Management Discussion & Analysis (MD&A) report for indications of financial stress, particularly related to any refinancing or restructuring transactions. In the case of these two coal miners, the disclosures underpin the need for close monitoring. While lenders have been working with Peabody so far, the company’s MD&A stated:

“Experienced negative cash flows from operations during the year ended December 31, 2020. Results from continuing operations, net of income taxes and Adjusted EBITDA for the year ended December 31, 2020 declined by $1,671.5 million and $624.2 million, respectively...The New Co-Issuer Term Loans mature on December 31, 2024 and bear interest at a rate of 10.00% per annum.”

Weak performance and restructured term loans leave the miner in a vulnerable position. A 10% interest rate is extremely high given that market yields remain near historically low levels. If earnings and cash flow fail to improve, its financing arrangements may need to be revisited once again.

Alpha is in a marginally better position, as the FRISK® score indicates, but not by much. Alpha’s financial leverage is modestly lower, yet it is still burning through cash. The company described the following actions in its MD&A:

“At December 31, 2020, we had cash and cash equivalents of $139.2 million and no remaining unused capacity under the Amended and Restated Asset-Based Revolving Credit Agreement (the “ABL Facility”)…We were required to post $25.0 million of cash collateral in January 2021 to remain in compliance with the terms of the ABL Facility as of December 31, 2020.”

Alpha was subsequently able to reduce the collateral needed to remain in compliance thanks to price improvements in the coal market, but compliance still needs to be monitored closely. Alpha’s concerned subscriber crowdsourcing patterns have wavered over the last year, so at least relative to Peabody, this scenario is less worrisome.

The Bottom Line

The coal mining industry continues to struggle with various regulatory and financing constraints, and risk professionals are scrutinizing these two operators intensely. Subscriber crowdsourcing helps professionals gauge the risk that is not captured by other sources of public information, like financial statements or stock market performance, which provides an incremental edge to analytical review processes. The importance of this is hard to understate given that 25-30% of public company credit financing derives from trade payables, which can quickly be reduced if credit professionals grow concerned enough. This is why subscriber crowdsourcing is such a powerful tool. With more timely and accurate warning signals, your company will make better business decisions. Want to learn more? Contact CreditRiskMonitor to see how crowdsourcing patterns will help evaluate the financial risk of your counterparties.