No more kicks of the can down the road?

The U.S. Federal Reserve is telegraphing at least three interest rate hikes in 2022, with some market watchers predicting even more. The Bank of England has already started increasing base interest rates and may hike again as early as February. Some companies will handle monetary tightening in stride, but not all. As rates rise, companies with high proportions of short-term debt are vulnerable, as they will face higher borrowing costs when they look to refinance loans and issue new debt with longer maturities.

Riskiest Operators

For example, Blue Dolphin Energy Company, on which we recently published a High Risk Report, has short-term debt that accounts for a massive 98% of its total indebtedness. The company’s problems are much deeper than rising interest rates. In fact, the high percentage of short-term debt is related to credit defaults, which accelerated its maturities. The refiner has been posting net losses and weak free cash flow, so such defaults were increasingly likely. It has even been forced to cut its capital spending to the bone to preserve as much cash as possible. Blue Dolphin Energy also issued a going concern warning at the end of Q1 2021.

The company had its work cut out for it when rates were at historic lows. The problem, however, becomes more difficult as rates rise, which translates to higher costs for Blue Dolphin Energy even if it manages to work with lenders on an agreement to avoid bankruptcy. If rates move far enough, lenders could very well decide that pushing the refiner into bankruptcy is a superior option to working outside of court protection.

Higher base interest rates pressure all financially weak companies, but those with large short-term debts must be monitored carefully. We have identified 14 U.S. companies and five U.K. companies that we believe financial counterparties should be watching closely because of a mixture of financial weakness, denoted by a low FRISK® score, and a high percentage of current debt to total debt.

Company | FRISK® Score | Current Debt to Total Debt | |

United States | Eros Stx Global Corporation | 1 | 26.1% |

Tupperware Brands Corporation | 2 | 75.5% | |

Armstrong Flooring, Inc. | 2 | 98.8% | |

Power Solutions International, Inc. | 2 | 99.6% | |

TPI Composites, Inc. | 2 | 96% | |

Blue Dolphin Energy Company | 2 | 98.6% | |

China XD Plastics Company Ltd. | 2 | 46.9% | |

Ucommune International Ltd. | 2 | 97.6% | |

Quad/Graphics, Inc. | 3 | 31.6% | |

Groupon, Inc. | 3 | 31% | |

Green Dot Corporation | 3 | 100% | |

Twinlab Consolidated Holdings, Inc. | 3 | 99.6% | |

Frontier Group Holdings, Inc. | 3 | 23.3% | |

Global Ports Holding plc | 3 | 53.8% | |

United Kingdom | Capita plc | 3 | 42.7% |

John Wood Group plc | 3 | 35.5% | |

SSP Group plc | 3 | 26.8% | |

Ferroglobe plc | 3 | 22.4% | |

James Fisher & Sons plc | 3 | 21.9% | |

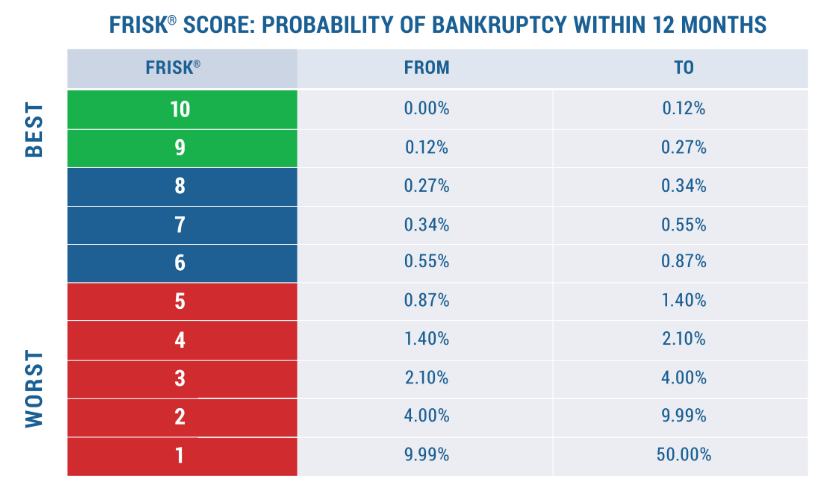

The 96%-accurate CreditRiskMonitor FRISK® score assesses bankruptcy risk, taking into consideration a company's financial statement ratios, stock market performance, and bond agency ratings from Moody’s, Fitch, and DBRS Morningstar. It also factors in the research click pattern behavior of our subscriber base, which represent key credit decision-makers at nearly 40% of current Fortune 1000 companies plus thousands of other large companies worldwide. A score of "5" or less on the "1" (highest risk)-to-"10" (lowest risk) scale indicates material bankruptcy risk that needs to be monitored with added scrutiny.

