To make a prediction that Bed Bath & Beyond would go bankrupt heading into 2023 was not exactly a controversial prognostication.

The true benefit of examining our recently published Bankruptcy Case Study on the New Jersey-based company’s descent is not just what can be gathered from news. Rather, it is observing all of the troubling trends in a condensed form as a company careens toward bankruptcy. And in the case of Bed Bath & Beyond, CreditRiskMonitor subscribers were hit with big, flashing warning signals in the form of our proprietary FRISK® score nearly one full year before the most distressing headlines hit the mainstream.

Here are some of the key themes of the report and some of the commonalities our subscribers find with past and future bankruptcy situations when properly leveraging the service.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

The FRISK® Score: Your Bankruptcy Fire Alarm

The path to bankruptcy is a process, not a single event. A freefall into Chapter 11 can take several quarters or even years; even though, toward the end, the pace of difficulty tends to pick up materially. Statistically, 96% of publicly traded companies that fail will enter and remain the FRISK® score "red zone" of the "1" (highest risk)-to-"10" (lowest risk) range at least three months before they tap out into bankruptcy protection. The FRISK® score provides the time needed to adjust for risk exposure and mitigate exposure as an unsecured creditor.

The FRISK® score’s superpowers are that:

- it provides a warning of bankruptcy risk when payment-based scores are rendered inefficient to use or effective. Even when public companies pay their bills on time, there may be a significant chance of financial distress and failure given their ability to issue securities within capital markets to source the funding needed to maintain timely payments and maintain access to low-cost trade credit, and

- the warning signals themselves are generated months – if not years – earlier than other popular risk metrics like the Altman Z’’-Score

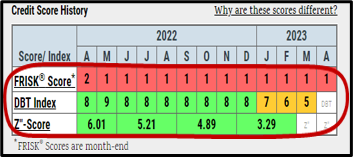

Bed Bath & Beyond's FRISK® score, for example, signaled elevated risk starting in January 2022. The Days Beyond Terms (DBT) Index, a payment-based model which is similar to Dun & Bradstreet's PAYDEX® score, and the financially derived Z’’-score did not provide much warning prior to bankruptcy.

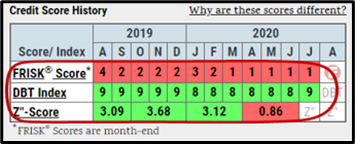

The DBT Index and Z"-Score demonstrated a similar pattern in the bankruptcy of industrial Briggs & Stratton Corporation:

This pattern can also be seen in the bankruptcies of Party City Holdco Inc., and Endo International plc. In all cases, the FRISK® score is highly accurate in identifying bankruptcy risk, usually around 12 months in advance of a filing, because it blends four high-quality data components, including:

- stock market performance

- credit agency ratings from Moody’s, Fitch, and DBRS Morningstar

- financial ratios, and

- CreditRiskMonitor® subscriber click sentiment data (crowdsourcing)

Risk scores that only use one factor or ones with limited efficacy have failed risk professionals time and time again.

Looking at the Numbers

Once the FRISK® score has alerted risk professionals, the next best step is reviewing a company’s financial statements. CreditRiskMonitor's news service pushes a company's quarterly SEC filings to subscribers via email alerts, highlighting the most important news when there is trouble brewing. There are clear patterns here with Bed Bath & Beyond.

On the income statement, Bed Bath & Beyond’s sales started to weaken more than a year before its bankruptcy filing. The bottom line was filled with red ink quarter after quarter. Weak interest coverage is another common theme that was on display.

