The loss of free-market operation in the Russian and Ukrainian stock markets can only be interpreted as a negative signal for businesses listed on those markets and their counterparties up-and-down the supply chain. The loss of access to or the restriction of equity markets removes or impairs a significant source of financing that does not carry interest expense. Businesses affected by these actions and those counterparties that rely on these businesses for supplies or orders are experiencing increasing risk of bankruptcy and significant financial pressure.

Sanctions aimed at weakening Russia and Putin-linked oligarchs combined with export interruptions due to war in Ukraine are knocking out supplies for key commodities, products, and services. Oil & gas, nickel, aluminum, palladium wheat, neon gas, and fertilizers such as DAP are just some of the commodities with extreme dependence on Russian and Ukrainian supplies. Intense demand with limited suppliers pushing up prices is a classic supply shock that leads to lower growth and higher inflation. Inflation is already at a 40-year high based on February’s year-over-year change in CPI and the impact of this supply shock is only just starting. The FRISK® score picks up these impacts in real-time with its daily-updating, 96% accurate bankruptcy model.

For a deeper analysis of the Russia-Ukraine conflict, check out one of our recent episodes of The CreditRiskMonitor Podcast, hosted by CreditRiskMonitor President & COO Mike Flum and Chairman & CEO Jerry Flum.

Enter the FRISK® Score

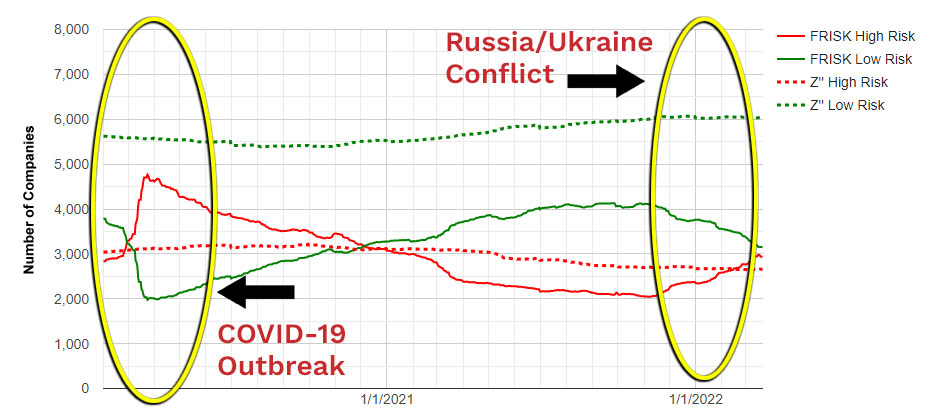

The FRISK® score’s blending of four input classes, including subscriber crowdsourced sentiment, stock market data, bond agency ratings, and financial ratio data, makes it uniquely positioned to provide effective, accurate, and daily-updating bankruptcy risk predictions. Models focused on only financial ratios like the Altman Z”-Score will inevitably lag such analytics as the effects of this conflict will not be reported until the Q1 filings have been processed in April and May or the Q2 filings in July and August.

We saw the same lag play out during the COVID-19 shutdown in early 2020 (the first oval, left-hand side):

FRISK® Score versus Altman Z''-Score

The Russia/Ukraine Scrutiny Index relays the rank of the business in relative scrutiny level to the other businesses contained in the daily list. Lower Ratings indicate higher scrutiny by subscribers displays. What is shown below in the top 50+ Russian or Ukrainian businesses that have experienced the largest increase in web traffic investigation by CreditRiskMonitor’s subscribers since the start of the conflict:

The OFAC Sanctions List summarizes the businesses affiliated with Russia or Russian interest that have been sanctioned by the U.S. Department of the Treasury’s Office of Foreign Asset Control. If you are involved with any of these counterparties, there can be significant civil and criminal penalties including both monetary fines and incarceration.

Please note that the use of this list to assess exposure to such sanctioned counterparties is at the user’s own risk. CreditRiskMonitor makes no claims about the accuracy or completeness of this list.

The Businesses Impacted by Putin List Sanctions summarizes the businesses affiliated with individuals named on the Putin List, which contains members of Vladimir Putin’s government and Oligarchs. The List provides the name of the business, the affiliated individual, and that individual’s relation to the Putin List.

Please note that the use of this list to assess exposure to such Putin List linked counterparties is at the user’s own risk. CreditRiskMonitor makes no claims about the accuracy or completeness of this list.

History Has a Way of Repeating Itself

With non-financial corporate debt at absolute highs, the potential financial downside from this conflict is enormous and will severely impact corporate A/R and supply chains. Most of this debt is held by public companies who are all covered by the FRISK® score. See the FRISK® score in action as more than 1,000 businesses have fallen into the high-risk category since the start of 2022: