If you are relying on payment history you will miss Rite Aid’s elevated risk of bankruptcy. In fact, Rite Aid's payment history is just as strong as competitor Walgreens Boots Alliance, even though the two are nowhere near equals financially. Here we compare the two retail pharmacy companies to show exactly what payment history misses. To stay ahead of bankruptcy, you should rely on CreditRiskMonitor's 96% accurate to reveal true risk.

The Cloaking Effect

CreditRiskMonitor's DBT Index tracks a company's historical payment trends, similar to Dun & Bradstreet's PAYDEX® score. The flaw with these metrics is that public companies often continue to pay on time right up until their bankruptcy filing, effectively hiding their financial stress.

Rite Aid actually looks similar to Walgreens on payment history, even though the two are nowhere close to being on equal footing financially in 2019. Back in 2012, Dun & Bradstreet’s whitepaper “Bankruptcy: Why the Surprise?” stated that credit professionals were shocked by how many of their public company customers were going bankrupt during the Great Recession. Payment scores were not signaling any risk of bankruptcy; the danger was there all along, hidden by what Dun & Bradstreet coined the “cloaking effect.” Dissecting this issue, they explained: “Some companies pay their credit obligations in a discount or prompt manner right up to the actual filing/closing date.” Sadly, little has changed as far as prevailing attitudes in the interim regarding the nuance in public and private company risk assessment.

Payment history is not merely an inadequate gauge for financial risk in public companies, but rather it conceals their poor financial condition. By consequence of bankruptcy, creditors were unable to collect their accounts receivables and took huge write-downs. CreditRiskMonitor has continually warned its subscribers about the risks posed by the cloaking effect – an important issue for public companies.

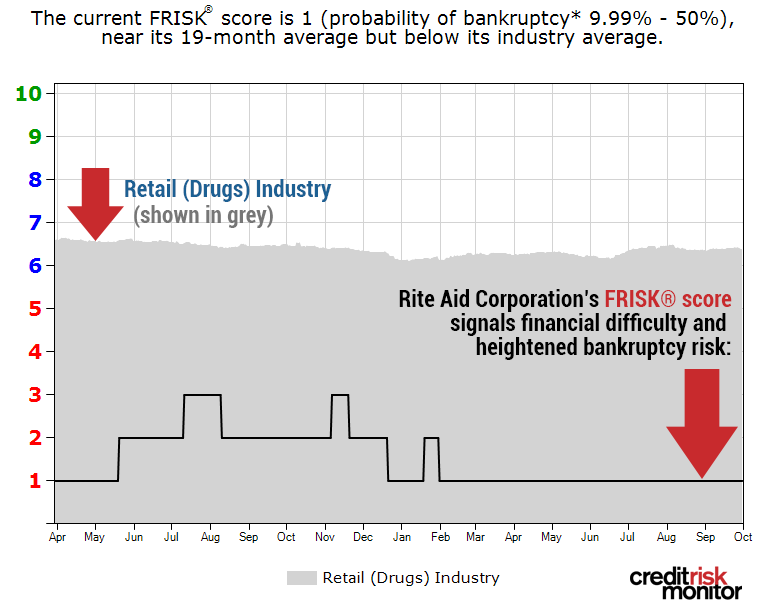

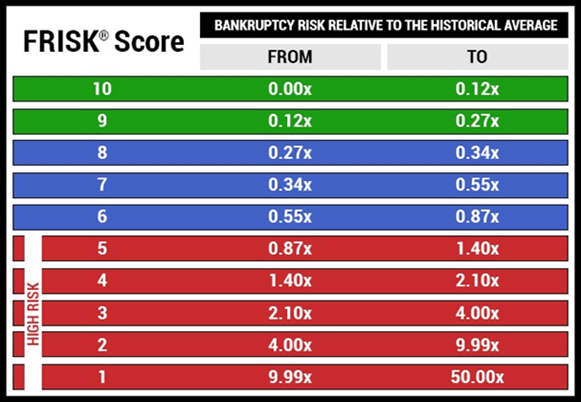

CreditRiskMonitor subscribers use the FRISK® score because it cuts right through the “cloaking effect.” The credit model, which doesn't rely on payment history, predicts public company bankruptcy with 96% accuracy. The FRISK® score is optimized for credit professionals, updated on a daily basis and formulated to assess bankruptcy risk within a 12-month window. Furthermore, it will provide at least three months of warning prior to the filing date.

There's no need to be surprised if you pay attention to the correct signals. Rite Aid has a worst-possible FRISK® score of "1," compared to Walgreens top-tier "9," highlighting the vastly different risk these two companies pose to counterparties.

A Simple Comparison

Rite Aid has lost money in each of the last five quarters with negative free cash flow in four of them. In comparison, Walgreens' net income has topped a billion dollars each quarter over that span. And free cash flow was positive in all but one period. Operationally Rite Aid is clearly struggling, which dovetails the restructuring efforts it is making – including selling stores to Walgreens a couple of years back.

Further, Rite Aid falls short from a debt coverage perspective. Rite Aid’s annualized debt-to-TTM EBITDA ratio is about 9x compared to Walgreens' more reasonable 2.3x. Walgreens covers its interest expenses by more than 8x, while Rite Aid's coverage is a far more troubling 1.5x.

Rite Aid's payment history misses all of this vital information. The FRISK® score, however, incorporates data like this and more, in one easy to use metric so you don't get blindsided.

The Smart Solution

Put your precious time to better use by focusing strictly upon the companies that pose the greatest risk. The FRISK® score allows you to do just that, so you are almost never surprised and can adjust before bankruptcy becomes reality. Payment-based scores have proven they can't match the timeliness, let alone the precision, of the FRISK® score. If you are still using payment data, it's time to call CreditRiskMonitor at 845.230.3000 or contact us here. We can help you sidestep real danger.