Restaurants continue to struggle globally, particularly the casual dining segment, as they look to comply with social distancing mandates. Many consumers remain wary of COVID-19, putting downward pressure on demand. Restaurants continue to be constrained to smaller dine-in capacities (25-50% of occupancy), while growth in take-out and delivery channels have only provided a modest offset for that lost revenue due to the steep percentage (often up to 30%) taken by delivery platforms like UberEats and GrubHub, in an already very thin margin industry.

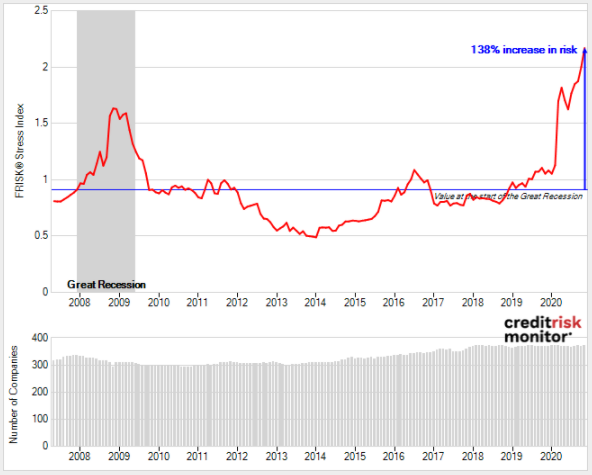

Restaurant FRISK® Stress Index

Across 350 restaurants globally, aggregated financial risk has increased by a staggering 138% relative to its 2007 year-end (pre-Global Financial Crisis) level.

The coronavirus pandemic has been significantly more detrimental to the restaurant industry compared to the 2008-2009 Great Recession. During the last economic downturn, nearly 130 restaurants were trending in the high-risk “red zone” worldwide. The coronavirus pandemic has pushed 220 restaurants into the red zone, or a 70% increase compared to the peak of the previous downturn.

Growing Bankruptcy Tally

According to FRED® Economic data, restaurant sales have rebounded in recent months yet remain 12% beneath the peak of 2019. In Q1 and Q2 of 2020, the average restaurant reported net profit margins of -1.8% and -11.4%, respectively. Looking forward, Q3 results for restaurants are expected to continue with more net losses.

One casual dining leader, Blooming Brands (owner of Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, and Fleming’s Prime Steakhouse) reported Q3 2020 revenue of $771.3 million, or a 20% decline and its net profit margin remained firmly in the red at -2.3% compared to the same period last year. For context, Blooming Brands has already established in-house delivery programs across all of its restaurants, so any casual dining chains that do not have such partnerships established will be dealing with relatively higher financial stress.

Between Q3 and Q4, several large restaurant chains have filed for bankruptcy including:

- NPC Restaurant Holdings, LLC, a franchise of Pizza Hut and Wendy’s, filed on July 1

- California Pizza Kitchen, Inc., owned by Golden Gate Capital, filed on July 29

- Ruby Tuesday, Inc., owned by NRD Capital Management, filed on Oct. 7

- Rubio’s Restaurant Inc., a Mexican food chain, filed on Oct. 26

According to the FRISK® score, several other large public company restaurants carry an elevated probability of bankruptcy heading in 2021.

| Company | FRISK® score | Probability of Bankruptcy |

| Red Robin Gourmet Burgers, Inc. | 2 | 4-10x more likely |

| Dave & Buster’s Entertainment, Inc. | 3 | 2-4x more likely |

| Good Times Restaurants, Inc. | 3 | 2-4x more likely |

Restaurants Amend & Extend

Certain restaurants have sought out covenant amendments to avoid defaulting on their credit agreements. Red Robin Gourmet Burgers ranked in the bottom 10% of restaurant industry peers with a FRISK® score of “2.” According to the company’s Management Discussion and Analysis (MD&A) report, the covenants subsection disclosed noncompliance during Q1 due to the adverse impact from the coronavirus outbreak:

“...we entered into the Amendment to our Credit Facility, which waives compliance with the lease-adjusted leverage ratio financial covenant ("LALR ratio") and fixed charge coverage ratio financial covenant ("FCC ratio") for the remainder of fiscal 2020 and allows adjustments during the first three fiscal quarters of 2021 to the LALR ratio…”

By Q2, total debt relative to tangible net worth increased from 0.80x to 1.68x, more than doubling due to goodwill and asset impairment charges on top of its actual operating losses. Looking back at the last four quarters, its free cash flow burn swelled to $50 million compared to free cash flow of $76 million prior to the pandemic. In order to satisfy covenant relief requirements, the company had to raise equity capital on June 17. While management was able to relieve its going concern opinion, the company remains financially stressed with several leverage and liquidity ratios trending in the bottom quartile of its restaurant industry peers. Given that financial losses for the broader industry may continue for the remainder of 2020 and potentially into 2021, Red Robin could require additional waivers from its creditors.

Bottom Line

With the restaurant FRISK® Stress Index trending at an all-time high and bankruptcy filings piling up during Q3 and Q4 of 2020, CreditRiskMonitor expects those unsecured ( trade ) creditors will continue bearing immense financial pain. Some of the largest U.S. restaurant chains continue to struggle and are primarily subject to the mercy of their secured lenders. If the coronavirus pandemic continues to linger longer than most anticipate, losses for suppliers in the restaurant industry may only be just beginning. Contact CreditRiskMonitor today to see how your company can stay ahead of this calamity.