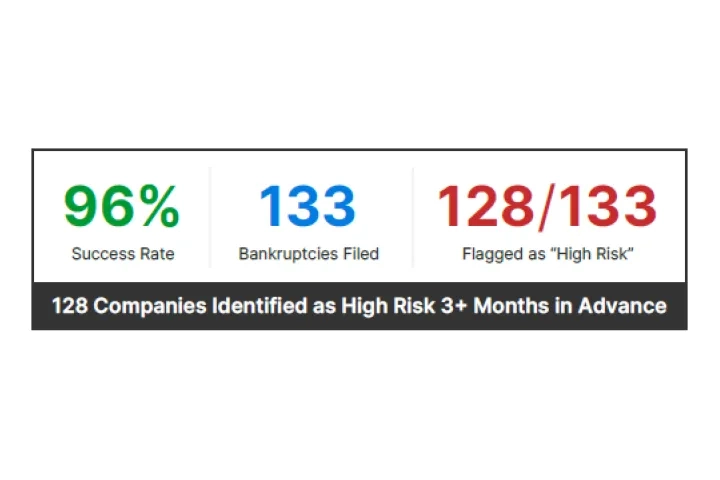

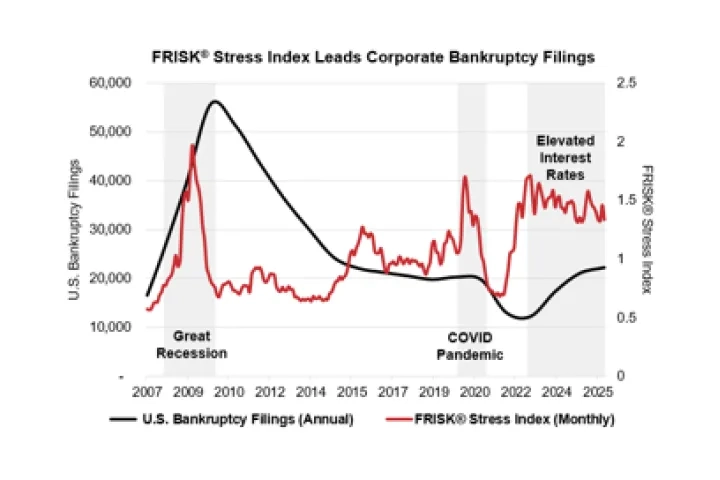

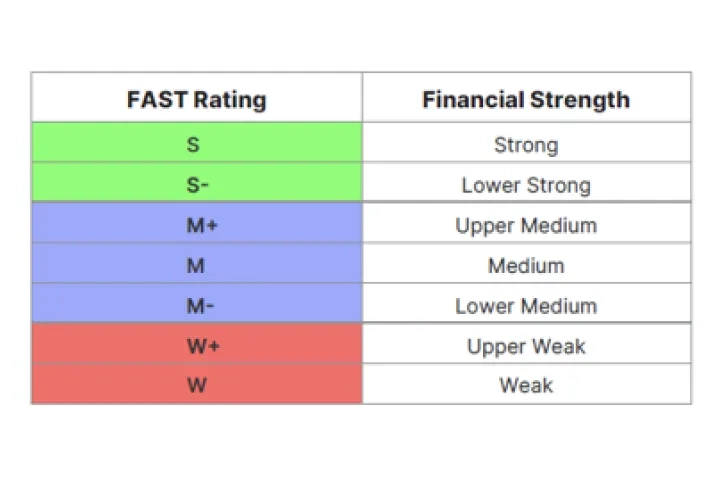

Modern supply chains are more complex than ever and more fragile. SupplyChainMonitor™ is a web-based risk monitoring platform that continuously tracks the financial health of your suppliers, alerting you to distress and bankruptcies. It also provides a holistic risk management solution covering geopolitical disruptions, severe weather, plant shutdowns, and regulatory sanctions, among other risks.