These same trends show up repeatedly, including at:

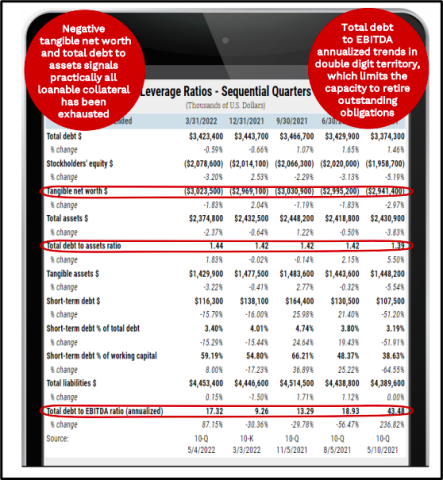

Troubling balance sheet trends are also frequent, with a substantial debt load (particularly a swift increase in short-term debt as a percentage of total debt), increasing leverage metrics, declining shareholder equity, and a falling tangible net worth all on display time and time again. Bed Bath & Beyond, while high profile, was not the only case where these warning signs showed up.

Other examples include:

Three of the biggest red flags on a company's cash flow statement are not generating cash from operating activities, increased reliance on issuing debt to support cash flow needs, and negative free cash flow. Armstrong Flooring, Inc. showed many of the same trends as Bed Bath & Beyond as it stumbled toward bankruptcy.

Leadership Upheaval

It is common for a company to see changes in its top-level management and/or board of directors. Yet such shifts take on greater importance when they happen in financially troubled companies. CreditRiskMonitor alerts subscribers as leadership changes are reported to the SEC.

Bed Bath & Beyond had an incredible amount of high-level turnover, including at the board level (which included changes related to demands from a dissident shareholder) and in the C-suite, including the CEO, the CFO, and various other executive-level employees. Changes of this nature can be a sign that employees are trying to get leave a sinking ship and/or that the company's attempt to correct course just aren't working and even more dramatic moves are needed. Either way, if you are dealing with a financially troubled company and you see a raft of high-level departures you should start to worry.

But, as with the points above, Bed Bath & Beyond is hardly unique. McColl's Retail had two key leaders leave even as it was trying to work with lenders to stave off bankruptcy. Companies where such changes wouldn't make it to news headlines see the same thing happen, like:

A simplified way to stay on top of important employee and board changes is to view the Officers and Directors report page and closely monitor corporate news releases, information that CreditRiskMonitor regularly updates for subscribers.

Strategic Alternatives

Another disturbing pattern among financially troubled companies is taking desperate steps to stave off bankruptcy and/or seeking out advisors that are experts in the bankruptcy process. Near the end Bed Bath & Beyond made a high-profile financing deal with a hedge fund that, in the end, didn't help the company very much. Earlier it worked with lenders to amend credit terms to give it more financial breathing room. And, at one point, it was rumored to be holding off on paying for its inventory, a step that further soured its relationship with its vital group of suppliers.

However, such actions are common among financially weak companies that are inching their way toward bankruptcy. For example, Grupo Posadas SAB de CV, in a last-ditch effort to avoid bankruptcy, worked with lenders to extend near-term debt maturities. It didn't work and the company landed in bankruptcy court a few months later. Seadrill Limited hired debt restructuring specialists before its bankruptcy, which occurred just a few months after a debt forbearance agreement with various creditors expired. Finally, Mallinckrodt plc, hobbled by opioid settlement costs, sold a business division in an attempt to raise cash and avoid its eventual bankruptcy. More recently, Vice Media LLC raised $135 million from existing investors after its SPAC plans failed and looked to sell its studio business before filing bankruptcy. When financially troubled companies start taking drastic steps like these, bankruptcy often follows.

Bottom Line

There's no single path toward bankruptcy that every company follows, but there are clear signs that every company displays along the way. Bed Bath & Beyond was certainly in trouble and the list of worrying performance trends, management decisions, and business/employee changes is particularly long in this case. Which is why it is so instructive to examine this one company's bankruptcy. But the real story is that what you see here has happened before, time and time again, to other companies that were destined for the same fate.

Contact CreditRiskMonitor today to see how we can help you identify the biggest risks in your portfolio well before they seek out court protections.