Three Key Things to Know at the Start:

- Corporate bankruptcies have nearly doubled over the past year due to high leverage levels and rising interest rates.

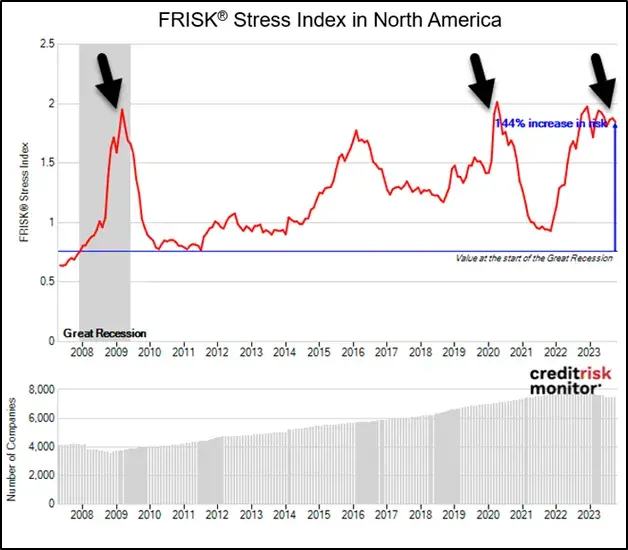

- The North American FRISK® Stress Index has matched recent historic highs indicating extreme and broad bankruptcy risk, but debt obligations and interest rates are higher this time around.

- CreditRiskMonitor's highly accurate bankruptcy prediction models, the FRISK® score and PAYCE® score, help with risk assessment to protect against bankruptcy.

***

CreditRiskMonitor's year-to-date bankruptcy tally for companies with FRISK® scores and PAYCE® scores has increased about 96% year-over-year compared to 2022 and exceeded the recent peak of 2020. As a natural consequence, credit professionals are paying stricter attention to the surge in bankruptcies and risk accumulation driven by higher interest rates. Our clients were given the warning signals to know that the financial pain being felt today was certainly predictable – and that there's likely more to come.

Bankruptcies in recent years have been subdued in part by covenant-lite loans, EBITDA add-backs, and credit amendments. These factors supported “business as usual,” yet spurred on an environment of excessive financial leverage. The financial strain created by this debt buildup is only just beginning to emerge as rates rise and debts come due. Unsecured creditors, who ultimately receive minimal recoveries on their residual claims, will feel severe pain when the time comes if they do not have a plan to get ahead of danger.

All is not lost, however. Now is the time for anyone who has neglected establishing a strong credit culture to learn how to best sound the alert, arming yourself with CreditRiskMonitor’s offerings.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

The FRISK® Stress Index Provides Warning

Company debt capital structures are exposed to rising rates in different ways. For starters, many companies borrowed via variable interest rate loans that change relatively quickly. In years past when rates were lower, many companies strategically issued fixed-rate bonds, but trillions of debt obligations are set to mature over the next 12-to-24 months and must be refinanced at currently higher rates. Companies broadly don’t have the liquidity to retire their debt. Finally, some companies hedged their debt with interest rate swaps to mitigate the risk of rising rates, but the hedges carry a cost and eventually expire. One way or another, company borrowing costs are exploding higher – with some companies even reporting that their interest burdens have as much as doubled in just 12 months!

Banks and private lenders certainly want to support their borrowers to avoid bankruptcy, however, companies cannot “kick the debt can” with broken feet, i.e., having inadequate interest coverage ratios.

It is now critically important for credit professionals to pay attention. CreditRiskMonitor’s FRISK® Stress Index shows the collective probability of failure in a group of companies (such as an industry, country, or portfolio) over the next 12 months. The North American FRISK® Stress Index for all industries has reached levels equivalent to the Great Recession and the worst days of the COVID-19 pandemic, except this time both debt obligations and interest rates are even higher.

As the 2023 bankruptcy tally continues to rise, credit professionals should expect this trend to continue into 2024 as debt-servicing deteriorates and interest rates remain elevated.

CreditRiskMonitor clients should proactively manage their portfolios with our AI-driven bankruptcy prediction models, including the 96%-accurate FRISK® score and 80%-accurate PAYCE® score. We recommend a set of simple-to-employ guidelines that can help you analyze your overall risk exposure and protect your accounts receivable (“A/R”) in this challenging bankruptcy environment.

| CreditRiskMonitor® Guidelines | Action Steps for Credit Professionals |

| Portfolio Review | - Assess the proportion of your portfolio that contains high-risk customers - Order your high-risk customers by your A/R exposure - Analyze the riskiest companies with the largest A/R dollars first |

| Company Review | - Use the FRISK® score, PAYCE® score, and/or other scores/ratings as a first line of defense in identifying bankruptcy risk - Review recent news alerts to find red flags - For public companies, review the liquidity MD&A report, financial statements, and industry peer analysis - For private companies, examine payment performance and the existence of federal tax liens |

| Credit Review | - Prioritize high-risk companies requiring risk mitigation - Use the Credit Limit Ranges solution to compare your existing credit limits against the ranges provided - Utilize the Credit Limit Service solution for automated monitoring and credit limit adjustments to optimize exposure - Discuss credit limits with high-risk customers - Consider trade credit insurance if deemed inexpensive relative to the expected loss |

Many companies have existing credit procedures but integrating any of the listed guidelines above into your existing workflows, and sharing with internal teams, can help your process. Together, these action steps will help control risk and ultimately mitigate allowances for doubtful accounts and bad debt expenses associated with customer bankruptcy.

Bottom Line

Bankruptcy risk is on the rise and credit professionals can't afford to waste any time. CreditRiskMonitor clients should act now to review their portfolios and see how they can improve their risk exposure. Our daily updated bankruptcy solutions provide the most timely and accurate assessments of distressed customers. Let us show you how our latest credit solutions can enhance your workflows and detect bankruptcy with precision.