International vacation and tourism operator Transat A.T. Inc. continues to struggle from pandemic headwinds and a cumbersome debt load. Without a major bump in travel demand sometime in 2021, bankruptcy proves more and more a possible endgame.

The devastating impact the COVID-19 pandemic has had on air travel cannot be understated. Following measures announced by the Canadian government, Transat's operations have been suspended until Apr. 30, 2021.

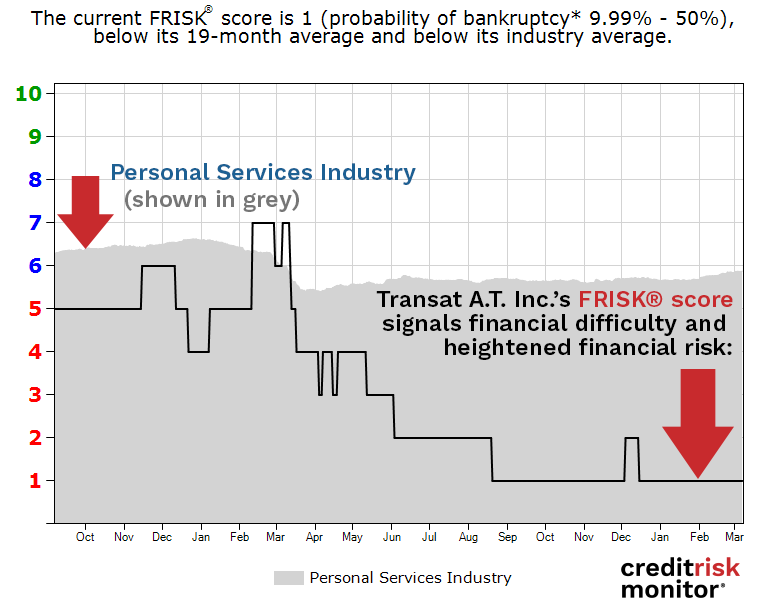

For Transat, limbo exists in an added layer, with the company seeking to be acquired by Air Canada. Slow progression on this front has done little to improve the FRISK® score outlook on the company. It currently sits at a bottom-rung "1."

A FRISK® score of "1" indicates a 10-to-50x greater probability of bankruptcy than the average publicly-traded company. We advise all of our clients to monitor any corporation in their portfolio rated with a score between "5" and "1" with extra scrutiny.

Download the free report to learn more.

Our FRISK® Score model incorporates four powerful risk inputs:

- “Merton”-type model of stock market capitalization and volatility

- Financial ratios, including those used in the Altman Z”-Score Model

- Agency ratings

- Website click pattern data from CreditRiskMonitor® subscribers, representing key credit decision-makers at nearly 40% of current Fortune 1000 companies plus thousands of other large companies worldwide

Since the start of 2017, the FRISK® Score’s rate of success in capturing public company bankruptcy is 96%. In any given year, you can count on one hand the times we miss – and in those outlier cases, the circumstances deal with unusual, unforeseen events such as natural disasters and CEO fraud.

Download the free report to learn more.

About High Risk Reports

Our High Risk Reports feature companies that are exhibiting a significantly high level of financial distress, as indicated by our proprietary FRISK® Score.

The reports highlight the factors that have pushed a company's score lower on the "1" (worst) to "10" (best) FRISK® Score, which is 96% accurate in predicting bankruptcy over a 12-month period. The High Risk Reports also includes analysis on financial indicators such as the company’s DBT index, stock performance, financial ratios and how it is performing relative to its industry peers.

The ultimate goal of the High Risk Report series is two-part: provide an early warning for those doing business with an increasingly distressed company and inform of the many signals that should be examined when assessing financial risks.