No other financial risk service drills deeper than CreditRiskMonitor to find bankruptcy potential in major corporations. These days, we have our eye on Houston-based oil company KLX Energy Services Holdings, Inc.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

In September, Tricolor Auto Group, a privately-held auto dealer and subprime lender, filed for Chapter 7 bankruptcy liquidation. Our 80%-accurate PAYCE® Score warned of elevated bankruptcy risk for 12 consecutive months, enabling clients to identify and mitigate risk exposure. Learn how our AI-driven financial risk analytics provide clear, actionable insights every day.

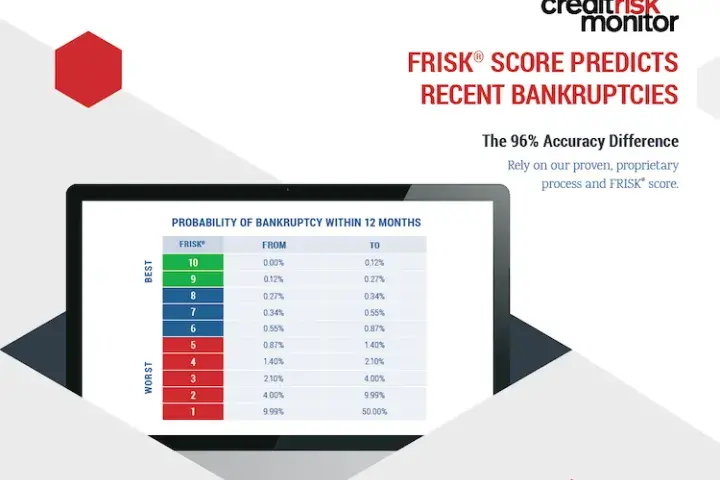

Powered by crowdsourcing and deep neural network technology, CreditRiskMonitor® uses two proprietary scores – FRISK® and PAYCE® – to more accurately predict financial risk at public and private companies, respectively.

American freight transporter Yellow Corporation has declared bankruptcy after years of financial struggles and growing debt, marking a significant shift for the U.S. transportation industry and shippers nationwide.

CreditRiskMonitor reported operating revenues of $4.6 million, an increase of approximately $253 thousand or 6%, for the three months ended March 31, 2023, as compared to the first quarter of fiscal 2022.

How can we be so sure of the accuracy? We measure it. Download this scorecard to see how the score performed in 2015 & 2016. In short – we predicted 98.6% of U.S. public company bankruptcies at least 90 days in advance.

CreditRiskMonitor reported that operating revenues of $18 million, an increase of approximately $1 million or 5%, for the year ended December 31, 2022, as compared to 2021.

CreditRiskMonitor reported operating revenues of $4.9 million, an increase of approximately $251 thousand or 5%, for the second quarter of fiscal 2024 compared to the same period of fiscal 2023.