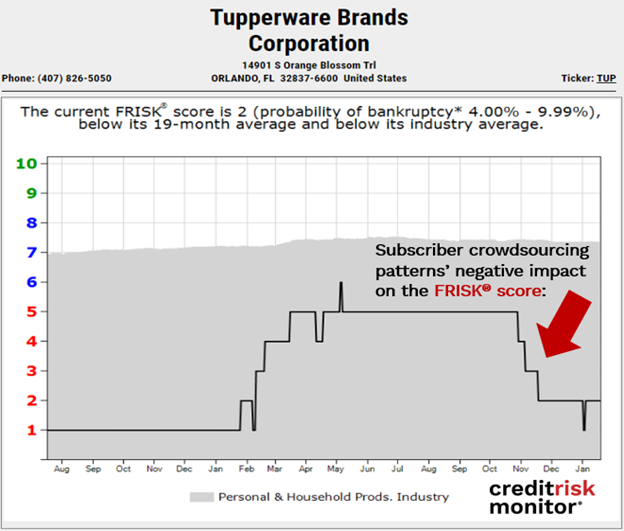

Subscriber Crowdsourcing Warning

Tupperware Brands Corporation is notable here. The company’s FRISK® score, which is currently at the next-to-the-worst-possible level of "2," is warning of elevated risk and short-term debt is a heady 75.5% of total debt. Presently, the proprietary crowdsourcing behavior of CreditRiskMonitor subscribers is indicating elevated concern among credit professionals. Essentially, those using the CreditRiskMonitor service to perform research on this company are exhibiting click patterns that have historically indicated elevated bankruptcy risk is present. Credit professionals also appear to be acting, as inventory financed by vendors has collapsed from a 50+% in recent years to only 38.5% as of Q3 2021, a credit negative. Q3 2021 revenues were down year-over-year, despite what should probably have been a relatively easy comparison to pandemic period results. Tupperware's earnings dipped into the red in the quarter and free cash flow has been weak over the last year. As rates rise and the company's refinancing costs increase, cash flow will be pressured further.

Not Enough Improvement

In the U.K., Ferroglobe plc is worthy of review. This silicon metals company's FRISK® score is in the red zone and its short-term debt is 22% of its total debt, which is only slightly less troubling than the situation at Tupperware. However, the company has lost money in four of the last five quarters while producing negative cash flow in three of those periods. Both metrics were deeply in the red in the third quarter. Total debt, meanwhile, has trended higher for more than a year while stockholder equity has declined, leading to a worryingly high debt to equity level of 1.9x, up from about 1x a year ago.

On Jan. 17, 2022, Moody’s Investors Service detailed the company’s developing credit situation:

"Ferroglobe's liquidity remains weak despite the materially improved debt maturity profile driven by the exchange of the March 2022 $350 million backed senior unsecured notes in 2021 with only around $5 million still outstanding. As of September 2021, the company reported unrestricted cash and cash equivalents of only $89 million. The company does not have a committed credit facility."

Moody's also noted that while Ferroglobe's business environment is improving and a debt exchange was beneficial, the company's liquidity position remained weak considering future cash consumption driven by several different factors. With short-term debt at 68% of working capital, liquidity risk remains elevated, and a cash crunch could be in the cards if performance weakens. Rising rates will complicate the effort to get back on a stronger financial footing and could push profitability even further out into the future. Moody's maintained its junk rating of “Caa”, which is indicative of substantial credit risk.

Bottom Line

Financial risk is rising, but you must know where to look. Some credit professionals argue that bankruptcy risk is modest today because there were few bankruptcies in 2021. However, that viewpoint ignores the steady rise in high-risk companies globally in recent months. CreditRiskMonitor subscribers seeking an edge dig into the details of financial counterparties daily to uncover looming risks. With interest rates on the rise, many companies will go from muddling through to facing extreme financial duress. Contact CreditRiskMonitor today and we'll help you see where the shift in the interest rate environment could quickly lead to headwinds in your portfolio.